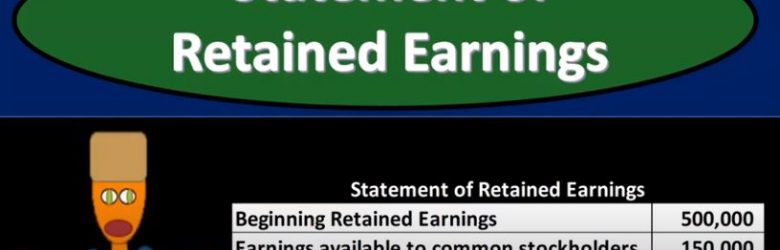

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the statement of retained earnings Get ready, it’s time to take your chance with corporate finance statement of retained earnings. So remember that as we think about the financial statements in total, the financial statements are basically answering questions that users of the financial statements would have. So for example, if we were thinking about investing into a company, the financial statements would help us answer the question as to how does the company stand at this point in time? How does the company look from a financial standpoint at this point, that is the balance sheet, the balance sheet gives you the assets, liabilities, equity, assets minus liabilities, being basically the book value being basically where the company stands at a point in time.

Posts with the Preferred Stock tag

Balance Sheet Continued 215

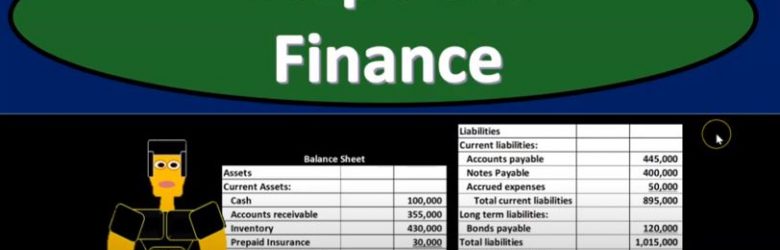

Corporate Finance PowerPoint presentation. In this presentation, we will go into more detail about the balance sheet. Get ready, it’s time to take your chance with corporate finance, balance sheet continued. Remember when we’re thinking about the financial statements, we can break them out to two separate objectives. If we’re considering this from an investor standpoint, that is, where does the company stand at a point in time, and what’s the likelihood or their earnings potential in the future, which we will typically based on past performance, therefore, you’re going to have the timing statement and the point in time type of statement. So when we think about the balance sheet, that’s going to be the point in time type of statements. So if you’re looking at the financial statements for the year ended December 31, the balance sheet will be as of the end of the period, in this case, December 31, as opposed to the timing statements, which are going to be the income statement being the primary statement that should come to mind measuring performance, which will be as of January through December 31 measure and how well we did for that range of time. So our focus over here is going to be on the balance sheet.

Financial Statements Overview 205

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview of financial statements Get ready, it’s time to take your chance with corporate finance, financial statement overview, the financial statements will be the primary tool that will be used to value the company, the financial statements are going to be generated from the company.

Consolidation & Preferred Stock

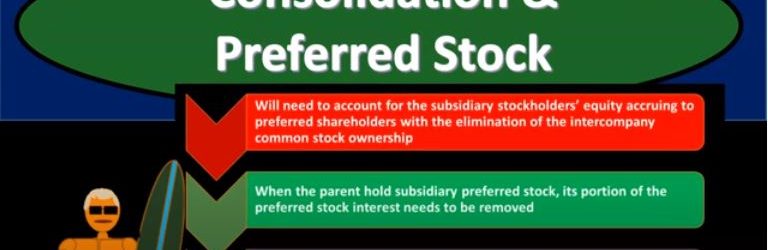

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process when there is a preferred stock involved, get ready to account with advanced financial accounting. We’re talking about a situation here where we have preferred stock in the subsidiary and a consolidation process we’re doing the consolidation subsidiary has some preferred stock, you’ll recall that the characteristics of preferred stock generally means that in general, they have preference with regards to dividends and distribution of acids in liquidation over common shareholders. So therefore, when when a distribution happens if there’s going to be dividend distributions, for example, the preferred stockholders will typically get paid first, and we got to consider how that will be impacted or affected within our consolidation process.

Preferred Stock Example – Preferred Stock Dividend

Preferred stock dividend example problem will discuss the process for determining the amount of a dividend to be paid to the preferred stock holders as compared to the common stock holders. Preferred stock holder get paid before common stock holders but have a limit to the amount they will receive. In a corporation the board of directors can determine the amount of dividend to give but has less control over how it will be distributed. Any dividend decided on will generally need to be paid first to the preferred stock holders before going to the common stock holder. The preferred stock holder typically to not have voting writes in the company.

For more accounting information see website.

Preferred Stock Introduction – What is Preferred Stock?

Preferred stock can be misleading because the name preferred stock makes it sound better on all ways t the more traditional common stock. In reality the type of stock we would prefer to have depends on circumstance. The reason preferred stack is called preferred is because it preferred stockholder have first clam to things like dividends or payment on liquidation of a company. However the amount of dividend and payment is limited to the terms of the preferred stock. Common stock will not receive dividends until the preferred stock holders are paid but if the dividends paid are large common stockholders may get paid more. In other words, preferred stock provides more protection against loss by allowing for a primary claim to assets over common stockholders, but common stockholder may be looking for long term growth and will typically benefit if there is long term growth. For more accounting information see website. http://accountinginstruction.info/cou…