Hello in this lecture we’re going to talk about the objectives of the closing process the closing process will happen after the financial statements have been created. So we will have done the journal entries where we will have compiled those journal entries into a trial balance, and then we will have made the financial statements. And then as of the end of the period in this case, we’re going to say as of December, when we move into the next time period, January, what we need to do is close out some of the temporary accounts those accounts including the income statement and the draws account so that we can start the new period from start in a similar way as if we were trying to see how many miles we could drive say in a month. If we wanted to Vince in December, and then see how many miles we’re going to drive in January of next year.

Posts with the assets tag

Accounting Building Blocks

Hello in this lecture we will discuss the accounting building blocks and the double entry accounting system. At the end of this we will be able to define and describe the double entry accounting system, write down the accounting equation and define each individual part of it, define and describe debits and credits, define a balance sheet and list its parts define an income statement list its parts and explain the relationship between the balance sheet and the income statement. Okay, so starting off every business and accounting software uses the double entry accounting system. So the double entry accounting system, it’s kind of like the math behind the calculator, every software is going to use it. In order to understand what the system is doing, we need to understand the double entry accounting system.

Cash Internal Controls Overview

In this presentation, we’re going to introduce the internal controls related specifically to cash, cash internal control goals, these are going to be the objectives of the internal control system over cash, we want to have the cash handling separate from the record keeping. So whoever is handling the cash, we would like to have them not be the same person doing the record keeping. And therefore we have that separation of duties. We have the person that is entering the data, not having as much of an incentive to steal the cash because they’re not the ones handling the cash, the people handling the cash, know that if they do steal it, the record keeping should pick that up, and they are a separate person. cash receipts are deposited to the bank. We want to make sure that the cash receipts are going to the bank as soon as possible, hopefully on a daily basis, so that we’re not actually emulating cash. We don’t want a cash to be piling up, because if it is then we have a greater risk of theft to happen and greater loss if that does happen.

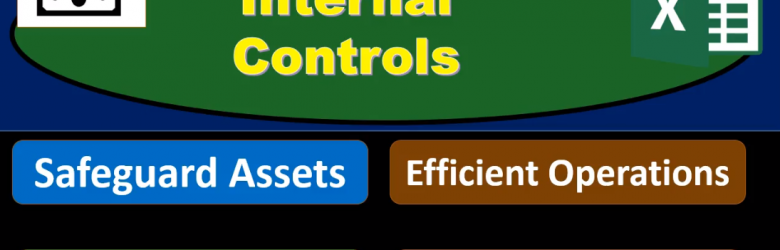

Internal Controls

In this presentation we will introduce the topic of internal controls. Internal Controls been policies within an organization in order to achieve certain objectives those objectives including the safeguarding of assets, having reliable accounting records, efficient operations, and company policy alignment. We’ll get further into what each of these categories mean in detail. However, first we want to discuss the fact that internal controls will change from organization to organization and industry to industry will have similar objectives between organization to organization industry to industry, however, the customization of the internal controls will differ in order to have an optimal amount depending on size of company and type of industry. For example, a small company often one run by one individual will have very much fewer internal controls for multiple reasons. One that that individual can really monitor A lot more of the transactions for a small company and have direct contact with the transactions that are taking place.

Lower of Cost or Market

In this presentation we will discuss the concept of lower of cost or market. We will define this concept first and then see it and talk about how it would apply to inventory. The definition of lower of cost or market according to fundamental accounting principles, while 22nd edition is required method to report inventory at market replacement cost when that market cost is lower than recorded cost. So, what we’re saying here is we have we’re talking about the inventory, of course, and we’re saying that we have to record it at the replacement cost. When that replacement cost that market cost is lower than the recorded cost, what we actually purchased it for. So this looks like a confusing type of definition. However, it’s pretty straightforward. What we’re applying here is going to be the conservative principle meaning that if our inventory has declined in value, we have to record it at the lower cost. We don’t want to be overstating our income mentoree obviously regulations are very concerned about us overstating something, when we’re talking about an asset, and making the financial statements look better than they would rather than understating it.

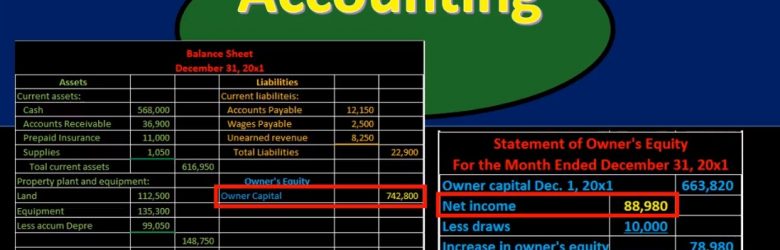

Financial Statement Relationships 18

Hello in this presentation we’re going to take a look at financial statement relationships. In other words, how do these financial statements fit together? How do these financial statements represent the double entry accounting system in the format of the accounting equation that have assets equal liabilities plus equity? First, we’ll take a look at the balance sheet. Note that most textbooks will talk about this relationship and constructing the financial statements by first saying to construct the income statement, then the statement of equity and then the balance sheet. If you’re constructing things by hand with a paper and pencil, that does reduce the number of calculations that you would need to do, however, if you’re using something like Excel, then it’s a lot easier to sum up columns of numbers and it might be useful to take a look at the balance sheet. In any case, the relationships will be the same when we consider the relationships between the financial statements.

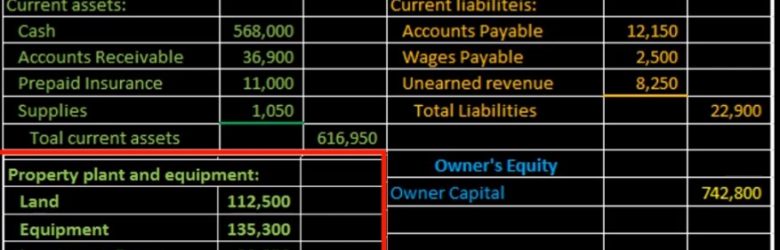

Balance Sheet Property Plant %26 Equipment From Trial Balance 13

Hello in this lecture we’re going to put together the section of the balance sheet of property plant and equipment from the trial balance property, plant and equipment will be part of the assets can be the subcategory of assets, we talked last time about the creation of the current assets. And now we’ll be moving on to property, plant and equipment, which will then sum up everything for total assets. We will be picking these numbers up from a trial balance. And once we have completed all the financial statements, what we’re basically doing is taking a debit and credit format from the trial balance, converting it to a plus and minus format in terms of the financial statements, assets, equal liabilities plus owner’s equity so that people can read it even if they don’t understand debits and credits. In this lecture, we’re focusing in on this section here, which will be a land equipment and each cumulated depreciation.

Accounts Payable Transactions Accounting Equation 170

So there’s gonna be problems later on where they’ll basically say, you know, you got to pay off something on account and you have to assume that the prior transaction took place. You got to kind of know in your mind how these things are related. So if we go through them by cycle that will help to achieve that goal. first transaction, we’re going to say purchase supplies on account. If we go through our list of questions, we’re going to say is cash affected? In this case? No, because we purchased it on account, then we’re going to ask what we’ve received, in this case supplies. So we got supplies, that is here, it’s going to be an asset. Therefore the asset is going to go up because we got more of them, then the only question is, what is the other account? It’s not a decrease to cash because we didn’t pay cash. And therefore we must be doing something somewhere else. That will be accounts payable, so accounts payable is going to increase by the same amount.

Financial Transaction Rules 155

Hello in this presentation we will be discussing the transaction rules financial transaction rules as they relate to recording financial transactions with regard to the accounting equation. At the end of this, we will be able to list transaction rules explained our reasons for the transaction rules and apply transaction rules to recording financial transactions. First rule, at least two accounts will be affected. It’s going to be whenever we record any transaction and whether we’re talking about a transaction for recording payroll record an accounts receivable, recording accounts payable, all those normal things that the accounting department does on a day to day basis.

Balance Sheet & Income Statement Relationship 132

Hello in this presentation we will discuss the balance sheet and income statement relationship. Objectives at the end of this we will be able to define the balance sheet and list its parts, define the income statement and list its parts and explain how the income statement relates to the balance sheet. When considering these concepts in terms of the balancing concept of the balance sheet in particular, we want to keep in mind the idea of the double entry accounting system. The double entry accounting system being the main system the main internal control, that we are always keeping in mind that internal control helping us to safeguard against making errors that’s our first line of defense against making errors is the double entry accounting system, which can be expressed in a few different ways. (more…)