This presentation we’re going to take a closer look at external business expansion, which includes things like mergers and business combinations, get ready to act, because it’s time to account with advanced financial accounting. Before we move into the external expansion, you want to give a review and keep your mind on what our focus is we’re talking about a business that is expanding. When we think of it about expansion, we can break that expansion into internal and external expansion. So we have a business expanding into new areas do segments, we can think of it as an internal or external expansion. In a prior presentation, we talked a little bit more on the internal expansion, in which case you might have a situation where a parent creates a subsidiary or a parent basically just creates another division possibly, and expands in that format. Now we’re going to be going to the external expansion, in which case we’re talking about two entities. So we have two separate legal entities that in some or two separate entities in some case in some way, shape reform are coming together. So now we’re going to have an expansion where we have an external expansion. So if we’re thinking of thinking about this, from the from the standpoint of one company, we’re thinking about ourselves as one company and we are expanding, then we’re thinking about the expansion externally, that we are going to be combining in some way shape or form with another company. Now, the format and form in which that combination can take place can be various we can have various forms of that combination, it could result in a parent subsidiary type of relationship, or it could result in the parent basically consuming that another company and bringing them into the overarching parent company.

Posts with the entity tag

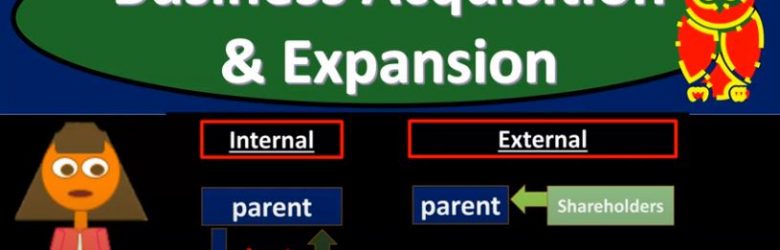

Business Acquisition & Expansion

In this presentation, we’re going to discuss an Introduction to Business acquisition and expansion, get ready to act, because it’s time to account with business, Advanced Accounting, advanced financial accounting will have to do with the concept of expansion and the accounting related to it. So first we need to know well, what is expansion? What are the types of expansion that can take place? What are the problems with regards to the accounting for it? And then what type of accounting principles can we apply in order to deal with the accounting related to those problems? So when we think about expansion in general of a business, we’re thinking about the growth of a business, typically, you have either internal expansion or external expansion. So those are two categories of expansion. We want to start to visualize in our mind and we got our mind our mind is visualizing a business that is trying to expand how are they going to do that? Are they going to do it with some type of internal growth or some type of external growth? Then we want to think about the legal structure of the of the expansion for example, an expansion often results in a parent subsidiary type of relationship. So, we have different legal entities that are associated in some way shape or form.

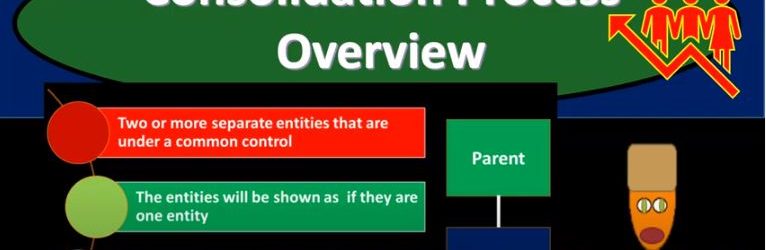

Consolidation Process Overview

In this presentation, we will take a look at an overview of the consolidation process, get ready to account with advanced financial accounting, consolidation process overview we’re talking about a situation where we have two or more separate entities that are under a common control. So the basic kind of format of that you’re imagining here, then you have a parent and a subsidiary, these are going to be connected in some way shape or form because the parent has control over the subsidiary, we can imagine more complex situations, for example, having one parent and multiple subsidiaries as well. The entities will be showing as if they are one entity. So if we have a situation like this, if there’s a control type of situation, it’s quite possible then we’re going to have the the subsidiary and the parent These are two separate companies have a consolidated basically a financial statement. So the financial statement the idea of that being we’re going to take these two financials and represent them as if these two separate entities in this case, two or more can be more than two are one entity. This means two or more sets of books are merged into one set of financial statements. So obviously, what does that look like from a practical standpoint, we have the parent company, we have this subsidiary company, they have two sets of books, we’re gonna have to take those two sets of books and put them together for the financial statements. Here is an example of a slightly more complex situation where we still have parent subsidiary relationships but multiple pole subsidiaries in this case, so we have the parent subsidiary one where there’s a 75% ownership. So we’re over we have a controlling interest, we’re over that 51, we’re going to say there’s a controlling interest here, therefore there’s going to be a consolidation. So we’re gonna have a consolidation subsidiary to is owned 52%. So we’re still over the 51.

Financial Reporting After a Business Combination

In this presentation, we will discuss financial reporting, after a business combination, get ready to account with advanced financial accounting, financial reporting, after a business combination, show the combined entity starting on the date of combination and going forward. So in other words, we probably when we’re imagining this type of scenario, we’re going to say, Okay, I see how this all works out here. And then we imagine this happening if we have a calendar year in a calendar, fiscal year, January through December, we say, Alright, the purchase happens, it will just apply it to January out through December. But obviously, that’s not always the case here. What happens when we have that interim kind of transaction where the purchase happened sometime in the middle of the of the fiscal year then that adds some bit of a complication. So you want to think about this in terms of a clean, you know, year, if it happened at the beginning of the fiscal year in combination, and then you know, what would happen if it did not happen at the beginning of the fiscal year, so if a combination of During a fiscal period, revenue earned by the acquire II before the combination is not reported in revenue for that combined enterprise. So you can see that can add a bit of complication with regards to that reporting