QuickBooks Online 2021 getting the software for free. Let’s get into it with Intuit QuickBooks Online 2021. Now, first question related to a QuickBooks Online Course is, how do I get access to QuickBooks Online so that I can practice with it. Two major scenarios there. One, you don’t have access to QuickBooks Online at all, or two, you do have access to it, but it’s through work or through your company file. And what we really want is a separate clean QuickBooks file that we can use to do data input in and practice with, without messing up the current company file that we may have access to.

Posts with the file tag

Day Free Trial Setup – .7 30

QuickBooks Online 2021 30 day free trial setup. Let’s get into it with Intuit QuickBooks Online 2021. Here we are on the Intuit website Intuit being the owner of QuickBooks, this is the first place I would go for anything that’s going to be QuickBooks related. Because if you just do a search into your favorite browser, such as Google, it might take you to some other websites. And you want to go here first, because this is the source. These are the owners of QuickBooks. So it’s Intuit, i NTU, i t.com, that’s into it, I empty you it.com. What we’re looking for here is to set up a free 30 day trial version of the software, which we will have for a limited time, that to been 30 days.

QuickBooks Online 2021 Test Drive .15

QuickBooks Online 2021 Test Drive File. Let’s get into it with Intuit QuickBooks Online 2021. Now, in a prior presentation, we looked at the 30 day free trial option of QuickBooks Online offered by Intuit, the owner of QuickBooks. This time, we want to look at the other free option that is offered by Intuit, the owner of QuickBooks, that being the test drive file. Easiest way to get there is just to go to your favorite search engine, such as Google type in QuickBooks Online test drive, QuickBooks Online test drive, as I’ve done here, then we’re just going to click on this item, QuickBooks Online test drive from Intuit, Intuit, the owner of QuickBooks, it may give you a little test here to say that you’re not a robot, and I’m gonna say, yeah, I’m not a robot.

Preferences – Account & Settings 30

QuickBooks Online 2021 preferences, account and account settings. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page searching for QuickBooks Online test drive. And then we’re going to be picking QuickBooks Online test drive for Intuit, the owner of QuickBooks, we’re gonna verify that we are not a computer, or a robot, kind of the same thing, I guess, I mean, a computer can be a robot, but a robot doesn’t necessarily have to be. But in any case, we’re here on the Craig’s design and landscaping services, we want to touch in on the preferences or account settings, because when you set up a new company file, this is often one area that you’re going to zoom in on towards the beginning of the setup process.

Consolidation & Income Taxes

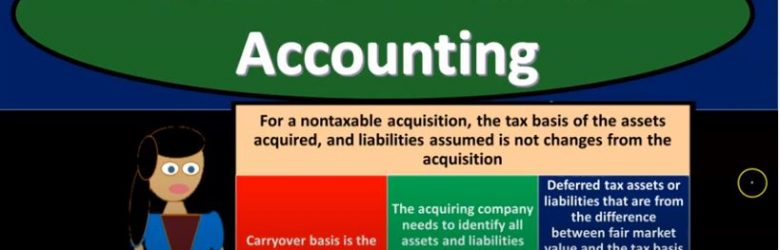

Advanced financial accounting PowerPoint presentation. In this presentation we’ll talk about consolidation and income taxes get ready to account with advanced financial accounting. For a non taxable acquisition, the tax basis of assets acquired and liabilities assumed is not changed from the acquisition. In this case, then the carrying basis is the acquire ease basis, the acquiring company needs to identify all assets and liabilities acquired and their fair market value when the acquisition takes place, and then the deferred tax assets or liabilities that are from the difference between the fair market value and the tax basis when allocating the purchase price must be recorded by the acquiring company. So we have the tax expense allocation. When consolidated return is filed. What are we going to do with this tax expense allocation, the parent company and subsidiaries can file a consolidated income tax return or they can choose to file separate returns. So this is one of the things that we kind of have to consider here we’ve got a controlling interest that’s going to be involved. So we have two entities, one has a controlling interest and the other obviously parents subsidiary type of relationship question, then should we report just one tax return? Or should we have two tax returns, this is going to be a decision that needs to be made. But if we file one tax return, then at least 80% of its stock must be held by the parent company or another company included in the consolidation return for a subsidiary to be eligible to be included in a consolidated tax return.