QuickBooks Online 2021 purchase and finance equipment and add sub accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be opening up a few reports up top balance sheet income statement trial balance,

Posts with the loan tag

Make Loan Payments Using an Amortization Table 8.07

QuickBooks Online 2021. Make loan payments using an amortization table. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our great guitars a practice file, we’re now going to make loan payments with the help and use of our amortization table, which we set up in a prior presentation. To do so let’s open up some of our reports, we’re going to duplicate the tabs up top, right click on the tab up top, duplicate it, we’re going to right click on the tab up top again, duplicate again opening up then our balance sheet and P and L Profit and Loss report going on down then to the reports on the left hand side, opening up the balance sheet report.

Make Loan Amortization Table 8.05

QuickBooks Online 2021. Make a loan amortization table, which we will then use to record loan payments within QuickBooks Online, making the loan amortization table with the help and use of Excel. Let’s get into it with Intuit QuickBooks Online 2021. Here we are, in our great guitars a practice problem, we’re going to be thinking about making payments on loans and breaking those payments out between interest and principal. As we do so, we’re going to be needing an amortization table. To help with that.

724 Economic Ordering Quantity (EOQ) Prob 2 6.80

QuickBooks Online 2021. Now, opening balances and add accounts to chart of accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be continuing to enter our beginning balances and add any necessary accounts to do. So if we go back on over to our trial balance, we’ve been entering those balances that have kind of like special needs as we enter the beginning balances.

Deposits From Owner & Loan 7.05

QuickBooks Online 2021. Now, deposits from owner and from alone. Now, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re now going to move on to some data inputs starting with a deposit from the owner and a deposit from a loan. Let’s first take a look at our financial statements, we’re going to be opening up the balance sheet, the income statement and the trial balance, I’m going to make three new tabs up top by right clicking on the tab, duplicating it, we’re going to duplicate it again, right click and duplicate and then one more time duplicating again.

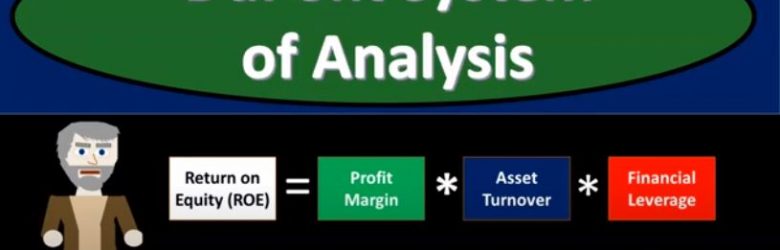

DuPont System of Analysis 315

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the DuPont system of analysis Get ready, it’s time to take your chance with corporate finance, the DuPont system of analysis, the DuPont system of analysis is going to be focusing in on a key financial ratio, that being the return on equity or our OE, the ROI he is calculated most simply as net income divided by equity, what we’re going to do is take this return on equity and break it out into components, those components drilling down on areas in the business, allowing us a better analysis in those areas and given us some opportunities to improve different components of the business. So it allows us to basically drill down and get more detail on the return on equity.

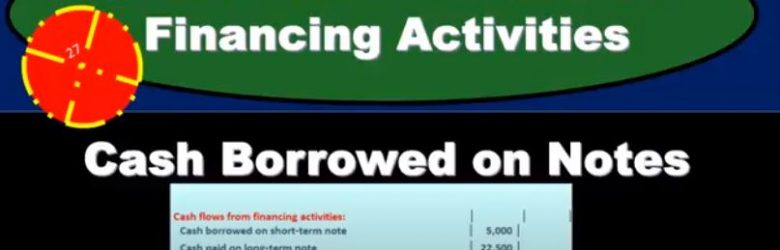

Statement of Cash Flow Financing Activities Cash Borrowed on Notes

In this presentation, we will continue on with the statement of cash flows. Looking at the financing activities looking at cash borrowed on notes, we’re going to be using the information with our comparative balance sheet, the income statement and the additional information focusing on the comparative balance sheet. First, it will be used to create this worksheet, we have going through this worksheet looking for all the differences and finding a home for them starting Of course, with cash down here, and then we kind of skipped around to pick up all of the cash flows from operating activities. And that’s really how people usually start this thing out. And rather than going just from top to bottom, picking out the operating activities, then we went back and we picked up the cash flows from investing activities. Now we’re going to go down and pick up the financing activities. And those deal with notes payable here. So we have the notes payable, and we have this common stock issuance. So those are going to be things that are typically going to be in the final financing. And you might think of as well, how would I know this? What? Why would I know that’s going through? Well, if we go through these, remember that the cash is obviously down here, that’s where we started. And then the current assets versus current liabilities, most of them are going to be up here. And that’s going to be the accounts receivable, the inventory, prepaid expenses, and then equipment.

Statement of Cash Flow Investing Activities Cash Paid for Purchase of Equipment

In this presentation, we will continue on with our statement of cash flows. Taking a look at the investing activities, specifically the purchase of equipment, we’re going to be using the comparative balance sheet, the income statement and additional information focusing here on the comparative balance sheet, which we use to make this worksheet. So this worksheet is our comparative balance sheet. We’ve been going through this worksheet and really looking for the differences. We’re finding a home for all the differences. Once we do that, we’re feeling pretty good. We have done this all the way through the operating activities. So are the cash flows from operations. So we’ve gone through here we’ve kind of picked and choose the items that are going to be cash flows from operations, which is probably the way most people approach this. But just note that as we’ve done that, we’ve tried to pick up the exact differences here. We haven’t gone to the income statement and thought about it separately outside of this worksheet, and then we’re going to go back and make adjustments. So we found a home for the difference in cash because that’s Kind of like our bottom line. And then we’ve got accounts receivable, inventory prepaid expenses, and then we skipped equipment and went down to accounts payable.

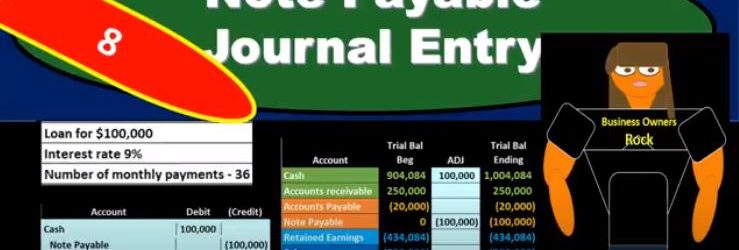

Note Payable Journal Entry

In this presentation, we will record the journal entry related to a note payable related to taking out a new loan from the bank. Here’s going to be our terms. We’re going to record that here in our general journal and then we’ll post that to our worksheet. The trial balances in order assets, liabilities, equity, income and expenses, we have the debits being non bracketed or positive and the credits being bracketed or negative debits minus the credits equaling zero net income currently at 700,000 income, not a loss, revenue minus expenses. The difficult thing in terms of a book problem, when we record the loan is typically that we have too much information and this is the difficult thing in practice as well. So once we have the terms of the loan, and we have the information, we’ve already taken the loan out, then it’s the question of well, how are we going to record this thing? How are we going to put it on the books and if we have this information here, if we have a loan for 100,000, the interest is 9%. And then the next number of payments that we’re going to have, we’re going to pay back our 36. Then how do we record this on the books? Well, first, we know that we can ask our question is cash affected? We’re going to say, Yeah, because we got a loan for 100,000. That’s why we got the loan.

01:14

So cash is a debit balance, it’s going to go up with a debit, so we’ll increase the cash. And then the other side of it is going to be something we owe back in the future. And that’s going to be note payable. And that’s as easy as it is to record the initial loan. The problem with this the thing it’s difficult in practice, and in the book question is that we’re often given, of course, the other information, like the interest in the number of payments, and possibly more information that can cloudy up the what we’re doing, and the reason these are needed, so that we calculate interest in the future, but they’re not really We don’t even need that information to record the initial loan. All we need to know is that we got cash and we owe it back in the future. And you might be asking, Well, what about the interest we owe interest in the future as well? We do, but we don’t know it yet. And that that’s the confusing thing interest, although we we will pay interest and we know exactly how much interest we’re going to pay in the future. We don’t owe it yet. Why don’t we owe it yet? Because we’re going to pay back more than 100,000. Why don’t we Why don’t we record something greater than 100,000? You might say, because we know we’re going to pay more than 100,000. And that’s because the interest is something that it’s like rent. So we’re paying rent on the use of this 100,000. And just like if we if we had a building that we rented, that we’re using for office space, we’re not even though we know we’re going to pay rent in the future. We’re not going to record the rent now. Because we haven’t incurred it until we use the building.

02:41

So the same things happening here. We know we’re going to pay interest in the future we’re no we know we’re going to pay more than 100,000 but it hasn’t happened yet. We haven’t used up we haven’t gotten the use of this hundred thousand and therefore haven’t incurred the expense of it yet. So the interest and is something we need to negotiate when making To turn off the loan, but once the loan has been made, and we’re just trying to record it, it’s not going to be in the initial recording. It will be there when we calculate the payments need and the amortization table. So the initial recording is pretty straightforward. We’re just going to say okay, cash is going to go up by 100,000. And then the notes payable is going to go up from zero in the credit direction to 100,000. So what we have here is the cash increasing the liability increasing, although we got cash, there’s no effect on net income because we haven’t incurred any expenses. We’re going to use that cash most likely to pay for expenses possibly or pay for other assets or pay off liabilities in order to help us to generate revenue in the future. But as of now, we’ve gotten we increase an asset and we increase the liability

Notes Payable Introduction

In this presentation, we will introduce the concept of notes payable as a way to finance a business. Most people are more familiar with notes payable than bonds payable, the note payable basically just being a loan from the bank. Typically, the bond payable is a little more confusing just because we don’t see it as often, especially as a financing option. From the business perspective, we often see it more as an investing or type of investment. But from a loan perspective, it’s very similar in that we’re going to receive money to finance the business if we were to issue a bond, or if we’re taking a loan from the bank. And then of course, we’re going to pay back that money. The difference between the note and the bond is that one the note is something we typically take from the bank. Whereas a bond is something we can issue to individuals so a bond we could have more options in terms of issuing the bonds than we do for a loan. Typically when we have a loan, we typically are Gonna have less resources, we can take a loan from the bank. When we pay back the bond, we often think of the bond as two separate things. And we set it up as two separate things, meaning we have the principal of the bond that we’re going to pay back at the end. And then we have the interest payments, which are kind of like the rent on the money that we’re getting, we’re getting this money, we’re gonna have to pay rent on it, just like we would pay rent if we had got the use of any physical thing.