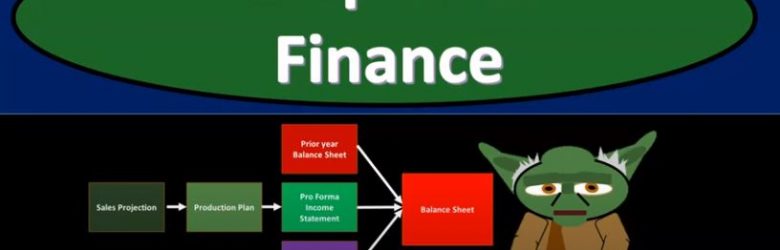

Corporate Finance PowerPoint presentation. In this presentation, we will discuss forecasting objectives Get ready, it’s time to take your chance with corporate finance, forecasting objectives. When thinking about forecasting, we’re thinking about into the future, we’re thinking about kind of like a budgeting or projection type of process, we want to plan ahead making changes in strategy as needed. So we’re going to think about what we think will happen into the future. So we can strategize now, and do what we need. Now, in order to accommodate what we believe will be happening in the future. Based on our best guesses based on our forecasts, we’re going to construct a financial plan to support the growth.

Posts with the year tag

Statement of Retained Earnings 230

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the statement of retained earnings Get ready, it’s time to take your chance with corporate finance statement of retained earnings. So remember that as we think about the financial statements in total, the financial statements are basically answering questions that users of the financial statements would have. So for example, if we were thinking about investing into a company, the financial statements would help us answer the question as to how does the company stand at this point in time? How does the company look from a financial standpoint at this point, that is the balance sheet, the balance sheet gives you the assets, liabilities, equity, assets minus liabilities, being basically the book value being basically where the company stands at a point in time.

Consolidation – Interim Acquisition

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidation and interim acquisition. In other words, we have a parent subsidiary relationship that parent owning a controlling interest over 51%. However, that controlling interest took place for a purchase of the common stock of the subsidiary that happened in the middle of the year. So prior to this, we’ve been talking about situations where we are doing consolidations for an entire year. And you may have question probably popped up in your head at some point in time as well what would happen if the purchase took place in the middle of the year now we have that mid year kind of purchase worse, especially concerned with that first year where the consolidation didn’t really happen. I mean, there wasn’t a consolidated ownership until sometime in the middle of the year, get ready to account with advanced financial accounting. So we’re talking about a situation where we have a consolidation but the consolidation happened in the middle of the years. We’re thinking about that first year, primarily What would happen? Well, if the consolidation didn’t take place in January in other words, the parent didn’t purchase the controlling interest in the subsidiary at the beginning of the year but happened at some point in the middle of the year what’s going to be the impact on the year in consolidation, which typically happens for the entire year? Well, the subsidiary is seen as being part of the consolidated entity from the time the stock is acquired, even if acquired in the middle of the year.

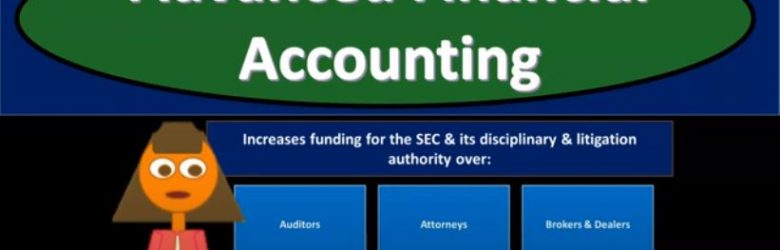

Requirements for Management Reporting Laws

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss requirements for management reporting laws. We’ll discuss major laws and the reporting requirements related to them get ready to account with advanced financial accounting requirements for management reporting laws, we’re going to be starting off with the Foreign Corrupt Practices Act of 1977. The fcpa Congress passed it as a major amendment to the Securities Exchange Act of 1934, which we’ve discussed in prior presentations. It has two primary sections first section Part One prohibits bribing foreign governmental or political officials for the purpose of securing a contract or otherwise increasing the company’s business and part two requires publicly held companies to maintain accurate records. It also requires an adequate system of internal control. So internal controls again, taking more of a central point focus a lot of times with the regulations related to large companies, we have then the Sarbanes Oxley act of 2002, also known as s o x Sox signed to law July 30 2002. So July 30 2002, Sarbanes Oxley gained traction after the accounting and financial mismanagement of Enron, WorldCom and other large companies. So there’s there’s big large scandals that were happening. And it was feared that and I think rightly so to a large extent that there was going to be faith lost in the financial reporting system. And once again, that’s the foundation really, that’s a huge component to why people invest in US companies because they have some more measure of trust than many other areas where they can put their money in. So if the financial statements are going to lose, lose that trust, that’s going to be a very big problems. So Sarbanes Oxley was a reaction to some of these large scandals which were reflecting missed. statements in the financial statements that looked like deceptive misstatements in the financial statements in an attempt to regain security to people who are investing and users of the financial statements to have faith in the contents of them, they’ll help the law has many implications for accountants. So there’s going to be a lot of changes. accounting firms have many implications related to it. We’ll go through it in some detail here. Not a whole lot of detail, but some detail we’ll go through some of the major parts of it. It was intended to minimize corporate governance, accounting and financial reporting abuses, resulting in restoration of investor confidence in the financial reporting of publicly traded companies.

Threshold Tests for Segment Reporting

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss threshold tests for segments reporting, get ready to account with advanced financial accounting threshold tests for segment reporting separate supplemental disclosures that need to be made for separately reportable operating segments. So we’ve got these separately reportable operating segments, we have to then determine what type of reporting needs to be taking place for them. determining if a segment needs separately reported information. There are 310 percent quantitative rules FA SB specifies separate disclosure is needed for any segment that meets at least one of the three tests that follow. So we have the segment we got to think about Okay, do we need separate disclosure for this segment, and in order to determine that we’re going to use these 310 percent tests, they only need to meet one of these tests in order for the separate disclosure to be necessary that being 10% revenue test 10% profit or loss test and 10% assets tests. We’re going to go into more detail on each of these tests. Now some we’re going next slides we’ll be focusing in on these three items. So we’re going to start of course with the 10% revenue test. If an operating segments revenue, including both external sales and intersegment sales or transfers is 10% or more of total revenues from external sales plus intersegment. transactions of all operating segments, then segment is separately reported and supplemental disclosures must be provided for it in the annual report so that we have the 10% of revenue basically top line of course on the income statement to determine if the segment is separately reportable. Then we have the 10% of profit and loss. So now the next test now looking at the bottom line, of the income statement, as opposed to The top line if the absolute value of the segments profit or loss or absolute value, so, if we have a income or loss is 10% or more of the higher in absolute value of a the total profit of all operating segments that did not report a loss or be total loss of all operating segments that did report a loss, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report. So, you can think about these tests you got the 10% of the top line of the income statement, the revenue, basically 10% of the bottom line, profit or loss on the income statement. Now, we’re looking at the balance sheet 10% of assets tests. If these segments assets are 10% or more of the total assets of all operating segments, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report.

Requirements for Management Reporting Laws

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss requirements for management reporting laws. We’ll discuss major laws and the reporting requirements related to them get ready to account with advanced financial accounting requirements for management reporting laws, we’re going to be starting off with the Foreign Corrupt Practices Act of 1977. The fcpa Congress passed it as a major amendment to the Securities Exchange Act of 1934, which we’ve discussed in prior presentations. It has two primary sections first section Part One prohibits bribing foreign governmental or political officials for the purpose of securing a contract or otherwise increasing the company’s business and part two requires publicly held companies to maintain accurate records. It also requires an adequate system of internal control. So internal controls again, taking more of a central point focus a lot of times with the regulations related to large companies, we have then the Sarbanes Oxley act of 2002, also known as s o x Sox signed to law July 30 2002. So July 30 2002, Sarbanes Oxley gained traction after the accounting and financial mismanagement of Enron, WorldCom and other large companies. So there’s there’s big large scandals that were happening. And it was feared that and I think rightly so to a large extent that there was going to be faith lost in the financial reporting system. And once again, that’s the foundation really, that’s a huge component to why people invest in US companies because they have some more measure of trust than many other areas where they can put their money in. So if the financial statements are going to lose, lose that trust, that’s going to be a very big problems. So Sarbanes Oxley was a reaction to some of these large scandals which were reflecting missed. statements in the financial statements that looked like deceptive misstatements in the financial statements in an attempt to regain security to people who are investing and users of the financial statements to have faith in the contents of them, they’ll help the law has many implications for accountants. So there’s going to be a lot of changes. accounting firms have many implications related to it. We’ll go through it in some detail here. Not a whole lot of detail, but some detail we’ll go through some of the major parts of it. It was intended to minimize corporate governance, accounting and financial reporting abuses, resulting in restoration of investor confidence in the financial reporting of publicly traded companies.

Interim Financial Reporting Rules

Advanced financial accounting PowerPoint presentation. In this presentation we will take a look at interim financial reporting or rules get ready to account with advanced financial accounting. Interim financial reporting rules started off with interim report. So interim reports they will cover a time period of less than a single year. So when we’re thinking about the interim reports, when we’re thinking about interim information, we have the year in information when we think about financial statements, we often what pops into most people’s head most of the time are going to be for the year ended financial statements income statement covering January through December balance sheet covering the year end. If it’s a fiscal year calendar year in interim, then we’re going to be talking about the financial statements at some interim period typically quarterly, quarterly meaning first, second, third quarter and then you got the yearly information for the fourth quarter. Therefore, the interim reports they will cover a time period of less than a single year. The goal is to provide timely information about the company’s options. Throughout the year, so obviously more information is nice. We want timely information for the decision makers, we got the year end reports, it would be nice if we have the quarterly reports, which we have now, to give us more timely information as the year goes by. quarterly reports are required to be published for publicly held companies. So if you’re a publicly held company, that company’s stock is being traded on stock exchanges and whatnot, then people need current information. The market needs current information. Therefore, it’s a requirement to have the quarterly reporting for that timely information. The quarterly reports can generally be thought of as smaller versions of the annual report. So when we think about the annual reporting, what’s going to be included in it, the quarterly reports is, as you would kind of expect, right a smaller version of that as we’re doing the reporting for a timeframe that’s going to be less than the entire year. Here some type of interim reporting requirements form q 10 q or form 10 q sec s quarterly report.

Threshold Tests for Segment Reporting

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss threshold tests for segments reporting, get ready to account with advanced financial accounting threshold tests for segment reporting separate supplemental disclosures that need to be made for separately reportable operating segments. So we’ve got these separately reportable operating segments, we have to then determine what type of reporting needs to be taking place for them. determining if a segment needs separately reported information. There are 310 percent quantitative rules FA SB specifies separate disclosure is needed for any segment that meets at least one of the three tests that follow. So we have the segment we got to think about Okay, do we need separate disclosure for this segment, and in order to determine that we’re going to use these 310 percent tests, they only need to meet one of these tests in order for the separate disclosure to be necessary that being 10% revenue test 10% profit or loss test and 10% assets tests. We’re going to go into more detail on each of these tests. Now some we’re going next slides we’ll be focusing in on these three items. So we’re going to start of course with the 10% revenue test. If an operating segments revenue, including both external sales and intersegment sales or transfers is 10% or more of total revenues from external sales plus intersegment. transactions of all operating segments, then segment is separately reported and supplemental disclosures must be provided for it in the annual report so that we have the 10% of revenue basically top line of course on the income statement to determine if the segment is separately reportable. Then we have the 10% of profit and loss. So now the next test now looking at the bottom line, of the income statement, as opposed to The top line if the absolute value of the segments profit or loss or absolute value, so, if we have a income or loss is 10% or more of the higher in absolute value of a the total profit of all operating segments that did not report a loss or be total loss of all operating segments that did report a loss, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report. So, you can think about these tests you got the 10% of the top line of the income statement, the revenue, basically 10% of the bottom line, profit or loss on the income statement. Now, we’re looking at the balance sheet 10% of assets tests. If these segments assets are 10% or more of the total assets of all operating segments, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report.