Corporate Finance PowerPoint presentation. In this presentation, we will give an introduction to ratio analysis. Get ready, it’s time to take your chance with corporate finance, Introduction to ratio analysis. So once we have the financial statements, then we want to think about how best to use those financial statements for decision making purposes. So remember, then the two primary financial statements being the balance sheet and the income statement, we can think of them answering primary questions that a user of the financial statements may have, such as an investor or someone who’s thinking about investing into the company may want to know where the company stands as of a point in time, that once again, is the balance sheet.

Posts with the problems tag

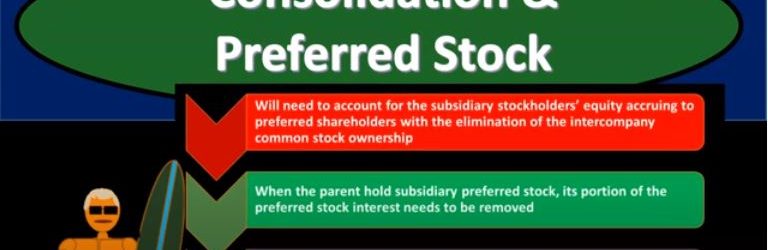

Consolidation & Preferred Stock

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process when there is a preferred stock involved, get ready to account with advanced financial accounting. We’re talking about a situation here where we have preferred stock in the subsidiary and a consolidation process we’re doing the consolidation subsidiary has some preferred stock, you’ll recall that the characteristics of preferred stock generally means that in general, they have preference with regards to dividends and distribution of acids in liquidation over common shareholders. So therefore, when when a distribution happens if there’s going to be dividend distributions, for example, the preferred stockholders will typically get paid first, and we got to consider how that will be impacted or affected within our consolidation process.

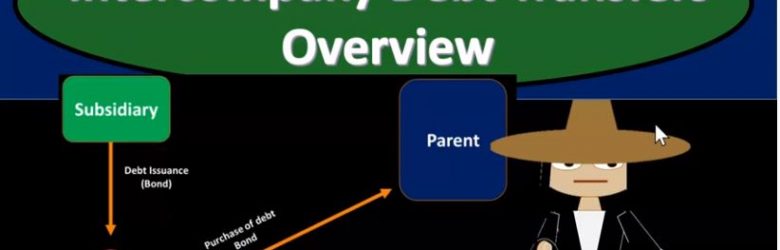

Intercompany Debt Transfers Overview

Advanced financial accounting PowerPoint presentation. In this presentation we will give an overview of intercompany debt transfers. In other words within the concept of our consolidation process where we have parent subsidiary relationships we have intercompany debt debt going from one entity to the other, from parent to the subsidiary or subsidiary to the parent could be in the form of, of notes payable or in the form of bonds payable, get ready to account with advanced financial accounting. When we think of intercompany debt, we can break it out basically into two categories intercompany debt the debt from one to the other from parent to subsidiary or subsidiary to parent, two categories, one direct intercompany debt transfer and the other is the indirect intercompany debt transfer.

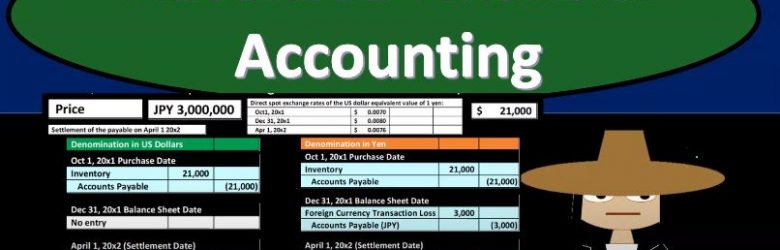

Foreign Currency Transactions

Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss foreign currency transactions get ready to account with advanced financial accounting, foreign currency transactions. So remember when we’re thinking about foreign currency transactions, we’re thinking about them from the perspective of the US company in US dollar. So we’re have our currency that we’re making our financial statements in, we’re measuring all the stuff on our financial statements with the measuring tool that we need to be using, that’s going to be the US dollar, that’s going to be our standardization. And then anytime we have foreign currency transactions with something other than US dollars, then we want to see them from that perspective, right? Because when we put them on our financial statements, just like anything else, just like inventory, if we were to value units of inventory, or to value stocks and whatnot, we need to value them in terms of our measure into a which of course is the US dollar.

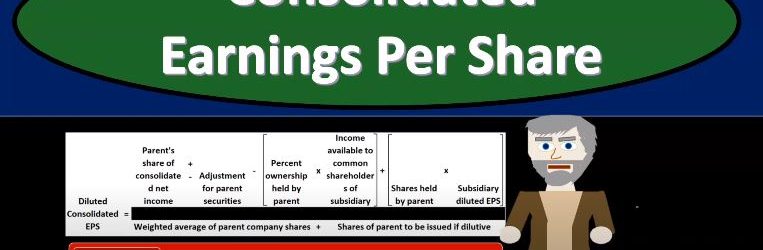

Consolidated Earnings Per Share

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated earnings per share, get ready to account with advanced financial accounting, consolidated earnings per share, how do we calculate the earnings per share for a consolidated entity, the basic calculation for the earnings per share will in essence be the same as for a single Corporation. So there’s not too much difference between the consolidated earnings per share calculations and the basic earnings per share for one entity one Corporation. So the basic earnings per share is is computed by deducting income to the non controlling interest and any preferred dividend requirement of the parent from the consolidated net income. So we’re going to take the net income and then we’re going to deduct income to the non controlling the non controlling interest and any preferred dividend requirement. In other words, we’re going to take the consolidated net income and then remove or deduct income to the non controlling interest and and in preferred dividend requirement, then we’re going to take that number, the amount resulting is divided by the weighted average number of the parents common shares outstanding during the period covered. So it’s a pretty straightforward calculation for the basic earnings per share, we do have practice problems on it. However, if you want to brush up on calculating the basic earnings per share, we have that there. diluted consolidated earnings per share is going to be a more complex calculation.

Business Acquisition & Expansion

In this presentation, we’re going to discuss an Introduction to Business acquisition and expansion, get ready to act, because it’s time to account with business, Advanced Accounting, advanced financial accounting will have to do with the concept of expansion and the accounting related to it. So first we need to know well, what is expansion? What are the types of expansion that can take place? What are the problems with regards to the accounting for it? And then what type of accounting principles can we apply in order to deal with the accounting related to those problems? So when we think about expansion in general of a business, we’re thinking about the growth of a business, typically, you have either internal expansion or external expansion. So those are two categories of expansion. We want to start to visualize in our mind and we got our mind our mind is visualizing a business that is trying to expand how are they going to do that? Are they going to do it with some type of internal growth or some type of external growth? Then we want to think about the legal structure of the of the expansion for example, an expansion often results in a parent subsidiary type of relationship. So, we have different legal entities that are associated in some way shape or form.

Internal Controls

In this presentation we will introduce the topic of internal controls. Internal Controls been policies within an organization in order to achieve certain objectives those objectives including the safeguarding of assets, having reliable accounting records, efficient operations, and company policy alignment. We’ll get further into what each of these categories mean in detail. However, first we want to discuss the fact that internal controls will change from organization to organization and industry to industry will have similar objectives between organization to organization industry to industry, however, the customization of the internal controls will differ in order to have an optimal amount depending on size of company and type of industry. For example, a small company often one run by one individual will have very much fewer internal controls for multiple reasons. One that that individual can really monitor A lot more of the transactions for a small company and have direct contact with the transactions that are taking place.