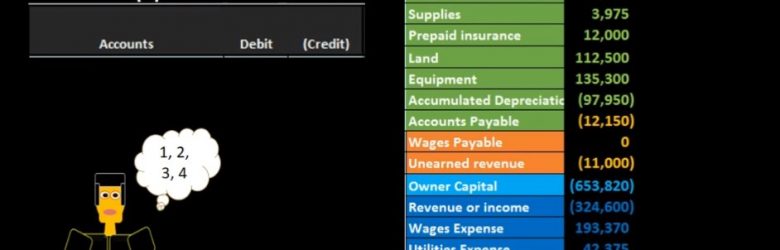

Hello in this lecture we’re going to be creating the equity section of the balance sheet. In prior lectures, we have taken a look at the current assets section, the property plant and equipment section and then the liability section. This will be rounding out the balance sheet where we will finally get to total assets being equal to total liabilities and equity represent in the double entry accounting system. In terms of the balance sheet in terms of the accounting equation, we of course, are pulling these numbers from the adjusted trial balance. the adjusted trial balance also represents the double entry accounting system. However, it represents that double entry accounting system in the format of the building blocks of debits and credits. All we’re doing is taking those building blocks in terms of debits and credits, rearranging them to the accounting equation, so that readers who don’t understand debits and credits can then read them. Now when we look at the equity section, this is a bit confusing when we convert from the trial balance to the equity section.

Posts with the Equity tag

Balance Sheet Liability Section Creation From Trial Balance 14

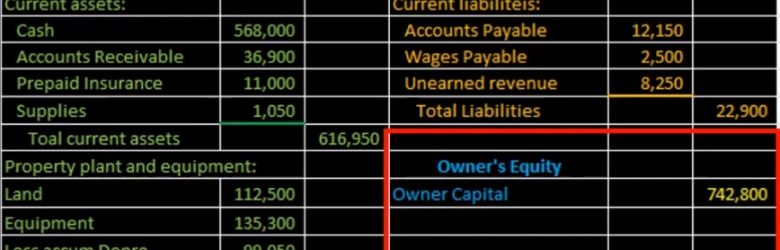

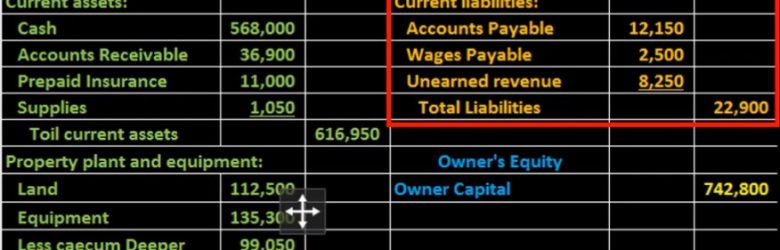

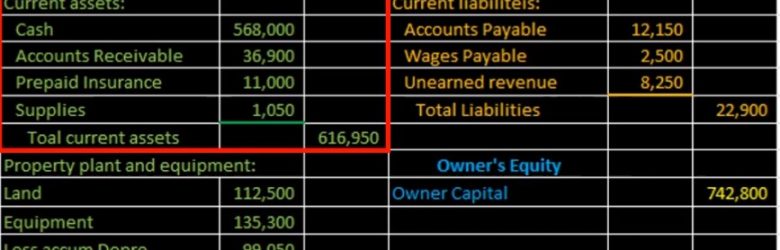

Hello in this lecture we’re going to create the liability section of the balance sheet. In prior lectures, we have taken a look at the assets in terms of first current assets and then property, plant and equipment and given us the total assets at that time, then we are now going to move on to liabilities, and that will be part of the second part of the balance sheet meaning it’ll then sum up to total liabilities and owner’s equity. We are going to be taking this information of course from the adjusted trial balance the adjusted trial balance in the format of debits and credits, we are now formatting it in the format of the accounting equation. Still the double entry accounting system just in two different formats, just reshuffling the puzzles so that different readers can understand the financial statements even though they don’t understand debits and credits.

Balance Sheet Current Assets from Trial Balance 12

Hello in this lecture, we’re going to create the current asset section of the balance sheet, we’re going to create this current asset section from a trial balance, we’re going to piece together the financial statements piece by piece as we go through a series of lectures, the trial balance being here at this is going to be the adjusted trial balance. And what will happen is we will then find a home for all of the accounts on the financial statements. Once we then do that, that means that we have then converted this from the double entry accounting system being in the format of debits minus credits equaling zero or debits equaling the credits to the assets equals liabilities plus the owner’s equity, basically the accounting equation, which is reflected on the balance sheet. So we’re going to start off by doing the current assets section, which will just be this part we’re going to find a home for these first few accounts.

Adjusting Entry Depreciation 10

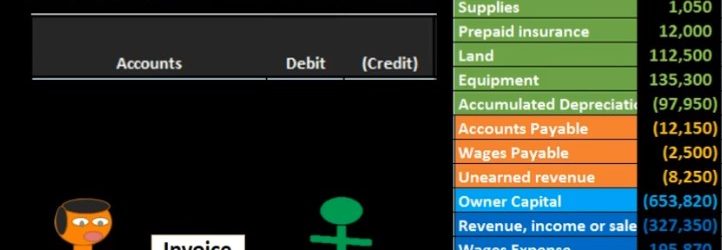

Hello in this lecture, we’re going to record the adjusting entry related to depreciation were recorded on the left hand side, that’s where the journal entry will go. And then we’ll post that to the trial balance on the right hand side trial balance being in the format of assets in green liabilities in the orange. Then we have the equity section in the light blue and the income statement, including revenue and expenses in the darker blue. We’ll first talk about what accounts are affected and then we’ll go back and explain why this is the case. So first, we know that it’s an adjusting entry. So that’s going to have some added rules, you want to keep the adjusting entry separate in your head from just normal journal entries. all entries have at least two accounts and an equal number of debits and credits as well as adjusting entries. But adjusting entries are all made of as of the cutoff date, we’re gonna say 1231 in this case, and they generally have one account above this equity line above the capital meaning a balance sheet account and one account below that line meaning an income statement accounts.

Adjusting Entry Accounts Receivable 8

Hello in this lecture, we’re going to record an adjusting transaction related to accounts receivable. We’re going to record the journal entry over here on the left hand side and then post it to the trial balance on the right hand side trial balance and format of assets in green liabilities in orange equity in the light blue and the income statement in the darker blue including revenue and expenses, we’ll first walk through which accounts will be affected and then explain why that is the case. So we know that it is an adjusting entry and knowing that it’s an adjusting entry means it’s slightly different than a normal journal entry in that it does have two accounts like normal journal entries, but it also generally has one income statement account below the blue line and one balance sheet account above the blue line the light blue line, so it’s going to be one account above owner’s equity, one account below owner’s equity.

Adjusting Entry Supplies 5

Hello in this lecture, we’re going to record an adjusting entry related to supplies. Remember that adjusting entries are going to have their own set of rules, you want to keep them separate in your head. They are still journal entries, and they follow the journal entry rules. But if we know that we are dealing with adjusting entries, we can apply an additional set of rules to help us to understand what the journal entry will be. For example, the adjusting entries will all be at the end of the time period, the end of the month or the end of the year. And if we take a look at the supplies account, we also know that typical adjusting entries will always have an account in the balance sheet section in terms of the trial balance that’s going to be somewhere up above this owner’s capital account. So we look for an account on the trial balance related to this supplies. on the balance sheet we said how about supplies and we also note that the supplies, the adjusting entries will have an account below the equity section below the owner’s capital in the income statement, revenue and expenses.

Rules for Using Debits & Credits 210

Hello. In this presentation we’re going to discuss rules for debits and credits, how to make accounts go up and down using debits and credits. objectives, we will be able to at the end of this define rules to make accounts go up and down, apply rules to make accounts go up and down and explain how rules are used to construct journal entries. When considering these rules that will be applied, the rule will be very simple to apply once we understand the normal balances or have memorized or are using a cheat sheet in order to know what those normal balances are. There’s no getting around just memorizing the normal balances. That’s where most of the time will take place. Once we know what those normal balances are, we’re going to want to do things to those normal balances. We’re going to want to be increasing or decreasing those normal balances in some way.

Debits & Credits 205

Hello in this presentation we will discuss debits and credits. Objectives at the end of this we will be able to define debits and credits list account normal balances and explain how debits and credits work. First we want to take a look at the double entry accounting system and recognize that the double entry accounting system can be represented in multiple different ways including as we have seen before the accounting equation meaning that assets equal liabilities plus equity, we can record transactions using this accounting equation as we have done in the past. That accounting equation is the basis behind the balance sheet where we have the assets liabilities and equity representing the fact that the balance sheet then would be in balance.

Accounts Payable Transactions Accounting Equation 170

So there’s gonna be problems later on where they’ll basically say, you know, you got to pay off something on account and you have to assume that the prior transaction took place. You got to kind of know in your mind how these things are related. So if we go through them by cycle that will help to achieve that goal. first transaction, we’re going to say purchase supplies on account. If we go through our list of questions, we’re going to say is cash affected? In this case? No, because we purchased it on account, then we’re going to ask what we’ve received, in this case supplies. So we got supplies, that is here, it’s going to be an asset. Therefore the asset is going to go up because we got more of them, then the only question is, what is the other account? It’s not a decrease to cash because we didn’t pay cash. And therefore we must be doing something somewhere else. That will be accounts payable, so accounts payable is going to increase by the same amount.

Accounts Receivable Transactions – Accounting Equation 167

Hello in this presentation we will record transactions related to accounts receivable recording the transactions using the double entry accounting system in the format of the accounting equation that equation of assets equal liabilities plus equity objectives at the end of this we will be able to list at transactions involving accounts receivable and record transactions involving accounts receivable using the accounting equation. We will go through some examples of the accounting equation and recording transactions related to accounts receivable quick review of the accounting equation we have assets equal liabilities plus equity as the accounting equation. We then need to start memorizing those accounts that fit into those subcategories of assets, liabilities and equity.