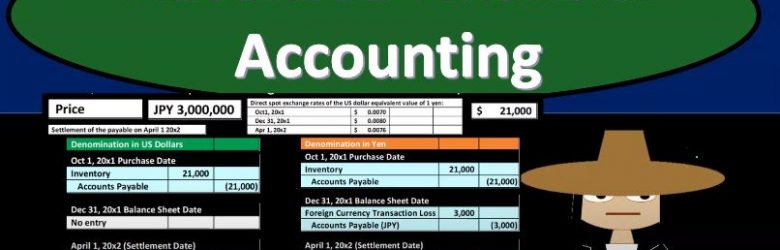

Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss foreign currency transactions get ready to account with advanced financial accounting, foreign currency transactions. So remember when we’re thinking about foreign currency transactions, we’re thinking about them from the perspective of the US company in US dollar. So we’re have our currency that we’re making our financial statements in, we’re measuring all the stuff on our financial statements with the measuring tool that we need to be using, that’s going to be the US dollar, that’s going to be our standardization. And then anytime we have foreign currency transactions with something other than US dollars, then we want to see them from that perspective, right? Because when we put them on our financial statements, just like anything else, just like inventory, if we were to value units of inventory, or to value stocks and whatnot, we need to value them in terms of our measure into a which of course is the US dollar.

Posts with the currency tag

Foreign Currency Exchange Rates

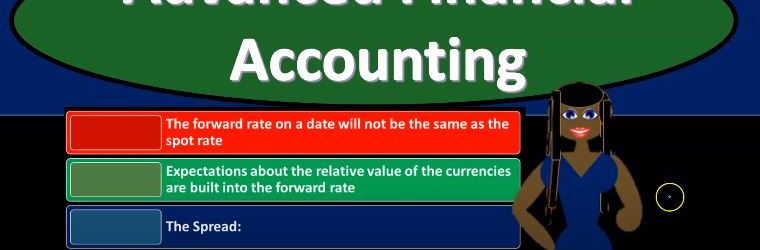

Advanced financial accounting PowerPoint presentation. In this presentation, we’re going to discuss foreign currency exchange rates get ready to account with advanced financial accounting, foreign currency exchange rates, let’s first define foreign currency transactions. So what are from foreign currency transactions? When are we going to need to account for foreign currency transactions. So from our perspective, we’re going to be looking at this from the perspective of a US company US company that is having their books then accounted for or measured in dollars. And when you think about the foreign currency transaction, it’s just like anything else, but it can be a little bit more confusing. So you want to remember, of course, that the dollar is basically the measuring tool.

Translation vs Remeasurement

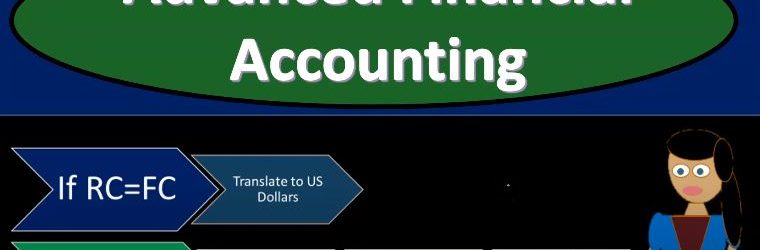

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss translation versus remeasurement. Get ready to account with advanced financial accounting, translation versus remeasurement methods to restate to foreign entities statements to US dollar. So the most straightforward methods can be translation of foreign entities functional currency statement to US dollars. So the translation is what we’ll use the most straightforward method when the entity statement is using the functional currency. So typically, if the if the entity is using the functional currency, and we need to translate it, then we’ll simply translate it from the functional currency to the US dollars. And then there’s remeasurement of foreign entities statement into its functional currency. So remeasurement means that the entity is running their bookkeeping in a currency that is not the functional currency. Right? So then we’re going to have to re measure we’re going to use this term re measure rather than translate the To the functional currency, so after we remeasure to the functional currency, after remeasurement statements need to be translated to the reporting currency if the functional currency is not the US dollar. So in other words, if we’re assuming, in this case, in the case of the remeasurement, or let’s say, we have an entity that we’re going to be consolidating a subsidiary entity in another country, and we’re in the US and we need to basically consolidate these data together in terms of US dollars at the end of the day, if the entity is using the functional currency as as their financial statements, their bookkeeping is in the functional currency, then we can simply use the term translate it to the US dollars, which will be the parent currency that we’re talking about here. If however, the foreign entity is having their books in some currency, that is not the functional currency, then what we’re going to have to do is re measure it. We want to use remeasurement To the functional currency, we want to make remeasure at first to the functional currency rather than straight to the US dollar. So we’re going to use remeasure to the functional currency. And after we re measure to the functional currency, if the functional currency is the US dollar, then then we should be able to stop there. That’s okay. If however, the functional currency is not the US dollar, then we would have to go from the functional currency and then translate to the US dollar. So we’ll talk a little bit more about that as we go. So let’s think about translation.

Functional Currency

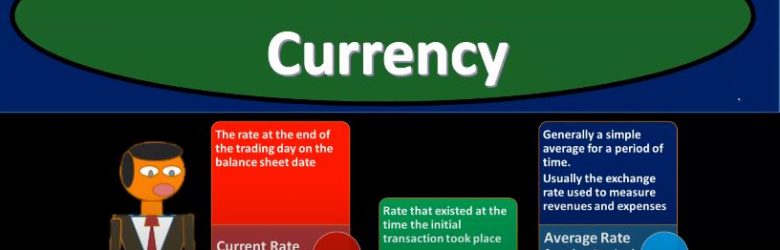

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss functional currency get ready to account with advanced financial accounting, functional currency. When financial statements are restated from a foreign currency into US dollars, we must consider which exchange rate should be used to translate the foreign currency amounts to the domestic currency. So, when we translate the foreign currency to the domestic currency, we’ll have to determine what our exchange rate Are we going to be using in order to do so how will we account for translation gains and losses? So if there’s going to be a translation gain or loss, what are we going to do with that? In other words, should we put the translation gains and losses as part of the income statement reporting it on the income statement, the gains and losses that are due to the translation process exchange rates that may be used? So what kind of exchange rates might we use during this exchange process? Well, we could use the current rates probably the first thing that comes to mind you say, Hey, we got the financial status. As of the year ended of this time period, why don’t we just use the current rate. And that’s typically what we will do for the balance sheet amounts. And that typically makes sense for the balance sheet amounts, because remember, the financial statements, of course on the balance sheet represents where we are at a particular point in time. So simply converting them makes some sense on the balance sheet. But you also might think, Well, what about those things, you know, that we purchased, like fixed assets at a point in time, maybe we should use the point in time that we had the purchase took place. So you could argue on that on the balance sheet, but the current rate on the balance sheet and makes the most sense, but if you’re looking at the income statement, the current rate might not make as much sense because we’re measuring a timeframe that from a year will, let’s say, for a year’s timeframe from the beginning to the end, so maybe it doesn’t seem quite right to use simply the current rate, which would be the rate as of the end of the financial statements if we’re talking like December 31, rather than using some type of race. That would be representative of the period that would covered being January through December, we could use the historical rate, that’s gonna be the rate that exists at the time the initial transaction took place. And again, this one is often would make sense to us if we’re talking about a situation like if we bought equipment or something like that fixed assets, property, plant and equipment, large purchases that are on the books, we might say, well, maybe we should be putting those on the books at the rate that we should be using at the time, basically, the transaction took place. So maybe we would argue for the historical right there. And then we have the average rate for the period, generally a simple average for a period of time, usually the exchange rate used to measure revenues and expenses.