In this blog post, we will dive into the concept of the Purchases Journal and its significance for service companies. The Purchases Journal plays a crucial role in accounting for businesses that regularly make purchases on account, which typically results in accounts payable transactions. We will explore the purpose of this journal, its applications in both manual and automated accounting systems, and the process of recording transactions and maintaining the accounts payable subsidiary ledger.

What is the Purchases Journal? The Purchases Journal is a specialized accounting record used to track and manage purchases made on account by a service company. Unlike businesses dealing with inventory, service companies often purchase items like supplies, and these transactions are recorded in the Purchases Journal.

Why Use the Purchases Journal? The Purchases Journal offers a practical way to streamline the recording of accounts payable transactions. Instead of creating separate journal entries for each transaction, a company can record them in the Purchases Journal throughout a specified period, which could be a day, a week, or a month. This approach helps expedite the data entry process and maintain financial records efficiently.

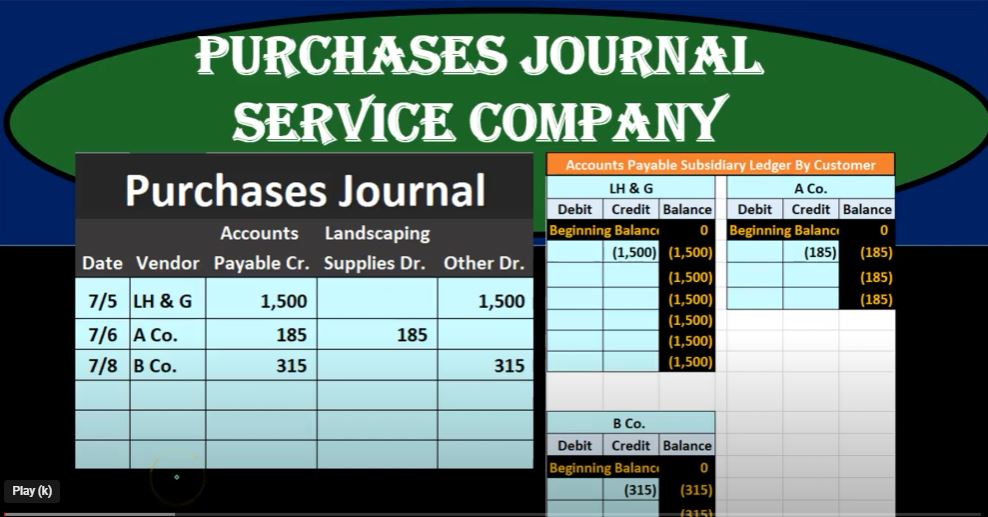

Recording Transactions in the Purchases Journal: To demonstrate how the Purchases Journal works, let’s go through a series of transactions:

- On 7/5, a service company, for example, L H and G, made a purchase of $1,500. This transaction increases accounts payable (an obligatory account) and is recorded in the Purchases Journal.

- On 7/6, another purchase was made on account, this time for $185. Since it’s for landscaping supplies, the corresponding account to be debited is “Landscaping Supplies.” This entry is also recorded in the Purchases Journal.

- On 7/8, a company (let’s call it “B Company”) made another purchase of $315, which falls under an “other” category. In this case, the company has not specified the nature of the purchase. The transaction is recorded in the Purchases Journal.

- On 7/18, L H and G made another purchase, this time for $140, which again goes to the “Landscaping Supplies” account. This transaction is documented in the Purchases Journal.

Creating the Accounts Payable Subsidiary Ledger: To keep track of whom the company owes money to, a separate ledger, known as the accounts payable subsidiary ledger, is maintained. For each vendor, a separate account is established, and the transactions related to that vendor are recorded here.

For the transactions mentioned above:

- L H and G is owed $1,500, bringing the balance to $1,500.

- B Company is owed $315, increasing the balance to $315.

Preparing the Journal Entry: At the end of the accounting period (in this case, the month), the transactions recorded in the Purchases Journal are summarized and used to create a journal entry. This entry typically consists of a credit to “Accounts Payable” and one or more debits to relevant accounts, based on the nature of the purchase.

For the transactions mentioned above:

- Landscaping Supplies is debited for $325.

- “Loan Equipment” (the $1,500 purchase) is debited for $1,500.

- “Advertising Expense” (the $315 purchase) is debited for $315.

- “Accounts Payable” is credited for the total, $2,140.

Posting to the General Ledger and Trial Balance: The journal entry is then posted to the general ledger, which keeps track of the balances in various accounts. The general ledger provides an overview of financial transactions.

Finally, the trial balance is prepared, which lists the ending balances of each account. It helps ensure that debits and credits in the general ledger are in balance. The trial balance shows the total accounts payable, but it doesn’t break down the amounts owed to specific vendors. That information is found in the accounts payable subsidiary ledger.

Conclusion: The Purchases Journal is a valuable tool for service companies to efficiently record and manage accounts payable transactions. By maintaining an accounts payable subsidiary ledger, companies can track their obligations to specific vendors. This process ensures that financial records are accurate and up to date, allowing businesses to make informed financial decisions.