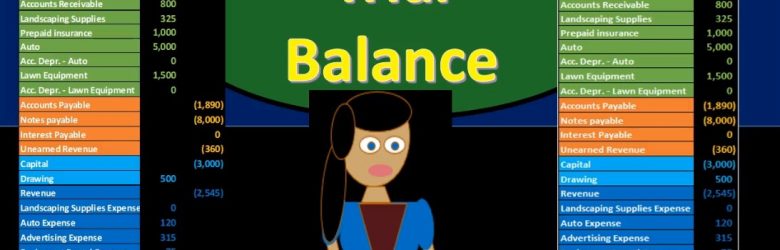

Hello in this presentation we will be discussing a trial balance objectives at the end of this, we will be able to define a trial balance list components of a trial balance and explain how a trial balance is used. When considering the trial balance, we first want to think about where the trial balance falls within the construction of the financial statements. In other words, what processes go before the trial balance, what goes after the trial balance, where’s the trial balance fit into our process? Remember, the ending goal, the ending process of the accounting been to compile the data in such a way to create the finance financial statements. Those financial statements have been the end product. Typically if we’re thinking about a linear process, then we’re thinking about all the transactions that would happen during the month.

Posts with the Credits tag

Debits & Credits 205

Hello in this presentation we will discuss debits and credits. Objectives at the end of this we will be able to define debits and credits list account normal balances and explain how debits and credits work. First we want to take a look at the double entry accounting system and recognize that the double entry accounting system can be represented in multiple different ways including as we have seen before the accounting equation meaning that assets equal liabilities plus equity, we can record transactions using this accounting equation as we have done in the past. That accounting equation is the basis behind the balance sheet where we have the assets liabilities and equity representing the fact that the balance sheet then would be in balance.

Financial Transaction Rules 155

Hello in this presentation we will be discussing the transaction rules financial transaction rules as they relate to recording financial transactions with regard to the accounting equation. At the end of this, we will be able to list transaction rules explained our reasons for the transaction rules and apply transaction rules to recording financial transactions. First rule, at least two accounts will be affected. It’s going to be whenever we record any transaction and whether we’re talking about a transaction for recording payroll record an accounts receivable, recording accounts payable, all those normal things that the accounting department does on a day to day basis.

Tax Energy Credits

#IRSTaxTip: Learn about two types of #tax credits for #energyefficiency: https://t.co/GUOxRXRaw9 pic.twitter.com/njQGa1JYA1

— IRS (@IRSnews) March 12, 2017

Yoda – Debits & Credits

https://t.co/zPDm2ESCU6 #Accounting #StarWars #DebitCredit pic.twitter.com/N9OHB2EOmE

— Accounting Instructi (@AccountingInst) March 7, 2017

Debits & Credits

https://t.co/uxiJbjlllk #Accounting #DebitCredit #doubleEntry #Education pic.twitter.com/kjjVaGvMHJ

— Accounting Instructi (@Accounting_Inst) March 7, 2017