QuickBooks Online 2021 setup sales tax. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file we’re going to be discussing turning on and setting up the sales tax. Before we do, let’s just recap the sales tax and how it will be working so that the setup will make more sense as we go through it. When we apply the sales tax, it’ll be on a sale.

Posts with the apply tag

Statement of Activities Formatting 185

https://youtu.be/S3lCOA6esqY?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

In this presentation, we’re going to take a look at the formatting of a statement of activities or income statement, we’ll take a look at customizing the statement of activities and customizing it for internal use, as well as external use and then saving those customized income statements so that when we go into them into the future, it will be as easy as possible, get ready, because here we go with aplos. Here we are on our not for profit organization dashboard, we’re going to be opening up our reports, let’s go to the reports on the right hand side to do so we’re then going to go into the income statement by fund. So let’s take a look at the income statement five fund which is going to be our statement of activities report.

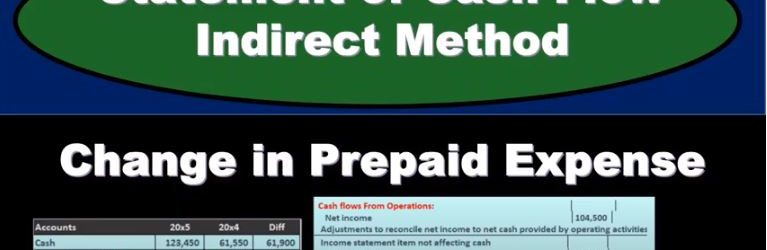

Statement of Cash Flow Indirect Method Change in Prepaid Expense

In this presentation, we will continue with the statement of cash flows indirect method looking at the change in prepaid expenses, we’re going to be using this information, we’ve got the comparative balance sheet, we’ve got the income statement and some additional information, we will be working primarily with the difference in the comparative balance sheet with the use of a worksheet taking this information to create this worksheet. So this is just basically a comparative balance sheet that has been condensed down to something that looks like a post closing trial balance. We are constructing our cash flows from operations from it, we have all of our differences. We’re basically just finding a home for these differences. We know if we do so that if we find a home for all of these differences, then it’ll add up to that difference, the difference in cash, which is basically the bottom line of our cash flow statement, or that’s what we want to get to in terms of adding up the cash flows. So we’ve gotten so far We’re working on the cash flows from operations. And we’ve done the cash flows in terms of the accounts receivable, inventory. Now we’re on prepaid expenses. We’re just going through these.