QuickBooks Online 2021 short term investment sale, including the recording of the gain or loss related to the sale of the short term investment. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our great guitars practice file, we’re going to be opening up our financial statements that being the balance sheet and income statement. So let’s go up top and duplicate our tabs to start off right clicking on the tab, duplicate the tab, we’re going to right click on the tab again, duplicate the tab.

Posts with the sold tag

Sales Receipts Form 1.40

QuickBooks Online 2021 sales receipt form. Let’s get into it with Intuit QuickBooks Online 2021. Here we are on the Google search page, we’re going to be searching for the QuickBooks Online test drive, then we’re going to be selecting QuickBooks Online at test drive from Intuit. We are then asked if we are a robot answer, yes, but I’m an old out of date Commodore 64. So you don’t need to worry about me causing any problems. So I’m going to go ahead and check that off anyways, and say continue.

Sales Receipt Payment Received at Point of Sale 7.30

QuickBooks Online 2021 sales receipt payment received at point of sale. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file where we’re going to be entering some sales receipts before we do so let’s open up our financials balance sheet income statement and trial balance. So we’re gonna duplicate some tabs up top right clicking on the tab, duplicate it, going to do it again, right click on the tab duplicate one more time, right click on the tab and duplicate.

Create Invoice Sale of Inventory Item 7.20

QuickBooks Online 2021 create invoice for the sale of an inventory item. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be entering an invoice. But before we do, let’s open up our reports balance sheet income statement, trial balance, and consider what will happen first, then record the invoice and then check out if what we thought was going to happen actually does happen. So we’re going to go up top, duplicate the tab, right clicking on it duplicating the tab, we’re going to do it two more times, right click Duplicate, right click Duplicate.

Inventory Tracking Options 6.55

QuickBooks Online 2021 inventory tracking options. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file. Last time we entered some items for our service items, we can check those out by going to the sales tab on the left hand side, then the products and services up top. These are the service items that we entered that would then be helpful or used to populate things like invoices and sales receipts.

Inventory Reports 4.35

QuickBooks Online 2021 inventory reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services. going on down to the reports, we’re going to be opening up now inventory reports, which you can find and which I probably will be looking for in the future by simply typing in inventory in the search field.

Invoice Form 1.34

QuickBooks Online 2021 invoice form, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re searching for QuickBooks Online test drive, then we’re going to be selecting QuickBooks Online test drive from Intuit, it’s then going to ask if we’re a robot, I was once but then I made a wish upon a lucky star. Now I’m a kangaroo. So we’re good. We’re gonna check that off continue.

Pro Forma Income Statement 410

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the pro forma income statement, get ready, it’s time to take your chance with corporate finance pro forma income statement. Let’s first take a step back and think about the pro forma financial statements in general, remembering the fact that we got to do them in some type of order in order to do them in a logical fashion. And that would mean that we would first need the sales projection information, the production plan, we can use those in order to create the pro forma income statement.

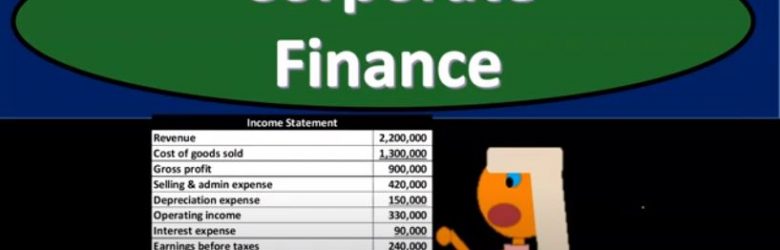

Income Statement Overview 225

Corporate Finance PowerPoint presentation. In this presentation, we’re going to continue on discussing the income statement. Get ready, it’s time to take your chance with corporate finance income statement continued. Remember that as we think about the financial statements, we can break them out into basically two objectives that an investor might have the investor would want to know two general things one, where does the company stand at a point in time with their approximate value as of a point in time? And two? What is the likelihood of their performance in the future? What how well, will they do in the future? How can we predict how well they will do, we’re going to base it on past performance. So the point in time statement is going to be the balance sheet. So remember, if you’re looking at financial statements, for the year ended, say, December 31, the balance sheet will be as of a point in time and therefore as of December 31, it will not be a range. Whereas if you’re looking at a time frame, meaning the beginning to the end of the period, so if you’re looking for financial statements for the period ended, or the year ended, December 31, then the income statement, the primary timing statement, will be represented, it’ll say January through December or for the year ended December 31.

Financial Markets 130

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial markets Get ready, it’s time to take your chance with corporate finance, financial markets, financial markets help to provide indicators for maximizing shareholder value. So when we’re thinking about financial markets, we’re thinking about markets. In general, we’re thinking about purchasing and selling things, a place where people purchase and sell items, that means there’s competition, there’s different people competing within a market, that will typically lead to better information about the value of the items being sold.