Hello in this presentation we will be recording that journal entries for business transactions related to accounts receivable otherwise known as the revenue cycle. We will be recording these using debits and credits. At the end of this we will be able to list transactions involving accounts receivable record transactions involving accounts receivable using debits and credits and explain the effect of transactions on assets liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here on the left hand side constructing those journal entries in accordance with our thought process our list of questions to most efficiently construct the journal entries. We will then be posting them not to the general ledger but to this worksheet here so that we can see the quick calculation of the beginning balance and what is happening to the individual accounts as well. account types, in that we have the accounts categorized, as is the case for all trial balances. accounts have been in order that order been assets in this case in green, the liabilities in orange of the equity, light blue and the income statement accounts of Revenue and Expense Type accounts. first transaction perform work on account for $10,000.

Posts with the asset tag

Receivables Introduction

In this presentation we will take a look at receivables. The major two types of receivables and the ones we will be concentrating on here are accounts receivable and notes receivable. There are other types of receivables we may see on the financial statements or trial balance or Chart of Accounts, including receivables, such as rent receivable, and interest receivable. Anything that has a receivable, it basically means that someone owes us something in the future. We’re going to start off talking about accounts receivable that’s going to be the most common most familiar most used type of receivable and that means something someone, some person some company, some customer typically owes us money for a transaction happening in the past, typically some type of sales transaction. So if we record the sales transaction, that would typically be the way accounts receivable would start within the financial statements, meaning If we made a sale, we would credit the revenue account, we’ll call it sales. If we sell inventory, it would be called sales. If we sold something else, it might be called fees earned, or just revenue or just income, increasing income with a credit, and then the debit not going to cash. But going to accounts receivable.

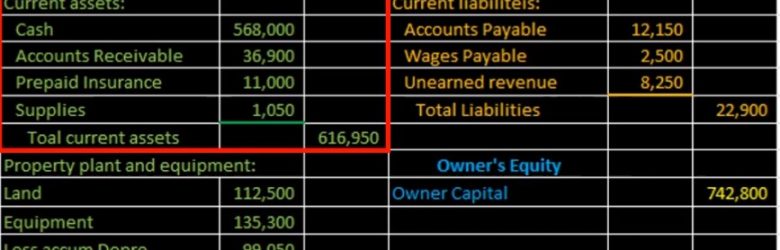

Balance Sheet Current Assets from Trial Balance 12

Hello in this lecture, we’re going to create the current asset section of the balance sheet, we’re going to create this current asset section from a trial balance, we’re going to piece together the financial statements piece by piece as we go through a series of lectures, the trial balance being here at this is going to be the adjusted trial balance. And what will happen is we will then find a home for all of the accounts on the financial statements. Once we then do that, that means that we have then converted this from the double entry accounting system being in the format of debits minus credits equaling zero or debits equaling the credits to the assets equals liabilities plus the owner’s equity, basically the accounting equation, which is reflected on the balance sheet. So we’re going to start off by doing the current assets section, which will just be this part we’re going to find a home for these first few accounts.

Adjusting Entry Depreciation 10

Hello in this lecture, we’re going to record the adjusting entry related to depreciation were recorded on the left hand side, that’s where the journal entry will go. And then we’ll post that to the trial balance on the right hand side trial balance being in the format of assets in green liabilities in the orange. Then we have the equity section in the light blue and the income statement, including revenue and expenses in the darker blue. We’ll first talk about what accounts are affected and then we’ll go back and explain why this is the case. So first, we know that it’s an adjusting entry. So that’s going to have some added rules, you want to keep the adjusting entry separate in your head from just normal journal entries. all entries have at least two accounts and an equal number of debits and credits as well as adjusting entries. But adjusting entries are all made of as of the cutoff date, we’re gonna say 1231 in this case, and they generally have one account above this equity line above the capital meaning a balance sheet account and one account below that line meaning an income statement accounts.

Accounts Receivable Journal Entries 230

Hello in this presentation we will be recording that journal entries for business transactions related to accounts receivable otherwise known as the revenue cycle. We will be recording these using debits and credits. At the end of this we will be able to list transactions involving accounts receivable record transactions involving accounts receivable using debits and credits and explain the effect of transactions on assets liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here on the left hand side constructing those journal entries in accordance with our thought process our list of questions to most efficiently construct the journal entries.

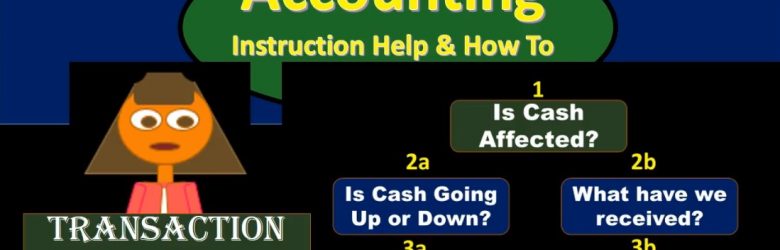

Journal Entry Thought Process 215

Hello in this presentation that we will discuss a thought process for recording financial transactions using debits and credits. Objectives. At the end of this, we will be able to list a thought process for recording journal entries. explain the reasons for using a defined thought process and apply thought process to recording journal entries. When we think about a thought process, we’re going to start with cash as the first part of the thought process is cash affected. We’ve discussed the thought process when we have considered the double entry accounting system in the format of the accounting equation, the thought process will be much the same here we now applying that thought process to the function of debits and credits recording the journal entries with regard to debits and credits.

Revenue Recognition Principle 134

Hello in this presentation we will be discussing the revenue recognition principle. first idea will be that revenue is not the same thing as cash objective. At the end of this presentation we will be able to define the revenue recognition principle explained the relevance of the revenue recognition principle and provide examples of the revenue recognition principle the revenue recognition principle has to do with when we should record revenue. When considering when revenue should be recorded. It’s often thought that we should record revenue when cash is received.

Depreciation Adjusting Entry 10.45

This presentation and we’re going to enter and adjusting entry related to depreciation. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s go down and open up our reports, we’re going to go down to the reports down below, open up our favorite reports at the end the balance sheet reports, we’re going to open that one up, we’re going to be changing the dates up top going to go up top and change those dates from a one on one to zero to 1231. Let’s make it as of the cutoff date here, Ode to 29 to zero, and then run that report and duplicate the tab up top by right clicking on it and duplicating it.