QuickBooks Online 2021. Check and expense forms. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive, then we’re going to be selecting and QuickBooks Online test drive. And then QuickBooks is going to try to call us a robot. Again, we’re gonna say we’re not a robot, you’re the robot, you’re you’re the robot, QuickBooks. And then we’re gonna log in there, we’re still looking at our vendor section. So if we hit the drop down over here, we’ve got the new drop down, we’re in the vendor section, we talked about, basically the accrual process, which is the entering of the bill and then the pain of the bill.

Posts with the item tag

Invoice Form 1.34

QuickBooks Online 2021 invoice form, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re searching for QuickBooks Online test drive, then we’re going to be selecting QuickBooks Online test drive from Intuit, it’s then going to ask if we’re a robot, I was once but then I made a wish upon a lucky star. Now I’m a kangaroo. So we’re good. We’re gonna check that off continue.

Receive Payment Form 1.35

QuickBooks Online 2021 receive payment form. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive, then we’re going to be selecting QuickBooks Online test drive from Intuit. We are not a robot, but we would like to be and we’re hoping QuickBooks can help us out with that process. Continuing on. Here we are in Craig’s design and landscaping services test file, we’re going to go to our new tab on the left hand side.

Day Free Trial Setup – .7 30

QuickBooks Online 2021 30 day free trial setup. Let’s get into it with Intuit QuickBooks Online 2021. Here we are on the Intuit website Intuit being the owner of QuickBooks, this is the first place I would go for anything that’s going to be QuickBooks related. Because if you just do a search into your favorite browser, such as Google, it might take you to some other websites. And you want to go here first, because this is the source. These are the owners of QuickBooks. So it’s Intuit, i NTU, i t.com, that’s into it, I empty you it.com. What we’re looking for here is to set up a free 30 day trial version of the software, which we will have for a limited time, that to been 30 days.

Government Grants 140

In this presentation, we will enter a transaction related to the receipt of a government grant into our not for profit organization. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to head on over to our Excel file to see what our objective will be, we’re going to be in tab four. So we’re in tab four, where we have a contribution that’s going to be for the school over to our description up top. So this is going to be the government grant to be used for education. So we’re going to get money, we got money from a government grant. And we have to use it for a specific reason, they put a restriction on it in other way.

Pledge 135

This presentation, we’re going to enter a transaction related to a pledge and our accounting system. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, let’s jump on over to Excel to see what our objective will be. We are in Excel, we’re in tab number three, we’re now recording a pledge. Now the pledge is going to be similar to the contribution. However, we haven’t got the money yet. So it’s a promise to pay. If you compare this to a for profit type of organization, the contribution would be similar to us doing the goods or services at the same point in time that we get paid. And you can imagine given a sales receipt, like at the register, at that point, and then the pledge is going to be similar to us doing a service or providing goods before we get paid.

Office Space Donated 125

This presentation, we’re going to record a transaction related to the contribution or donation of office days to our not for profit organization. Get ready because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to jump on over to Excel to see what our objective will be, we’re going to be on tab one. So I’m on tap one here, and number one says it’s going to be office space donated. So it’s going to be a bit of a tricky transaction for the first transaction here we got a contribution, but that contribution isn’t cash and which would be the normal type of contribution what was contributed instead, the use of the facilities the use of office space.

Break Even Analysis 510

Corporate Finance PowerPoint presentation. In this presentation, we will discuss breakeven analysis, get ready, it’s time to take your chance with corporate finance. Break Even analysis includes our fundamental tools for making projections and predictions into the future. Now note, when we think about breakeven analysis, the fundamental calculation within a breakeven analysis will be the break even point. But when we hear breakeven analysis in general, you can think of it that as a more broad kind of perspective, to use some of these tools in order to think about projections into the future. So when you hear breakeven analysis, you’re typically thinking kind of projections, budgeting, future based analysis, as opposed to some financial accounting, which is typically going to be based on the past prior performance.

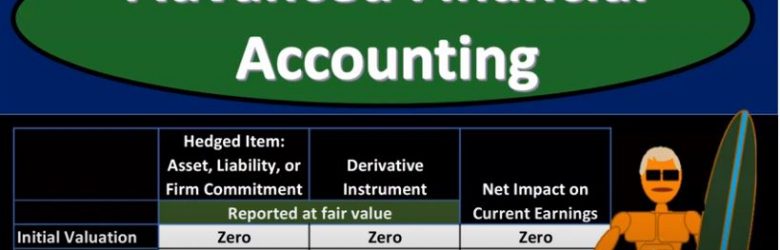

Forward Exchange Financial Instruments

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss forward exchange of financial instruments get ready to account with advanced financial accounting, forward exchange financial instruments let’s start off with some definitions starting off with financial instrument itself will be either cash evidence of ownership or a contract that imposes on one entity on contractual obligation to deliver cash or another instrument and conveys to the second entity, the contractual right to receive cash or another financial instrument. That of course, being the most complex component here. So let’s read that one more time. The financial instrument a contract that imposes on one entity a contractual obligation to deliver either cash or another instrument and conveys to the second party the second party in this item, the second entity, the contractual right to of course, receive the cash or another financial instrument derivative. So a derivative, financial instrument or other contract whose value is derived from some other item that has a value that varies over time. So let’s think about that one more time again, derivative financial instruments or other contracts whose value is derived from, they’re going to get the value from some other item that has a value. That is that varies over time, meaning of course, that it will be changing over time. So let’s think about the derivative characteristics. And then we’ll apply these to the component of what we’re considering here. foreign currency and foreign currency transactions in terms of typically foreign currency type hedge transactions.

Receive Inventory Requested With P.O. Enter Bill 8.20

In this presentation, we’re going to record the receipt of inventory with a bill. In other words, in prior presentations, we entered a purchase order requesting inventory. Now we’re going to receive that inventory along with the bill and enter that into the system. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars practice problem. Let’s first take a look at our flow chart. So we’re going to go down to QuickBooks desktop.