Corporate Finance PowerPoint presentation. In this presentation, we will discuss the nature of asset growth, get ready, it’s time to take your chance with corporate finance, the nature of asset growth, we’re going to start off with working capital management, what is working capital management, the financing and management of current assets of the company. So when we consider this, let’s think about the accounting equation assets equal liabilities plus equity, remember that the assets are what the company has, why does the company have them in order to help generate revenue to get a return on the assets in order to help generate revenue?

00:34

So we need the assets in order to do so in order to do business, of course, and how do we finance the assets either with liabilities, or with equity, third party liabilities, debt, in other words, or equity, which is the accumulation of revenue over time, that’s going to be retained in the company, or investments from the owners, such as the issuance of the stocks in the case of a corporation. Now, when we think about the the financing of the assets, the day to day kind of financing is going to focus more on the current assets, because those are going to be the assets that are going to be fluctuating seasonally or from time to time. And as they fluctuate, we need to then be considering, you know, are kind of more of our short term financing needs, which can be a little bit more complex at times because of that fluctuation, and how we’re going to deal with the the short term financing of the assets.

01:24

And that’s going to deal with liabilities and equity, we’re going to be focusing more in this in this section on the liability side of the financing related to our assets. So the nature of asset growth. So when would the assets grow over time, we’re hoping of course that the company continues to do well, the company is going to continue to generate revenue, what’s the goal of the company revenue generation, the goal of the company is not just simply asset accumulation, to just simply accumulate assets up forever. Why? Because if the assets are not good, if you’re not getting a return on the assets, if we generate revenue, that generates assets, and we have a cash that we’re just basically holding on to, then if we’re not getting a return on that, it makes no sense to hold them in, in the company, we would then distribute it in the form of dividends, if we can take that money and roll it back into the company, and get a return on it by buying more property plants and equipment or something like that, that would further increase the sales, then we would want to grow.

02:26

So when we think about the assets growth, like when I used to think of acid growth for a company, I used to just think that the company that has been in business for a longer period of time is just going to accumulate assets. And that’s a you know, that’s a good thing, we’ll just have a bunch of assets that are just going to accumulate over time, the longer that the company has been in business, then the more assets they would have, even if it’s not really possibly generating revenue, that’s not really the picture that you want to have in mind, the picture you want to have in mind is that if the if the assets increased due to sales, or due to other investments or due to debt, in order to get a return on that investment by buying something like more property, plant and equipment, which is going to increase the return, if a company is established, and they have everything they need, they don’t need to invest anymore at any given time, then the accumulation of the assets that they’re getting through doing business will most likely go to the owners who can then find some other place to get a return on the investment.

03:22

So just keep that picture in mind. As we think of the asset growth here. When we think of asset growth, the assets should be growing in order to continually get a return on on the investments. And when we think about asset growth, then there’s two ways we can do that, either with debt or with equity equity, the accumulation of revenue over time or owner investment debt, we’re going to focus more on here, taking loans to increase the assets so that you can increase the generation of revenue. So matching production schedules with accurate sales forecasts is necessary for asset planning. So note, when you’re thinking about the asset plan, you got to get the sales forecasts and think about how you’re going to do production. So the production if you make the inventory, if we’re producing the inventory, we want to make sure to match up the production with the sales forecasts as best we can within the plan that we have set up, because that’ll help us to manage that the assets of the asset grows and in the financing that could be related to the assets.

04:25

So when there are discrepancies between actual sales forecasts and sales can result in so if there’s a description discrepancy in what we predicted the sales to be and what actually happens, we can result in the unexpected inventory build up. So for example, if we produce inventory or even if we buy inventory, and then we’re going to then sell the inventory. If we think that we’re going to sell more, we predicted that we’re going to sell more and we don’t, then what happens we buy or produce more inventory than we need, we result in an inventory build up inventory cost us to make or to purchase. That cost then is something that’s a cash flow that went out or cost that went out. It could be liability with regards to us being financing that production with debt as well. So we want to make sure that we can get the plant as as in alignment as possible, so that we can then make our production or purchasing plan to line up with the amount of sales that we are going to have.

05:25

So I reduction and shortage in inventory, that it can impact receivables and cash flow. So on the other side of things, if we have more sales, obviously, than we thought, then we won’t have produced as much as we want as we could have sold. And then we’re going to have a shortage or a reduction in inventory that wasn’t planned. And then I got a shortage, of course will result in sales that could have been made that were not made. So and so that’s not good. So a company’s current assets can be self liquidity, they teen temporary current assets and permanent current assets. So when we think about the current assets on the balance sheet, we can break them out conceptually into two more categories that we will want to consider. It’s useful to consider these two categories because it helps us manage our total assets, and then manage how we’re going to be financing those total assets.

06:17

So for example, we might have the concept of permanent current assets might sound counter intuitive, it’s not something that’s on the balance sheet, you have assets on the balance sheet, you have current assets on the balance sheet, you don’t typically have temporary current assets and permanent current assets to have something permanent, which is a current asset seems contradictory. So what does that mean? Well, note that the current assets do turn over, they’re going to be more liquid type of assets, things like inventory, things like accounts receivable, they’re going to turn over all the time. But we expect some at some point those current assets to basically be replaced. And therefore you can think of them as current in that nature. So for example, accounts receivable, although we’re going to be receiving payments on them all the time, we will always be making more sales up to a certain level.

07:06

And therefore we can we can expect the accounts receivable to be replaced all the time. And whatever our constant or steady growth is, you would expect then that to be somewhat permanent of a level, even though it’s churning all the time. So in that sense, we can think of it as permanent. And when thinking about financing something that is more permanent in nature, we might use a different tech financing strategy, then the temporary nature and then the things that will be temporary, temporary current assets then are going to be those assets that don’t churn over, we don’t expect in the turnover, they might be resulting from spikes, seasonal spikes, possibly in sales. So if we had a seasonal spike in sales, you would expect them the accounts receivable to spike as well, because if sales goes up, then the asset of receivable will go up in relation to it, as we collect on the receivables, you would expect then it to go back down as sales go back down after the spite, you might see a similar kind of pattern with inventory as we prepare for our seasonal increases and decreases in the inventory that we’re going to be needing.

08:12

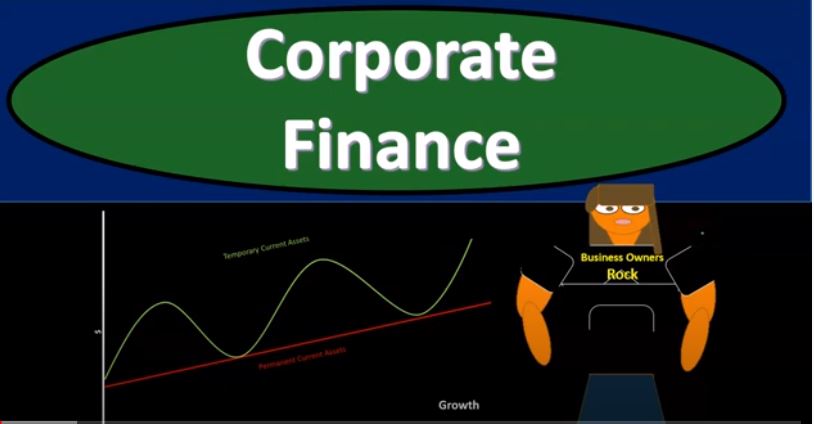

So if you were to graph that it might look something like this. So we’ve got time, and then we’ve got dollars. So the permanent current assets are going to be things like the accounts receivable, things like the inventory that are always going to be turning over that are always going to be replaced, and therefore they can be somewhat constant, we can think about them as basically somewhat constant, same dollar amount as the time changes that might affect our financing decisions.

08:36

As we think about the accounting equation, we’re talking about the assets, assets equal liabilities plus equity, if we’re financing the assets by something like liabilities, it might affect the type of financing we might have. If we break out financing into like short term and long term, we might lean more towards the permanent current assets being financed more towards long term type of financing, even though it is a it’s kind of like it’s a current asset, which you could think of as like kind of a short term asset, typically, and then the temporary current assets assets are things like the accounts receivable and inventory and whatnot, that could change and they could change with the seasonal production and the seasonal sales that could be taking place in our production plan in relation to it. So we’re going to have the these increases and decreases with regards to the temporary current assets.

09:23

That’s what they mean by self liquidating, right, they’re going to go back down the accounts receivable are going to go back down after a spike has happened when the sales go back down possibly after like a seasonal increase in the sales so that in that sense, they’ll be self liquidating. When you think about the financing for them, then you might be thinking then that you might want shorter term financing because you would expect the financing of these receivables to be going down so you might be able to find to match your financing needs with with this chart with regards to the permanent current assets and temporary current assets. Now To do that, of course, you’d have to estimate what the permanent current assets and temporary current assets are, that’s not an easy thing to do all the time, you also have to guess what the fluctuation will be.

10:10

And the temporary current assets, which you can do to some degree based on the past, because seasonal businesses will act much the same from season to season. But it’s not, you know, you can’t it’s not an exact science as well. Now, if there’s an increasing period, then you might expect, say, the permanent asset or the permanent current assets to be increasing. So you might have a seasonal business, which is also growing, meaning the sales are going up from year over year. So that means if the if the sales are constantly increasing each month, even though you still have the seasonal fluctuation within the year, the permanent current assets, then you would expect them to steadily be increasing as your sales for each month steadily increases.

10:54

And you would have lines looking somewhat like this for your permanent current assets. And then your temporary current assets would be doing the same kind of fluctuation off of that baseline as well. So that might be how the graph might look in that case, which you can then figure your financing on. So controlling assets. So fixed assets will generally grow slowly with increase in production capacity, and the replacement of old property, plant and equipment. So when you’re thinking about the assets, and how to, you know, how they’re how they will behave, when you’re thinking about the fixed assets, otherwise known as the property, plant, and equipment, or the PP and E, the depreciable, assets, things like building things like equipment, they’re going to grow more slowly, of course, because your point, the point is to take your money, put it into something like property, plant and equipment to help you to generate the revenue in the future by putting in that investment, that investment, which is going to help you into many periods into the future as you have this property, plant and equipment.

11:55

So it’s not something that’s that’s likely to increase substantially unless there’s some kind of very substantial growth plan that was put into place. So it’s going to increase when there’s an increase in product in and productive capacity. So if you haven’t, like a growth plan a productive capacity, where you want to increase the capital assets, in order to increase your sales, increase the equipment to increase the sales, or just in the nature of normal business, when there’s a replacement of old property, plant and equipment, with new property, plant and equipment, that’ll increase the total value of the assets as you buy newer equipment. So current assets will fluctuate in the short run, and will depend on the level of production as compared to sales level. So obviously, the current assets in the short run is gonna have more fluctuation.

12:42

So it’s going to be a little bit more difficult to determine, although, of course, you know, both the fixed assets and the current assets have their challenges, when you think about the fixed assets, they’re going to be more fixed in nature move more slowly. But the decisions that you do make will be big decisions that have a large impact into the future. When you’re thinking about the current assets, you’re thinking about things that will be happening in the short run and will be changing a lot. And so that’s going to be some of the difficulty there that you’re constantly dealing with that fluctuation, which is more volatile. So production being higher up in sales, resulting in inventory rising. So if the production is higher, if your production is higher than the sales, then you’re going to have increased inventory. So if you’re making units of stuff, and then your production is higher than the sales that took place, you’ll have increasing an increase in inventory. Now you may have planned for an increase in inventory.

13:34

We’ll talk more about the planning of that in a future presentation. But that increase in inventory has consequences in terms of how you’re going to finance that with and if you’re financing it with that, you know what kind of debt Are you going to use to do that sales being higher than production, resulting in a decline in inventory. So obviously, if the sales are higher than the production, you’re going to have a decline in inventory and possibly a shortage that could be a result from from that situation as well. And again, you might have that scheduled into your plan. If it’s not in the plan, then it could cause unexpected problems such as shortages and not being able to make the sales that you could have made otherwise. So now let’s take a look at production methods, we’re going to be comparing and contrasting the level production method and to match sales and production as closely as possible. So let’s read through these first and we’ll talk about them in a little bit more detail.

14:25

So you could have a level production method. So that’s going to be the case where you have the even production schedule over time may use equipment and labor more efficiently lowering maintenance and overtime costs. Or you could try to match sales and production as closely as possible. And that could result in the current assets being able to increase or decrease with the level of sales does away with large seasonal inventory buildup and sharp reductions in current assets. So let’s just picture a situation where you have a situation where you have a seasonal type of business Some months are going to be better than other months with regards to the sales process that’s going to be taking place. How do you deal with that with regards to production, if you’re selling inventory, you’re going to make the inventory. That’s where it’s more complex. If you’re simply buying the inventory, and then selling them, then it could be a little bit less complex, depending on how fast the turnover would be to be purchasing, and then selling. But if you’re making the inventory, then you have to put in the more time to make the inventory.

15:27

And that’s going to be a more time intensive process. But either way, you could then say, Well, if I have that seasonal sales type of business, what one strategy would be able to say, I’m just going to see what the sales will be, say for the entire year. And I’m going to produce evenly over the entire year, even though I’m going to sell them unevenly over the entire year. And what that would do for you what that strategy would do, the benefits it would have is that it would be easier on the sales on the production process, right, it’d be easier on the production, it would be easier on employees, it would be easier for you to basically hire employees for the year to hire to make a standard production process throughout the entire year. And then instead of running basically overtime and whatnot, or work in the machine hours over time, and really cranking them out when you have that seasonal spike within the business. So that’s going to be one method that you can use. Now the downside to a method like that, of course, is that you can have inventory build up during the low times and the seasonal type of production.

16:31

Again, there’s some pluses to that that could be good, because the inventory buildup that you might have, will make it less likely that if there’s a spike in sales, that you won’t be able to meet that spike. So that’s good. But you also have to hold the inventory. And you might have to finance the inventory. So it’s going to be a cost to hold it to maintain the inventory spite levels, because you also have to finance it, because inventory is an asset accounting equation, assets equal liabilities plus equity. So you might have to be financing that asset build up the production of the inventory, possibly with debt, it could be some of the way that you’d be financing it in the short term. The other way you can look at it is to match the sales production as closely as possible sales and production. So if you look at the production process and the sales process, you’d start with the sales process, you’d say, hey, look, I have a seasonal type of business, what I want to do is try to really downplay the sales and the production process in the low periods, and then ramp up production right before the point in time that the sales are going to be increasing. So sales increasing in December or November, then you’re going to ramp up production right before that point in time.

17:38

And you’re going to crank out as many as these things are as possible so that you can meet the sales for that time period. What that does for you, of course, is lower the amount of inventory that build up that you’re going to have. And that lowers the amount of financing you might have and being able to hold on or needing to hold on to the inventory, inventory storage costs and whatnot, during the low period of the lower periods in time. It also reduces the need to have financing costs that you may need in order to finance the inventory build up during those time periods. Of course, the downside to that is that you’re now running in a situation where you have less inventory on hand. So that means that if your sales projections are off, then you might not have the inventory to meet the sales that are needed. And it will be more difficult for the the wait for the machinery and the employees because you’re going to have to ramp up the amount of labor possibly that you’re going to need right before the end of the year.

18:35

And that could lead to things like overtime. And it could lead to things like you know, increased wear and tear on machine hours and whatnot. As you ramp up the production, it could also be a little bit more difficult just in terms of maintaining the standard process and maintaining employees and the labor that would be there. When you have this kind of swings all the time that are going to be taking place you’d be probably easier on them and less costly. Therefore, if you were to have an easy even production so there’s pros and cons of either method, we’ll do some practice problems related to that so we could see it the numbers related to that highly recommend taking a look at that. The computerized inventory control systems are going to be used in order to help us to track the inventory to track our current assets. So retail companies use computerized inventory control systems that are linked to online point of sale terminals.

19:26

So they point of sale terminals when we sell the inventory then we got the scanners and whatnot that are going to help us to track the inventory as we sell the inventory in a perpetual inventory tracking type of system, digital input or use of optical optical scanners to record inventory code numbers and amount are of each item are used. In a computerized inventory control systems are going to help us to track the inventory and track our current assets real retail companies use can computerized inventory control systems that are linked to online point of sale terminals. That’s going to help us when we have the point of sale, when we sell the inventory, we’re going to have the point of sale terminal that’s going to help us to track that inventory as we go in a perpetual inventory system method. So the digital input or use of optical scanners to record inventory code numbers and amount of each item sold are then used. So we have the scanners that we’ve probably seen, of course, with the point of sale inventory system that’s really useful.

20:30

And it’s more high tech than you might think, when you just you know, do you do your shopping have something be scanned, because that allows you to when you scan something that allows you to basically the person that scans it only needs to know obviously the sales amount and give the give the cash back and the computer system will then use the code to do the other side of the transaction, which is to record the cost of goods sold on a perpetual basis and record the reduction of the inventory. And then we also have the radio frequency identification. That’s kind of a newest thing. The RFID chip chips is a new system in inventory or supply chain management. This is another way that it’s going to help us to basically track our inventory as it goes through the inventory process.