QuickBooks Online 2021, enter service items. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re not going to be thinking about entering items into the system. Now remember, as we’re entering these items into the system are keeping in mind these beginning balances that we’re going to be entering into the system as well, the beginning balances that are going to be related to items would be the inventory items.

Posts with the column tag

Journal Report 4.60

QuickBooks Online 2021 journal report. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports on the left hand side, we’re going to go all the way down to the accounting reports looking for the journal report, which after this point in time, you might find by simply typing up top for it, but right now we’re going to scroll on down.

Transaction List by Date Report 4.55

QuickBooks Online 2021 transaction list by date report. Well, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by typing into your favorite browser, QuickBooks Online test drive, we’re in Craig’s design and landscaping services, we’re going to go down to the reports on the left hand side, we’re going to be taking a look at a transaction that detailed report which you may be able to find by simply typing in up top, which we may do in the future.

Accounts Receivable Graphs Excel 4.82

QuickBooks Online 2021. net, accounts receivable graphs with the help and use of Excel. Let’s get into it with Intuit QuickBooks Online 2021. Now, here we are in our QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports on the left hand side, we’re looking for reports for who owes you the money.

Comparative Balance Sheet Creation 2.35

QuickBooks Online 2021 comparative balance sheet creation, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive practice file, which you can find by searching in your favorite browser for QuickBooks Online at test drive, we’re in Craig’s design and landscaping services practice file, we’re going to be constructing a comparative balance sheet. So we’re going to go down here to the reports. On the left hand side, we’re going to be creating the comparative balance sheet from a standard balance sheet.

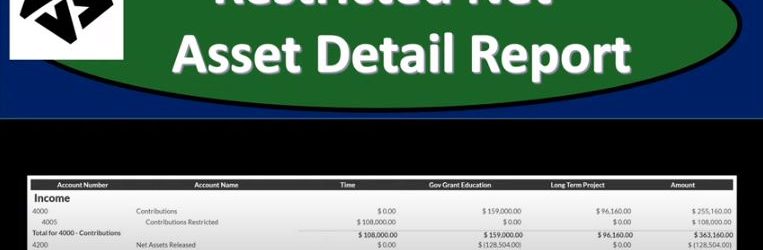

Restricted Net Asset Detail Report 190

This presentation we will generate, analyze, print and export to an Excel a restricted net asset detailed report and get ready because here we go with aplos. Here we are in our not for profit organization dashboard, let’s head on over to Excel to see what our objective will be. We’re currently in the 10th, tab, tab number 10. And last time and a few prior presentations, we’ve been creating the statement of activities, including three columns, two columns, for width restrictions, without restrictions, we then broke out the width restriction column out into the expenses by both function and by their nature.

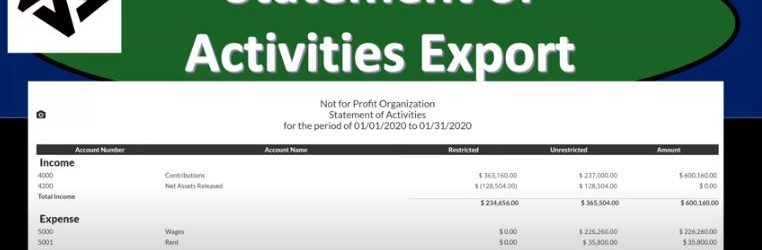

Statement of Activities Export 186

This presentation we will generate, analyze, print and export to Excel a statement of activities or income statement report, get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to be heading on over to the reports on the right hand side. So let’s be opening up the reports. And we’re looking at the statement of activities. So you’ll recall the statement of activities is, in essence, an income statement. We’ve been working with the income statement by fund, but then we created our custom reports down below. So we took this report, that’s going to be a general report, we’re going to scroll down to like custom reports down below, which is then the saved reports.

Net Assets Released From Restriction 172

This presentation we will record a transaction related to net assets being released from restrictions. In other words, we have net assets that had some restrictions put on them, we’re going to be spending money in such a way that it will be releasing the net assets from restriction will record the journal entry to move those net assets from a restricted area to unrestricted so that they can be used and reflected on our statement of activities and statement of net position. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard. Let’s head on over to our Excel worksheet to see what our objective will be. We’re over here in tab 10. So tab number 10. On the Excel worksheet, you’ll recall in previous presentations, what we have done thus far is we’ve been thinking about recording transactions in terms of journal entries, the accounts that are affected, and then putting them into our trial balance.

Allocate Expenses to Categories Par 1 170

https://youtu.be/F4FtVtXckPo?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation and we’re going to start breaking out our expenses by nature. In other words of what the expenses are used for with the use of the tags, the categories being the education, the community service, the administrative and the fundraising for that 4020 2020. Being the allocation percentages, we will be using, get ready, because here we go with abalos. Here we are in our not for profit organization dashboard, we’re going to be heading on over to Excel to see what our objective will be.

Government Grants 140

In this presentation, we will enter a transaction related to the receipt of a government grant into our not for profit organization. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to head on over to our Excel file to see what our objective will be, we’re going to be in tab four. So we’re in tab four, where we have a contribution that’s going to be for the school over to our description up top. So this is going to be the government grant to be used for education. So we’re going to get money, we got money from a government grant. And we have to use it for a specific reason, they put a restriction on it in other way.