QuickBooks Online 2021 applied customer deposit or credit to an invoice. In other words, we got a pre payment from a customer in the past which we will now apply in the format of a credit to the invoice that we will create to complete the sale complete the transaction. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re now going to be creating an invoice for a customer who made a deposit in the past. Let’s first open up our financial statements, we’re going to right click on the tab up top and duplicate it.

Posts with the unearned revenue tag

Advanced Customer Deposit Payment 8.30

QuickBooks Online 2021 advanced customer deposit payment. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in the get great guitars practice file, we’re going to be recording a pre payment from a customer or a deposit sometimes called unearned revenue. So let’s first open up our balance sheet and income statement reports. We’re going to go up top right click on the tab up top, duplicate, we’re going to duplicate again, right click on the tab up top and duplicate again. So we got the double duplications.

Customer Prepayment Unearned Revenue Two Methods 8.45

QuickBooks Online 2021 customer prepayment or unearned revenue, we’re going to take a look at two different methods to record the unearned revenue. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice problem, we’re going to take a look at the trial balance.

00:18

First, let’s first duplicate a tab up top, we’re going to right click on the tab up top and duplicate it, then we’re going to go down to the reports down below, we’re going to be opening up then a trial balance typing into the find area trial balance and open that up range, change it up top Indian ads, we’re going to say 1230 121. And then we’re going to go ahead and run that report. Let’s close up the hamburger for this tab, hold down Control scroll up just a bit.

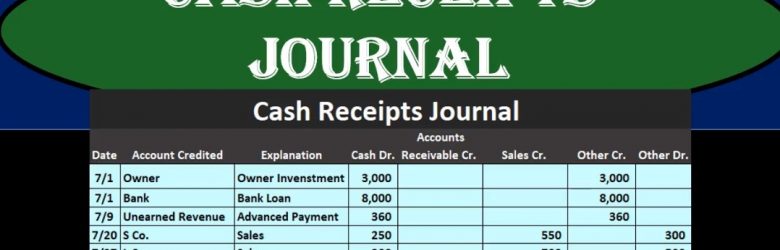

Cash Receipts Journal 40

In this presentation we will talk about the cash receipts journal. The cash receipts journal will be used when we have cash receipts when using a more of a manual system or a data input system that we will be doing by hand as opposed to an automated system. It’s still useful to know the cash receipts journal if using an automated system for a few different reasons. One is that we might want to generate reports from an automated system, similar to what we would be creating in a manual system for a cash receipts journal. And to it’s just a good idea to have different types of systems in mind, so we can see what’s the same and what is different between different accounting systems. The cash receipts journal will be used for every time we have a cash receipts. So the thing that transaction triggering a cash receipt will be when cash is being used. And we’re going to have a little bit more complex complexity in a cash receipts journal than something like a sales journal because we may be receiving cash for multiple different things.

Types of Adjusting Journal Entries Adjusting Journal Entry 2

Hello in this presentation we’re going to talk about types of adjusting journal entries. When considering adjusting journal entries we want to know where we are at within the accounting process within the accounting cycle. all the entries the normal adjusting entries have been done the bills have been paid the invoices have been entered for the month we have reconciled the bank accounts. Now we are considering the adjusting process. Those adjusting journal entries are needed in order to make the adjusted trial balance so that we can create the financial statements from them. The adjusting journal entries being used to be as close to an accrual basis as possible. those categories of adjusting journal entries, which will then have more types of adjusting entries within each category will include prepaid expense, unearned revenue, accrued expenses and accrued revenue. Let’s consider each of these we have the types of adjusting entries first type prepaid account expenses. prepaid expenses are items paid in advance.