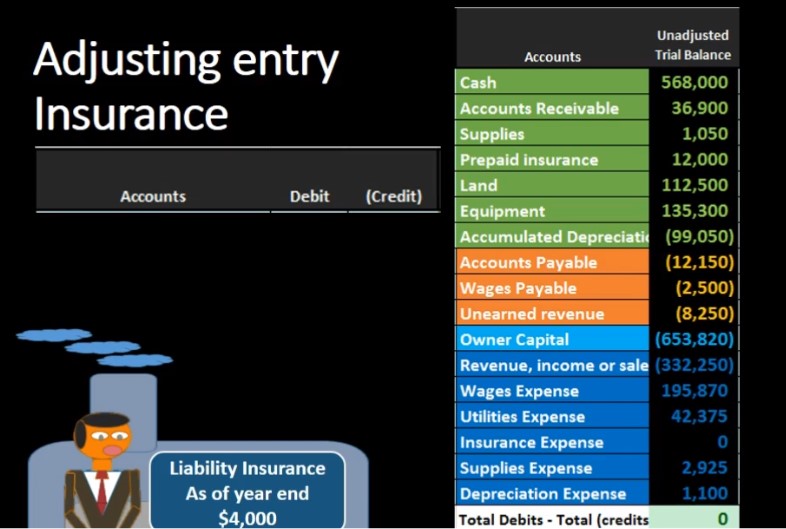

Hello in this lecture, we’re going to record the adjusting entry related to insurance, we’re going to record the transaction up here on the left hand side and then post that to the trial balance on the right hand side, the trial balance being in the format of assets in green liabilities in orange. Then we have the equity section in light blue and the income statement, including revenue and expenses in the darker blue. We will start off by just identifying the accounts that will be affected and then talk about why they will be affected. So we know that we have the adjusting entries. Remember that adjusting entries should be kept separate in your head in that they do have the same characteristics of having debits and credits in at least two accounts affected however, they’re also all as of the end of the time period, either the end of the month or the end of the year.

00:43

We’re going to say the end of the year 1231 in this case, and they all have one balance sheet account in terms of the trial balance that means an account above the owners capital account and one income statement account. At least that means the accounts below the capital account revenue and expenses. If we know that We look at the trial balance, we can then determine which accounts will be affected. Even if we don’t really know what’s going on, for example, we’re talking about an insurance expense. And if we look above this blue line for something related to insurance, we can see how about prepaid insurance? That looks like one of the accounts that will be in our adjusting entry? How about an account related to insurance in the income statement in the dark blue area? How about insurance expense, we can see those two accounts are going to be the ones that will be included in the journal entry. Even if we don’t really know what’s going on.

01:33

We can even know which way they are going just by the fact that this is an income statement account and Sharon’s expense. And income statement accounts only go one way they go up, expenses go up with debits, and therefore we’re going to have to debit insurance expense. So we know we’re going to debit insurance expense. We may not know the amount yet that we’re going to debit it for, but we know that that’s going to be the debit and therefore, if this is the other account, it must then be the account that we will credit just by knowing that we are recording An adjusting entry we can do all that work without really knowing why we’re doing all that work. Now let’s talk about why we’re doing all that work. What is prepaid insurance? How did it get there? prepaid insurance means that when we purchased the insurance, we have not yet consumed it.

02:13

By definition, when we buy the insurance, we haven’t consumed it. It’s there’s no such thing as getting into a car accident and then buying insurance to cover the car accident that we got into now. What happens is the insurance is gonna cover us in the future, it doesn’t necessarily mean that we have to consume the insurance in terms of using it. We don’t need to get into an accident. In order to use the insurance. We are using the insurance when the insurance has covered us for a Pacific time period we’re guarding against risk as the insurance guards is against risk. That’s the time period when we should expense it. That’s the time period it has been consumed. Therefore, we can tell our accounting department Hey, accounting department, whenever you pay for the insurance, instead of debiting insurance expense and crediting cash.

02:57

We want you to debit prepaid insurance and credit cash So that we can plan on at the end of the month or the end of the year, adjusting it for our financial statements to whatever the accrual is, as of that period of time, meaning, we’re going to figure out how much has been expired? And how much we should then record as an expense, and how much should also be included and still be on the balance sheet as an asset prepaid insurance, how would we do that? We would look at the insurance policy, we would look at the insurance policies, how much was paid, and what’s going to be the time period that was covered and figure out the ratio of in terms of how much is still a prepaid asset as of the cutoff date 1231 in this case, and how much is not. In this case, we’re saying that the determination when we did this calculation, is that as of the end of the year, we should still have 4000. In prepaid insurance. Be careful with insurance because we could have worded that either way.

03:50

The question could say, we should still have 4000 in prepaid insurance or it could say that 4000 has expired and therefore We should expense it, it’s a little bit more difficult of a calculation. So most problems often say that what is going to be still as an asset? Because then we have to figure out the calculation, we have to say we got to get this 12,000 down to 4000. How do we do that? Well, we’re going to take the amount that’s on the books at this point in time 12,000. prepaid insurance, we determined from our calculation that there’s 4000, that is still not consumed as of the end of the cutoff date 1231. In this case, we subtract that out then we have an adjustment of 8000, meaning 12,000 needs to be decreased by our calculation of 8000. To bring us to the 4000. The amount that we determined was not yet expired as of the cutoff date. So let’s do that transaction.

04:46

Now. We’re going to say okay, now we know the number it’s going to be 8000 for debit to insurance expense and credit to prepaid insurance. If we post that out, then we’re going to say that insurance expense is going to be debited by 8000, bringing the balance up to 8000. And prepaid insurance has 12,000 in it, we are doing the opposite thing to it crediting it bringing the balance down to 4000 matching the amount that we calculated should be the calculation based on our analysis of the policy and what has been expired and what has not yet been expired. The assets then are going down because prepaid insurance is an asset and it went down liabilities, nothing happened and the equity section has gone down. Why? Because the expense went up bringing net income down which brings down the entire equity section. If we look at net income, we can see that we had net income before 89 nine ad revenue minus expenses credits winning within debited by 8000. Bringing the balance down to 81,009 84 net income