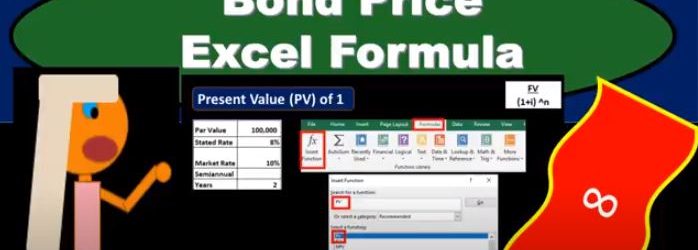

In this presentation, we will calculate the bond price explaining how this can be done using present value formulas within Excel. Remember that the bonds is going to be a great tool for both accounting and finance to describe the present value calculation. So that’s why it’s going to be used. Oftentimes It has two cash flows related to it, one’s going to be the face amount of the bond that’s going to be due at the end of the term of the bond. In our case, it’s going to be two years semiannual or four time periods. And the other is the flow of interest. So bonds are a great example because they have the two types of present value problems that we need in one area. So even if you’re not in an area where you’re dealing with bonds all the time, they’re still going to be used and useful to understand present value types of calculations. So here we’ve got the bond is going to have one cash flow of 100,000 at the end of four periods or two years, and we need to figure out what the present value is in order to price it back here at your at time period zero. And then we have these four payments in terms of the annuity 4000. And we need to take those and present value them, we could take each period and present value each payment and present value it. But the easier thing to do is to present value, an annuity when it’s applicable and present value, the one amount when it’s applicable. And therefore think of that about these as two basically separate cash flows that we’re going to have to present value separately. So we can do this multiple different ways. And it just depends on what you’re what tools you have. And where you are, in order to know how to do it. What you want to know is just that there’s different tools to do it. Anytime someone uses a different tool. What are they doing the same thing? And and when can you apply these tools and what’s actually happening here. So that’s what’s actually happening. We’re present valuing this information.

Posts with the Excel tag

Bonds Present Value Formulas

In this presentation, we will take a look at present value formulas related to bonds. One of the reasons bonds is so important to accounting and finance is because they’re a good example of the term of present value of money. We’re trying to look for an equal measure of money, when we think of bonds and bonds is going to have this relationship between market rates and the stated rate, which helps us to kind of look through and figure out these types of concepts. So even if we don’t work with bonds, in other words, if we’re not planning on issuing bonds, or buying bonds, or knowing anything about bonds not being important to us, the time value of money is a very important concept and bonds is going to be a major tool to help us with that. Why is bonds so useful for learning time value of money, because there’s two types of cash flows with bonds meaning at the end of the time period, we typically are going to get the face amount of the bond that 100,000 similar to a note and then we’ve got the interest payments that are going to happen on a periodic To basis, and therefore we have these two different types of cash flows, that we can use two different formulas for, to think about how to equalize.

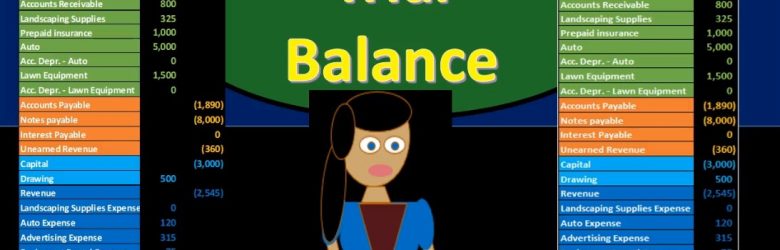

Trial Balance 220

Hello in this presentation we will be discussing a trial balance objectives at the end of this, we will be able to define a trial balance list components of a trial balance and explain how a trial balance is used. When considering the trial balance, we first want to think about where the trial balance falls within the construction of the financial statements. In other words, what processes go before the trial balance, what goes after the trial balance, where’s the trial balance fit into our process? Remember, the ending goal, the ending process of the accounting been to compile the data in such a way to create the finance financial statements. Those financial statements have been the end product. Typically if we’re thinking about a linear process, then we’re thinking about all the transactions that would happen during the month.

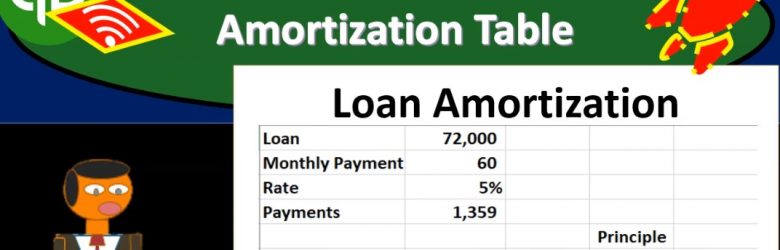

Loan Amortization Table 8.03

This presentation and we’re going to create a loan amortization table. And this will help us to track our loan payments and break out the principal portion and the interest portion of them. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to first start off with our reports, we’re gonna go down to the reports down on the left hand side and then we’re going to be opening up our favorite report that being the balance sheet report, opening up the balance sheet report scrolling up top, we’re going to be changing the dates from a 10120 to 1230 120. Then we’re going to run that report. Then I’m going to close up the hamburger to get it out of the way so I don’t doesn’t bother me and I’ve got the 125 on the zoom holding down control scrolling up to get there.

7.40 Part 1 Inventory Payment

We will record financial transactions related to inventory payment into a comprehensive Excel worksheet using debits and credit. We will first take a quick look at QuickBooks and then enter the accounting transaction into Excel using debits and credits. For more information about QuickBooks see our QuickBooks 2018 course. See the link below for more information about the online course. http://accountinginstruction.info/qui… For more information about accounting and Excel see our Accounting and Excel course. More information about the online course at the link below. http://accountinginstruction.info/fin… • Affiliate links ○ Microsoft Office 2016 (Affiliate) http://amzn.to/2CYi6LO ○ QuickBooks (Amazon Affiliate) http://amzn.to/2m14h7h ○ QuickBooks Online Plus (Amazon Affiliate) http://amzn.to/2CYRWsE

7.35 Deposit Part 1

We will record the deposit of cash or check received from a customer into the bank. We will first take a quick look at QuickBooks and then enter the financial transaction into Excel using debits and credits. For more information about QuickBooks see our QuickBooks 2018 course. See the link below for more information about the online course. http://accountinginstruction.info/qui… For more information about accounting and Excel see our Accounting and Excel course. More information about the online course at the link below. http://accountinginstruction.info/fin…

QuickBooks vs Excel 10.550 Unearned Revenue Reversing Entry

We will record the financial accounting reversing entry related to unearned revenue. We will first enter the reversing entry into Excel. We will then enter the accounting transaction into QuickBOoks. For more information about QuickBooks see our QuickBooks 2018 course. See the link below for more information about the online course. http://accountinginstruction.info/qui… For more information about accounting and Excel see our Accounting and Excel course. More information about the online course at the link below. http://accountinginstruction.info/fin…

10.65 Closing Process February u

We will enter journal entries related to the financial accounting closing process into a comprehensive Excel worksheet. We will first take a quick look at QUickBooks and then enter the financial accounting data into Excel using debits and credits. For more information about QuickBooks see our QuickBooks 2018 course. See the link below for more information about the online course. http://accountinginstruction.info/qui… For more information about accounting and Excel see our Accounting and Excel course. More information about the online course at the link below. http://accountinginstruction.info/fin…

10.50 Unearned Revenue Adjusting Entry u

We will enter the financial accounting adjusting journal entry for unearned revenue into a comprehensive Excel accounting problem using debits and credits For more information about QuickBooks see our QuickBooks 2018 course. See the link below for more information about the online course. http://accountinginstruction.info/qui… For more information about accounting and Excel see our Accounting and Excel course. More information about the online course at the link below. http://accountinginstruction.info/fin…

10.45 Depreciation Adjusting Entry u

We will record the financial transaction related to depreciation. We will record the accounting transaction in both Excel and QUickBooks. We will first enter the financial transaction into Excel using debits and credits and then enter the same accounting date into QuickBOoks. For more information about QuickBooks see our QuickBooks 2018 course. See the link below for more information about the online course. http://accountinginstruction.info/qui… For more information about accounting and Excel see our Accounting and Excel course. More informatin abou the online course at the link below. http://accountinginstruction.info/fin…