Hello. In this lecture we’re going to talk about the idea of tracking inventory and recording inventory, both in terms of the balance sheet as well as the income statement in the format of cost of goods sold. In our example, we’re going to be purchasing and selling forklifts, meaning we’re going to purchase forklifts from the factory and then we’re going to sell those forklifts. That means that forklifts to us will be inventory their inventory because we are purchasing the forklifts in order to resell them for the generation of revenue. That’s really going to be the definition of inventory the purchasing of something for the resale of it as opposed to if we were someone else purchasing the forklift in order to help us generate revenue in another way through the use of the forklift, in which case it would then be property plant and equipment.

Posts with the sales tag

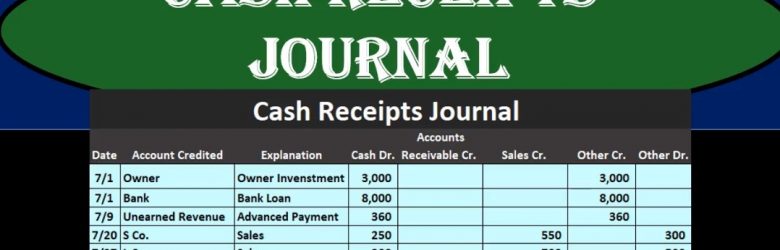

Cash Receipts Journal 40

In this presentation we will talk about the cash receipts journal. The cash receipts journal will be used when we have cash receipts when using a more of a manual system or a data input system that we will be doing by hand as opposed to an automated system. It’s still useful to know the cash receipts journal if using an automated system for a few different reasons. One is that we might want to generate reports from an automated system, similar to what we would be creating in a manual system for a cash receipts journal. And to it’s just a good idea to have different types of systems in mind, so we can see what’s the same and what is different between different accounting systems. The cash receipts journal will be used for every time we have a cash receipts. So the thing that transaction triggering a cash receipt will be when cash is being used. And we’re going to have a little bit more complex complexity in a cash receipts journal than something like a sales journal because we may be receiving cash for multiple different things.

Special Journals Subsidiary Ledgers 2

In this presentation, we’re going to talk about special journals and subsidiary ledgers. First, we’re going to list out the special journals and talk about when we would use them, why we would use them and how they fit into the accounting system. The special journals are basically going to group types of transactions. So when we think about all the transactions that happened during the month, we typically see them in order of when they happen in the accounting system, we’re going to record transactions in other words, by date as they occur. But if we are able to group those transactions into special journals that can simplify the process.

Invoice & AR Adjusting Entry Part 2 Solution 10.26

This presentation and we’re going to continue on with our adjusting entry related to an invoice that was entered into the wrong period. We laid out the problem last time. Now we’re going to enter the adjusting entry of this time. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to open up our reports.

Rental Income New Service Item New Income Account 8.90

This presentation and we’re going to record rental income. In other words, we’re going to create a sales receipt within that sales recruiting receipt, we’re going to create a new service item that for rental income, we’re also going to be creating a new income statement account a new revenue account for the rental income. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re not going to create a sales receipt for a sale, the sale for rental income. So we’re imagining then that we’re renting out our equipment and we’re receiving revenue for the rental of the equipment.