In this presentation, we will continue on with our statement of cash flows. Taking a look at the investing activities, specifically the purchase of equipment, we’re going to be using the comparative balance sheet, the income statement and additional information focusing here on the comparative balance sheet, which we use to make this worksheet. So this worksheet is our comparative balance sheet. We’ve been going through this worksheet and really looking for the differences. We’re finding a home for all the differences. Once we do that, we’re feeling pretty good. We have done this all the way through the operating activities. So are the cash flows from operations. So we’ve gone through here we’ve kind of picked and choose the items that are going to be cash flows from operations, which is probably the way most people approach this. But just note that as we’ve done that, we’ve tried to pick up the exact differences here. We haven’t gone to the income statement and thought about it separately outside of this worksheet, and then we’re going to go back and make adjustments. So we found a home for the difference in cash because that’s Kind of like our bottom line. And then we’ve got accounts receivable, inventory prepaid expenses, and then we skipped equipment and went down to accounts payable.

Posts with the equipment tag

Statement of Cash Flow Indirect Method Change In Accounts Payable

In this presentation, we will continue on with our statement of cash flows using the indirect method looking in on the change in accounts payable, we’re going to be using this information or a comparative balance sheet income statement and other information focusing primarily on comparative balance sheet creating a worksheet with it, looking like this. This basically being the comparative balance sheet. But in a post closing trial balance format, we have our two periods and the difference between those periods here. Our goal is to find a home for all of these differences. Once we do so we’ll end up with basically the change in cash. That being our bottom line that we’re looking for. We’ve gone through this information in terms of the cash flows from operations. We’re currently looking through the current assets, and now we’re moving on to the current liabilities. So we’ve looked at the accounts receivable, the inventory, prepaid expenses, we have these here. We’re moving on now to a liability and notice when we do that, when we’re working From the worksheet, we’re kind of skipping over some things here.

Statement of Cash Flow Indirect Method Adjustments to Reconcile Net Income to Net Cash Provided

In this presentation, we will continue putting together a statement of cash flows using the indirect method focusing in on adjustments to reconcile net income to net cash provided by operating activities. So this is going to be the information we will be using, we have the comparative balance sheet, the income statement added information, we took this comparative balance sheet to create our worksheet. So here is our worksheet for two time periods. This is the difference we’re basically looking to find a home for all of these differences we have done so with cash, and we’ve done so with a difference in retained earnings. So here’s cash, here’s net income, the difference in retained earnings, we will have to adjust net income shortly or at the end of the problem. We’ll we’ll take a look at that we’ll make an adjustment for it. We’re going to now find the difference for all the rest of these. Also note that of course cash is going to be the change in cash will be our bottom line. Never we’re going to recalculate this But it’s nice to know where we are ending up at. So this is kind of like even though it’s at the top of our worksheet, that’s where we want to end up by finding a home for everything else. So now we’re going to take a look at the adjustments to reconcile net income to net cash provided by operating activities. So these are going to be those types of things that we look at the income statement, and we’re going to say that these are non cash activities, meaning income is calculated as revenue minus expenses. And the cash flow.

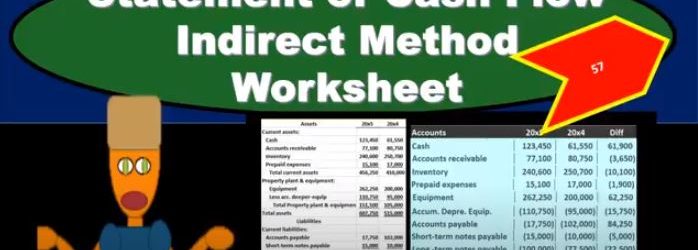

Statement of Cash Flow Indirect Method Worksheet

In this presentation, we will put together a worksheet that will then be used to create the statement of cash flows using the indirect method. To do this, we’re going to use our resources which will include a comparative balance sheet, and income statement and added information. Remember that in practice, we’re typically going to have a comparative balance sheet RS here being for the current year 2005 and 2000. x for the prior year. So we need a comparative to time periods in order to create our worksheet. This will be the primary components that we’ll use to create our worksheet. We will need the income statement when I’m creating the statement of cash flows mainly to check up on some of the differences that we will have in our worksheet. And then in a book problem will typically be told some other things related to for example, purchases of or sales of equipment, borrowings, if we had any cash dividends or any dividends at all, this is added information we would Need. In practice, of course, we would just be checking on these things by looking at the difference and going back to the GL. And just taking a look at those differences in order to determine if we have any added information that needs to be adjusted on our statement of cash flows.

Statement of Cash Flow Tools For Completion

This presentation we will take a look at the tools needed in order to complete a statement of cash flows. to complete a statement of cash flows, we are typically going to need a comparative balance sheet that’s going to include a balance sheet from the prior period, whether that be the prior month or the prior year and a balance sheet from the current period, then we’re going to have to have an income statement. And then we’ll need some additional information in a book problem, it’ll typically give us some additional additional information often having to do with things like worth an equipment purchases, whether equipment purchases or equipment sales, were their investments in the company where their sales of stocks, what were the dividends within the company. In practice, of course, we would have to just know and recognize those types of areas where we might need more detail. And we would get that additional information with General Ledger we’d go into the general ledger, look at that added information. Now once we have this information, our major component we’re going to use is going to be the comparative balance sheet. That’s where we will start. So that comparative balance sheet is going to be used to make a worksheet such as this.

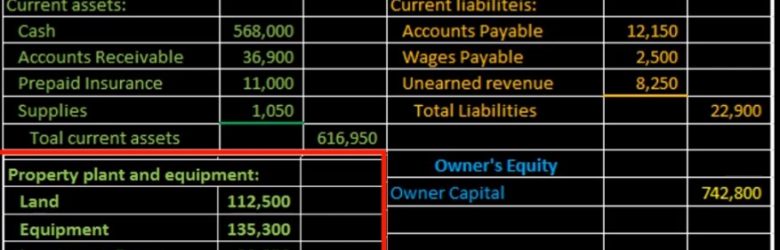

Balance Sheet Property Plant %26 Equipment From Trial Balance 13

Hello in this lecture we’re going to put together the section of the balance sheet of property plant and equipment from the trial balance property, plant and equipment will be part of the assets can be the subcategory of assets, we talked last time about the creation of the current assets. And now we’ll be moving on to property, plant and equipment, which will then sum up everything for total assets. We will be picking these numbers up from a trial balance. And once we have completed all the financial statements, what we’re basically doing is taking a debit and credit format from the trial balance, converting it to a plus and minus format in terms of the financial statements, assets, equal liabilities plus owner’s equity so that people can read it even if they don’t understand debits and credits. In this lecture, we’re focusing in on this section here, which will be a land equipment and each cumulated depreciation.