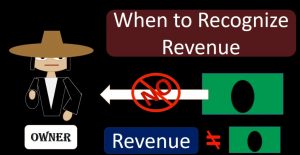

Hello in this presentation we will be discussing the revenue recognition principle. first idea will be that revenue is not the same thing as cash objective. At the end of this presentation we will be able to define the revenue recognition principle explained the relevance of the revenue recognition principle and provide examples of the revenue recognition principle the revenue recognition principle has to do with when we should record revenue. When considering when revenue should be recorded. It’s often thought that we should record revenue when cash is received.

00:37

Although revenue may be recorded when cash is received, it should not be the driving factor of the recording of revenue. In other words, revenue is not the same thing as cash revenue is not equivalent to cash. Because cash is such an the normal form of payments. It’s the most common form of payment. It is often assumed that cash is the same thing as revenue. It’s also the case that in many transactions, we will receive cash at the same point in time that revenue will be received. But the driving factor for when revenue should be recognized is when the work is done. So the concept of the revenue recognition principle will be, we want to recognize revenue when work is done.

01:20

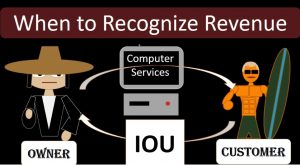

This kind of leads to the idea of what is revenue versus cash and revenue represents the earning of our revenue, we have to measure that earnings in terms of dollars, we’re going to say we earned so many dollars worth of revenue even though possibly we have not yet received the cash, the revenue will be measured in terms of units of dollars. However, the revenue is not going to be recognized necessarily, at the point in time cash is received and might be recognized before or after depending on the circumstances. So our first example is an owner. We’re going to do Computer Services, we just do services. We’re not selling the computer.

02:00

We’re just doing Computer Services for the customer over here, that being our normal service transaction. If cash is received at that same point in time, then it does just so happen that we will record revenue at the same time that cash is received if we do the work and we receive the cash at the same point in time, however, it’s important to note that under a revenue recognition principle, the driving factor of recording revenue at this point in time is not because we received cash but because it’s the point in time we did the work. So many types of industries are going to be industries in which we receive payment at the same point in time work is done. merchandising payments, often are that way restaurants or that way, we’re going to receive payment at the point in time, the work is done, and therefore it might be thought then that cash is the driving factor, or that cash and revenue are the same thing.

02:58

They’re they’re not the same thing. just so happened to be happening at the same point in time, we could be using an accrual system and still basically be recognizing revenue at the same point in time, cash is received just by the nature of the business. In this case, the nature being one, where we always receive cash at the same point in time that we do the work. But the driving factor under the accrual principle will be the work done, not the cash received as to when revenue should be recognized. Another type of transaction is we might be the same service company but we might take the computer back to our shop, do the do the work and then build a client at a later time. Once the work is done, we might invoice the client and expect to receive money in the mail.

03:45

Again, this is really the type of format of payment and when work is done is not so much up to the individual just in terms of running the business as it is to the type of industry that they are in. If we’re in a bookkeeping if we do tax returns or if we are no longer firm, it’s often the case that we are going to do the work, and then build a client because we have to add up our hours and see how long it took and see how much the bill actually is before we can build a client. So the nature of the work then requires that the work be done before we build a client and then the client the build, then we receive payment in the future. In those types of circumstances, we’re still going to record the revenue at the point in time the work is done, although in this case, no cash has been received.

04:31

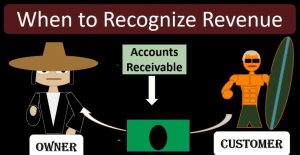

So that’s going to be the difference. We’ll see the difference when we have types of transactions where the work has been completed, and the cash being received happens at some other point in time. In this case, the cash being received at some point in the future we hope to receive cash in the mail for the work we have done and then build the client for so we’re going to record then the revenue at the point in time the work was done. And we’re also going to have this basically an IOU that’s what the customer is given. To the owner, the business owner in this case, an IOU. That IOU is something to the owner, it’s going to be equivalent to accounts receivable, we’re going to put it into accounts receivable and account tracking the i o use for work that has been done but has not yet been received.

05:18

The accounts receivable then is going to be hopefully collectible in some normal time period, hopefully 30 to 30 to 60 days possibly we expect those accounts receivables to be converted to cash. Because of this, the accounts receivables do have value, they’re not the same as cash. So the IOU here is not equivalent to cash in that we would much rather have the cash but the accounts receivable is still an asset, because it represents what will be owed to the company. And if we think about that, sometimes people think that the account recording accounts receivable as an asset is not a good thing or could cause problems because we have not yet received the cash.

06:03

And therefore we’re recording something before it has been received, because the cash is really the solid asset we’re looking for at the end of the day. But it’s helpful to think of it if you were to give your financial statements to a bank asking for a loan, or some other transaction or investments. The accounts receivable is an important thing to be recording on the financial statements. If you were the bank, giving a loan, and we’re talking about a business that has a lot in accounts receivable, accounts receivable that we believe are very reliable in terms of the customers being reliable and dependable in the format of payment based on past history. That would be something very relevant to the financial statements it is it is an asset.

06:49

Although there are of course times when accounts receivable may not be receivable. We’re going to talk about how to deal with that. How should we report that at a later time but For now just recognize that we’re going to recognize the accounts receivable added as an asset at the point in time that we make the sale at the point in time that the work has been completed. Therefore, if we take a look at our transaction, remember that the work has been done, we have done the work, we invoice the client, that’s usually going to be the documentation that will tell the client and tell us and tell us to record this transaction. That work has been done, and we expect to receive payment in the mail. And we’re going to record the related accounts receivable on the books so we got the revenues being recorded, the accounts receivable asset is being recorded on the books, no cash has yet been received.

07:42

Then of course at a later point in time, we expect it to receive cash probably in the form of a check in the mail from the customer. It’s important to note that at this point in time, we will not see we will not record revenue even though cash has been received at this point in time because it has has already been recorded. It’s been recorded in the past. What we will do is decrease the receivable account, we’re going to say okay, we had this account saying that this customer owed us money.

08:10

They have now paid us that money. We’re going to reduce this asset that we put on the books at the time that we earned the revenue. And we’re going to increase the better asset to cash that we have now received no effect on income no effect on net income no effect on the income statement. At this point in time, even though cash is received it already having been recorded in the past at the point in time that the work was done. We are now able to define the revenue recognition principle explain the relevance of the revenue recognition principle and provide examples of the revenue recognition principle.