Corporate Finance PowerPoint presentation. In this presentation, we will discuss patterns of financing, get ready, it’s time to take your chance with corporate finance patterns of financing. As we think of financing patterns, let’s first think of our accounting equation assets equal liabilities plus equity assets are what the company has, we have those assets in order to help us to generate the revenue, we need to finance those assets, either with liabilities or equity, equity being the retaining of earnings over time, the earnings that have not been paid out in dividend and or investments that have been put into the company for the distribution of stocks.

Posts with the temporary tag

The Nature of Asset Growth 605

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the nature of asset growth, get ready, it’s time to take your chance with corporate finance, the nature of asset growth, we’re going to start off with working capital management, what is working capital management, the financing and management of current assets of the company. So when we consider this, let’s think about the accounting equation assets equal liabilities plus equity, remember that the assets are what the company has, why does the company have them in order to help generate revenue to get a return on the assets in order to help generate revenue?

Closing Process Step 4 of 4 Closing Journal Entry Draws or Withdraws

Hello in this lecture we’re going to continue on with the closing process with step four, the final step of the process which will be to close out the draws. Remember that the objective is to have the adjusted trial balance be converted to the post closing trial balance. adjusted trial balance is what we use to create the financial statements. And the difference between the adjusted trial balance and the post closing trial balance will be that we want to have all temporary accounts including draws revenue and expense accounts to be converted to zero and have all that be in the owner capital account meaning the owner capital account will now be including all these accounts underneath it crunched into basically one number, we’re going to do that with a four step process.

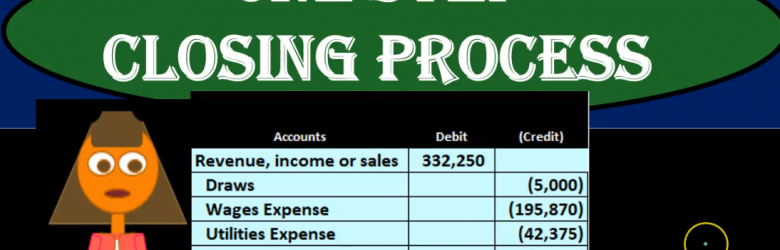

One Step Closing Process

Hello in this presentation, we will be looking at a one step closing process. In other words, we will be closing out temporary accounts using one journal entry. There’s a few different ways that we can perform the closing process. And there’s benefits and cons to each way of doing it. The one step closing process is the simplest way to do it. And it’s also a way that we can imagine what is happening within the closing process as easily as possible a skill useful when considering what’s happening from time period to time period, and how the financial statements are working. So here we’re going to look at a one step closing process. Remember what the closing process is, it’s going to be a process at the end of the time period that we will be performing.

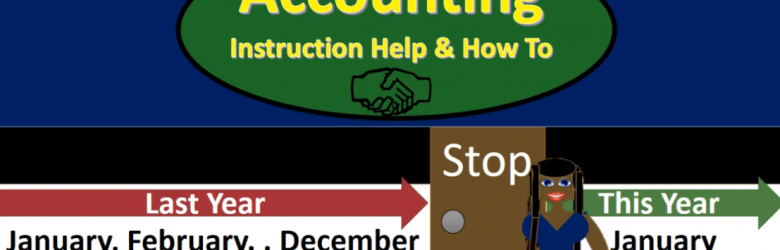

Post Closing Trial Balance

Hello in this section we will define the post closing trial balance. When seeing the post closing trial balance, it’s easiest to look at it in comparison to the adjusted trial balance and consider where we are at in the accounting cycle in the accounting process. When we see these terms such as the adjusted trial balance and post closing trial balance, as well as an unadjusted trial balance, we’re really talking about the same type of thing. We’re talking about a trial balance, meaning we’re going to have the accounts with balances in them. And we’re going to have the amounts related to them. And of course, the debits and the credits will always remain in balance. If it is a trial balance, no matter the name, whether it be just a trial balance on an adjusted trial balance and adjusted trial balance or a post closing trial balance.

Closing Process Explained

Hello in this lecture we’re going to talk about the objectives of the closing process the closing process will happen after the financial statements have been created. So we will have done the journal entries where we will have compiled those journal entries into a trial balance, and then we will have made the financial statements. And then as of the end of the period in this case, we’re going to say as of December, when we move into the next time period, January, what we need to do is close out some of the temporary accounts those accounts including the income statement and the draws account so that we can start the new period from start in a similar way as if we were trying to see how many miles we could drive say in a month. If we wanted to Vince in December, and then see how many miles we’re going to drive in January of next year.