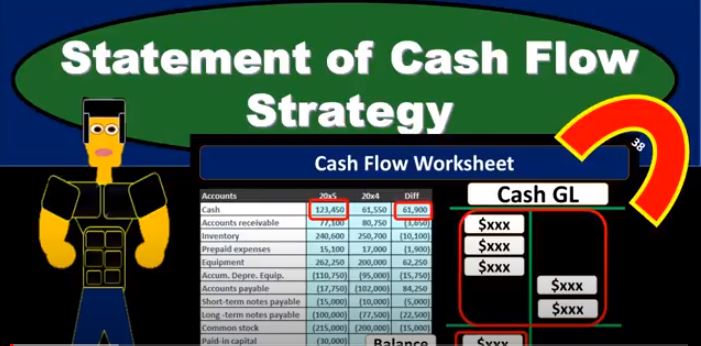

In this presentation, we will take a look at strategies for thinking about the statement of cash flows and how we will approach the statement of cash flows. When considering the statement of cash flows, we typically look at a worksheet or put together a worksheet such as this for my comparative balance sheet, that given the balance sheet accounts for the current year and the prior year or the current period, and the prior period, and then giving us the difference between those accounts. So we have the cash, we’ve got the accounts receivable inventory, we’re representing this in debits and credits. So this is in essence going to be a post closing trial balance one with just the balance sheet accounts, the debits represented with positive and the credits represented with negative numbers in this worksheet, so the debits minus the credits equals zero for the current year, the prior year. And then if we take the difference between all the accounts, and we were to add them up, then that’s going to equal zero as well. This will be the worksheet that we’re thinking about. Now. When can In the statement of cash flows, we can think about the statement of cash flows in a few different ways. We know that this, of course, is the change in cash, this is the time period in the current time period, the prior year, in this case, the prior period, the difference between those two is the difference in cash.

01:16

That’s the change in cash. That’s kind of like the bottom line of the statement of cash flows, meaning we’re really looking for this change in cash, we’re going to end the statement of cash flows by getting back to this cash at the end of the time period, so that it’ll tie out to the balance sheet. But we’re really looking for the activity that change that’s what the statement of cash flows is designed to do. So to think about that, let’s go through we could think of the GL and just look at the GL for the cash flow. Now of course, the GL for cash flow is going to be a lot of activity. That’s why the cash flow statement is so important, because cash is going to be involved in so many activities. It’s involved in every cycle. We deal with cash transactions every day. So when we see the god We know that it’s going to be increasing with debits, we know that it’s going to be decreasing with credits. And we know that if we looked at the entire GL, for most companies, it would be very long, very extensive. But we can see all this activity. And we can see that we can, if we’re trying to look at the cash flow, one way we can do that is, of course, to look at the activity within the cash flow statement within the GL.

02:23

And we can think about trying to categorize those that would be one approach to figuring out what is happening within the cash flow, we can go through the actual cash flow statement, the GL and try to categorize all the activity because we know that this activity, of course, represents the change here that represents the difference then of what’s happening from one period to the next. So this will give us our Indian balance. So we know then that this ending balance is going to equal what’s on the balance sheet. And we know that if we added up all this activity, that’s going to give us the change. And this is really what we’re looking for, for the statement of cash. flow. So when we consider the statement of cash flows, you could think of it well, you know, what’s really what we’re really getting after here is looking at all the changes in the GL. And try to categorize those changes into basic categories in terms of operating, investing and financing type of activities. So that’s one way we can approach this and think about this. Now, we don’t typically do it this way, when we when we do the cash flow statement, because it’s too tedious to do that to go through each activity.

03:29

Again, we basically be kind of recreating the entire books on a cash flow basis. And so we can think about it this way in theory, and then in practice, we typically do something a little bit different, we kind of back into this information. And we do that by noting the accounting equation of assets equal liabilities plus equity, and just kind of breaking out the cash component to it. So in our worksheet, we can see that if this is the change in cash, this is the number we’re really looking for. Then we could look at the change in everything else. And that’ll back into the change in cash. In other words, we know that the debits equal the credits here, so the change in cash is equal to the change in everything else, or the change in everything adds up to zero. And therefore everything else other than cash, the change in everything else other than cash will add up to the change in cash. And by doing this, we can see a kind of a grouping a little bit more easily rather than looking through every transaction in the GL. because there’ll be a lot of transactions, for example, that make up this difference in accounts receivable. But we don’t need to look at every transaction because they’re all pretty much the same. We know what happens with accounts receivable goes up when we make a sale on account. And accounts receivable is going to go down when a customer pays off the account. So we don’t need to look at every single transactions within there as we would do if we saw it in the geo. We can kind of group those together and say that difference here and we can take that as a whole and try to think about what’s the net that happened in terms of accounts receivable and back into what happened. We’ll talk more about how to do that on each individual account. But just note, the theory here of what we’re doing is we’re backing into the cash flow statement. And that may seem confusing at first in theory, because if you’re looking at the change of the activity and the cash flow, you would think you would be looking directly at the GL as we did in the prior slide, you think we would go to the activity in the GL and try to recategorize them in terms of cash flows, in terms of categories, operating, investing, and financing. But what we’re really going to do typically is used as an equation more like this.

05:39

We’re going to say here the accounting equation is assets equal liabilities plus equity, then we’re going to break out cash and say, well, then we can say well, cash, plus all other non cash assets. So we’re saying this, keeping this one alone cash versus all non cash assets, will equal liabilities plus equity. And so we’re just We’re working with this formula to break out cash. And by doing that, we can look at the cash flow and we can kind of back in to the cash flow. So these are the two ways they’re kind of the opposite ways we can look at it, we can go in and we can look at the activity that’s happening to cash itself, which is a bit of a tedious job in practice, although in theory makes the most sense makes the most sense that say, Hey, we would want to know what’s happening with cash. Let’s look at the GL and recategorize everything that happened in cash. But what is more practical in practice is to use the equation and really look at everything else other than cash in these groupings of categories, which is what this worksheet will in essence do. And by doing that, we’ll kind of back into we’re going to back into what the changes in cash are happening. So that’s how the cash flow statement will typically be working with something more like this using this accounting equation using this worksheet reflecting what this accounting equation is saying.