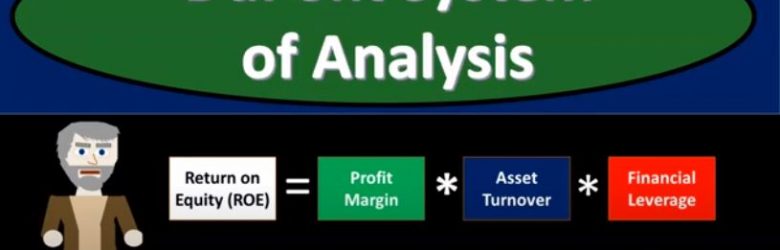

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the DuPont system of analysis Get ready, it’s time to take your chance with corporate finance, the DuPont system of analysis, the DuPont system of analysis is going to be focusing in on a key financial ratio, that being the return on equity or our OE, the ROI he is calculated most simply as net income divided by equity, what we’re going to do is take this return on equity and break it out into components, those components drilling down on areas in the business, allowing us a better analysis in those areas and given us some opportunities to improve different components of the business. So it allows us to basically drill down and get more detail on the return on equity.

Posts with the equal tag

Subsidiary Sells Additional Shares to Parent

Advanced financial accounting PowerPoint presentation in this presentation will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to the parent. So we have a situation where we have the subsidiary selling additional shares to the parent, what’s going to be the effect on the Consolidated Financial Statements get ready to account with advanced financial accounting. We’re talking about a situation here where the subsidiary is going to sell additional shares to the parent and the price is going to be equal to the book value of the existing shares. In that case, it’s going to increase the parents ownership percent, because the parent now has more stocks and no one else got more stocks. Therefore, their percent ownership is increasing. The increase in the parents investment accounts will equal the increase in the stockholders equity of the subsidiary the book value of the non controlling interest is not changed and the normal consolidation entries will be made based on the parents and new ownership percent. So obviously when we do The consolidation entries, we’re going to be basing them on the new ownership percent, that’s going to be the more simple kind of situation where we have the price equal to the book value. What if there’s a sale of additional shares to the parent at an amount of different than the book value, so we still have shares going from the subsidiary to the parent, but now the amount is different than the book value. This increases the carrying amount of the parents investment by the fair value of the consideration. So in other words, the carrying amount of the parents investment in the subsidiary is going to go up by that what was paid for it that consideration given whether that be cash at the fair value of something other than cash. At consolidation, the amount of a non controlling interest needs to be adjusted to reflect the change in its interest in the subsidiary.

Closing Step 2 of 4 – Journal Entry 2 of 4

Hello in this lecture, we’re going to talk about the closing process. Step two of the four step process being closing the expense accounts to the income summary. Remember that the goal of the closing process is to close out the temporary accounts that would include the drawers as well as all the income statement accounts, including revenue and expenses to the capital account. So we want our adjusted trial balance to thing we used to make our financial statements to look like the post closing trial balance with all the zeros from the capital accounts down. How do we do that? Last time we did the first step step one, which was to close out income to the income summary. This time we’re going to close out expenses to the income summary. Next time we’re going to close out the income summary to the capital account. And finally closeout draws to the capital account.

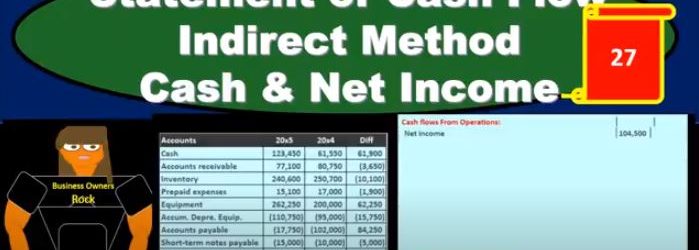

Statement of Cash Flow Indirect Method Cash & Net Income

This presentation, we will start to construct the statement of cash flows using the indirect method focusing in on cash and net income. This is going to be the resources we will have, we’ll have that comparative balance sheet, the income statement, and we’re gonna have some added information. In order to construct the statement of cash flows, we’re mainly going to be working with a worksheet that we’ve put together from a comparative balance sheet. That’s where we will start. So we’re going to find a home, this is going to be our worksheet. We have the two periods. So we have the current year, we’ve got the prior year, and we’ve got the difference between those activities. Now our goal here is to basically just find a home for every component on this difference section. So that’s going to be our home. Why? Well, we can first start thinking about cash. What are we going to do with cash? That’s the main thing. This is a statement of cash flows here. So where are we going to put cash? that’s actually going to start at the bottom, we’re going to say that’s going to be our in numbers. In number we know it’s going to be cached. Now, we’re going to recalculate it. But it’s useful for us to just know and we might just want to put there, hey, that’s where we’re going to end up. That’s where we are looking to get. And now what we really want is the change.

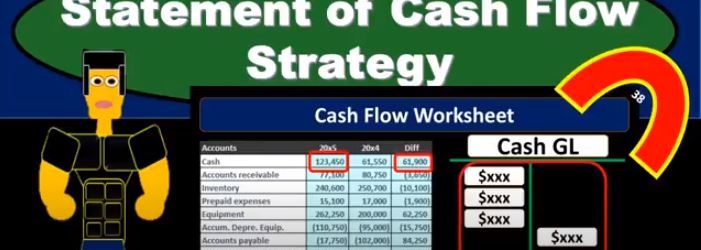

Statement of Cash Flow Strategy

In this presentation, we will take a look at strategies for thinking about the statement of cash flows and how we will approach the statement of cash flows. When considering the statement of cash flows, we typically look at a worksheet or put together a worksheet such as this for my comparative balance sheet, that given the balance sheet accounts for the current year and the prior year or the current period, and the prior period, and then giving us the difference between those accounts. So we have the cash, we’ve got the accounts receivable inventory, we’re representing this in debits and credits. So this is in essence going to be a post closing trial balance one with just the balance sheet accounts, the debits represented with positive and the credits represented with negative numbers in this worksheet, so the debits minus the credits equals zero for the current year, the prior year. And then if we take the difference between all the accounts, and we were to add them up, then that’s going to equal zero as well. This will be the worksheet that we’re thinking about. Now. When can In the statement of cash flows, we can think about the statement of cash flows in a few different ways. We know that this, of course, is the change in cash, this is the time period in the current time period, the prior year, in this case, the prior period, the difference between those two is the difference in cash.

Statement of Cash Flow Tools For Completion

This presentation we will take a look at the tools needed in order to complete a statement of cash flows. to complete a statement of cash flows, we are typically going to need a comparative balance sheet that’s going to include a balance sheet from the prior period, whether that be the prior month or the prior year and a balance sheet from the current period, then we’re going to have to have an income statement. And then we’ll need some additional information in a book problem, it’ll typically give us some additional additional information often having to do with things like worth an equipment purchases, whether equipment purchases or equipment sales, were their investments in the company where their sales of stocks, what were the dividends within the company. In practice, of course, we would have to just know and recognize those types of areas where we might need more detail. And we would get that additional information with General Ledger we’d go into the general ledger, look at that added information. Now once we have this information, our major component we’re going to use is going to be the comparative balance sheet. That’s where we will start. So that comparative balance sheet is going to be used to make a worksheet such as this.