Advanced financial accounting PowerPoint presentation. In this presentation we’re going to discuss a consolidation that when there is a complex ownership structure, so more complex ownership structure comparing the direct ownership, which is what we’ve normally been dealing with, with structures such as multi level ownership and reciprocal ownership, get ready to account with advanced financial accounting. Normally, when we think about our consolidation structure, we’re dealing with a direct ownership situation which looks like this direct ownership type of situation, it gets more complex. Of course, if we have more complex type of ownership structures, such as a multiple multi level ownership structure where we have a parent owning a subsidiary, that basically we have an indirect ownership, let’s say in another subsidiaries, that’s going to be more complex for us to deal with or if we have a situation where we have reciprocal ownership, where the parent has ownership a controlling interest in s, but as also has some ownership in p, right. We’ve been dealing with basically P parent company owning portion of S. So if we talk about direct ownership we’re talking about the parent has, as has controlling interest in every subsidiary. So that’s going to be of course, this situation.

Posts with the consolidate tag

Other Foreign Operations Issues

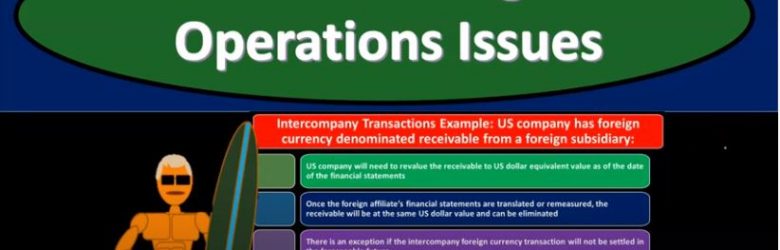

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss other foreign operations issues, get ready to account with advanced financial accounting, other foreign operations issues. So we’re going to start off with an issue related to the parent company having a foreign subsidiary. Typically when that is the case, they’re going to have to consolidate. In other words, you’re going to have to get the foreign subsidiary books in some way to the US dollar and then do the consolidation process. However, you might have a situation where that wouldn’t take place under certain conditions. So, parent generally consolidates a foreign subsidiary except when certain conditions are so severe that the US company owning the foreign company may not be able to exercise the necessary level of economic control. So notice when we think about the consolidation process, we’ll typically think about, we need to consolidate the entities if there’s control right over the 51% is that going to be a general rule but the overarching concept is that there is control. Now if there are certain conditions even though it’s the ownership is over the 51%, we would think there would be control, but there are certain conditions in the foreign subsidiary that are restricting that economic control, then then they might not meet you know that condition and therefore in that situation you might not have the consolidation process. So in that situation then you might have a parent company that has basically a controlling interest you would think in terms of the stock, the stock but you’re not having a consolidation due to the due to one of these factors limiting the actual economic control. So, those include restrictions on foreign exchange in foreign country. So severe strict restrictions, there could be one of the items that would stop the basically consolidation process possibly restrictions on transfers of property in foreign country.

Other Foreign Operations Issues

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss other foreign operations issues, get ready to account with advanced financial accounting, other foreign operations issues. So we’re going to start off with an issue related to the parent company having a foreign subsidiary. Typically when that is the case, they’re going to have to consolidate. In other words, you’re going to have to get the foreign subsidiary books in some way to the US dollar and then do the consolidation process. However, you might have a situation where that wouldn’t take place under certain conditions. So, parent generally consolidates a foreign subsidiary except when certain conditions are so severe that the US company owning the foreign company may not be able to exercise the necessary level of economic control. So notice when we think about the consolidation process, we’ll typically think about, we need to consolidate the entities if there’s control right over the 51% is that going to be a general rule but the overarching concept is that there is control. Now if there are certain conditions even though it’s the ownership is over the 51%, we would think there would be control, but there are certain conditions in the foreign subsidiary that are restricting that economic control, then then they might not meet you know that condition and therefore in that situation you might not have the consolidation process. So in that situation then you might have a parent company that has basically a controlling interest you would think in terms of the stock, the stock but you’re not having a consolidation due to the due to one of these factors limiting the actual economic control. So, those include restrictions on foreign exchange in foreign country. So severe strict restrictions, there could be one of the items that would stop the basically consolidation process possibly restrictions on transfers of property in foreign country.

Consolidation Process Overview

In this presentation, we will take a look at an overview of the consolidation process, get ready to account with advanced financial accounting, consolidation process overview we’re talking about a situation where we have two or more separate entities that are under a common control. So the basic kind of format of that you’re imagining here, then you have a parent and a subsidiary, these are going to be connected in some way shape or form because the parent has control over the subsidiary, we can imagine more complex situations, for example, having one parent and multiple subsidiaries as well. The entities will be showing as if they are one entity. So if we have a situation like this, if there’s a control type of situation, it’s quite possible then we’re going to have the the subsidiary and the parent These are two separate companies have a consolidated basically a financial statement. So the financial statement the idea of that being we’re going to take these two financials and represent them as if these two separate entities in this case, two or more can be more than two are one entity. This means two or more sets of books are merged into one set of financial statements. So obviously, what does that look like from a practical standpoint, we have the parent company, we have this subsidiary company, they have two sets of books, we’re gonna have to take those two sets of books and put them together for the financial statements. Here is an example of a slightly more complex situation where we still have parent subsidiary relationships but multiple pole subsidiaries in this case, so we have the parent subsidiary one where there’s a 75% ownership. So we’re over we have a controlling interest, we’re over that 51, we’re going to say there’s a controlling interest here, therefore there’s going to be a consolidation. So we’re gonna have a consolidation subsidiary to is owned 52%. So we’re still over the 51.