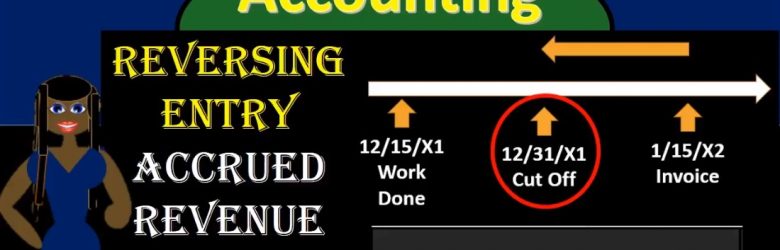

Hello. In this presentation we’re going to talk about reversing journal entries as they are related to accrued revenue. When considering reversing journal entries, we’re talking about those journal entries made after the financial statements have been generated after the adjusting process has been done. Remember that the adjusting process happens after all the normal transactions for the month have happened. Then at the end of the month, we have that adjusting process. All journal entries being made as of the same date as of the end of the month in order to make the financial statements correct so that the financial statements can be made. As of that point in time, in this case, the end of the year being 1231 that the cutoff date that the point in time that we make the financial statements, then we want to consider if we want to use reversing journal entries.

Posts with the cutoff date tag

Adjusting Entry Insurance 9

Hello in this lecture, we’re going to record the adjusting entry related to insurance, we’re going to record the transaction up here on the left hand side and then post that to the trial balance on the right hand side, the trial balance being in the format of assets in green liabilities in orange. Then we have the equity section in light blue and the income statement, including revenue and expenses in the darker blue. We will start off by just identifying the accounts that will be affected and then talk about why they will be affected. So we know that we have the adjusting entries. Remember that adjusting entries should be kept separate in your head in that they do have the same characteristics of having debits and credits in at least two accounts affected however, they’re also all as of the end of the time period, either the end of the month or the end of the year.

Adjusting Entry Accounts Receivable 8

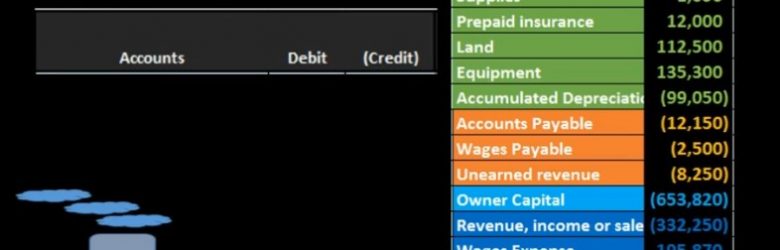

Hello in this lecture, we’re going to record an adjusting transaction related to accounts receivable. We’re going to record the journal entry over here on the left hand side and then post it to the trial balance on the right hand side trial balance and format of assets in green liabilities in orange equity in the light blue and the income statement in the darker blue including revenue and expenses, we’ll first walk through which accounts will be affected and then explain why that is the case. So we know that it is an adjusting entry and knowing that it’s an adjusting entry means it’s slightly different than a normal journal entry in that it does have two accounts like normal journal entries, but it also generally has one income statement account below the blue line and one balance sheet account above the blue line the light blue line, so it’s going to be one account above owner’s equity, one account below owner’s equity.

Adjusting Entry Wages Payable 7

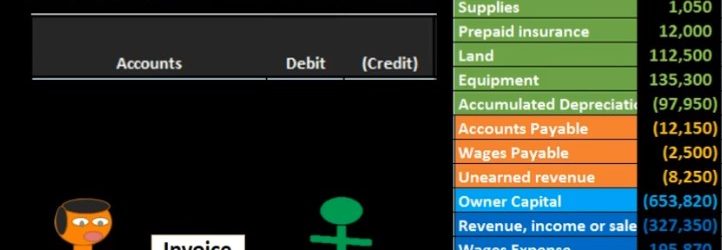

Hello, in this lecture, we’re going to record the adjusting entry related to payroll, we’re going to record the journal entry up here on the left hand side and post that post that to the trial balance over on the right hand side trial balance in terms of assets and liabilities, then equity and the income statement, including revenue and expenses, all blue accounts, including the income statement being part of equity, we’re first going to go through and see if we can find the accounts that will be related to a payroll adjusting entry. And then we’ll go explain why we are going through this process. So just if we have the trial balance, and we know it’s an adjusting entry related to payroll, we know that there’s going to be at least two accounts affected. And we know that because it’s an adjusting entry, it will be as of the end of the time period. In this case, let’s say it’s the end of the year 1231.

Types of Adjusting Journal Entries Adjusting Journal Entry 2

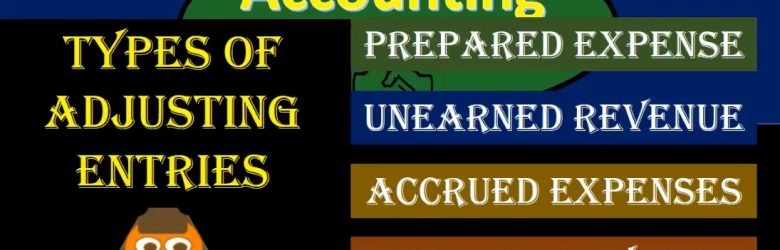

Hello in this presentation we’re going to talk about types of adjusting journal entries. When considering adjusting journal entries we want to know where we are at within the accounting process within the accounting cycle. all the entries the normal adjusting entries have been done the bills have been paid the invoices have been entered for the month we have reconciled the bank accounts. Now we are considering the adjusting process. Those adjusting journal entries are needed in order to make the adjusted trial balance so that we can create the financial statements from them. The adjusting journal entries being used to be as close to an accrual basis as possible. those categories of adjusting journal entries, which will then have more types of adjusting entries within each category will include prepaid expense, unearned revenue, accrued expenses and accrued revenue. Let’s consider each of these we have the types of adjusting entries first type prepaid account expenses. prepaid expenses are items paid in advance.

Unearned Revenue Adjusting Entry 10.45

This presentation and we will enter and adjusting entry related to unearned revenue. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s open up our reports by going to the reports on the left hand side, we’re going to be opening up our balance sheet First, the balance sheet, the favorite record, we’re going to go back up top, we’re going to be changing the dates up top that being from a 10120 to the cutoff date of Oh to 29 to zero, we’re going to run that report, we’re going to right click on the tab up top so we can duplicate that report.

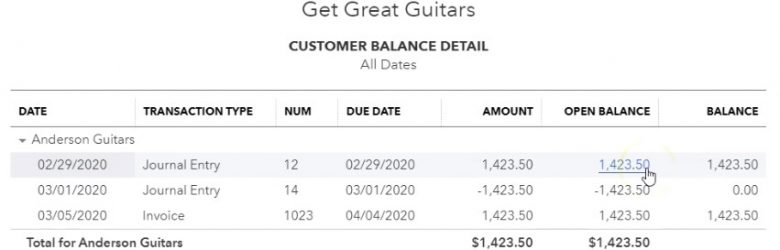

Accounts Receivable Reversing Entry 10.35

In this presentation, we’re going to take a look at an accounts receivable reversing entry. So the story goes like this, we had an invoice that was entered into the system in March after the cutoff date, we pulled it back before the cutoff date. So that income was reported correctly as of the cutoff date, which is going to be February 29. Now we’re going to do a reverse in entry, so that everything is correct and the following period in February as of the date of the original invoice. Let’s get into it with Intuit QuickBooks Online.

Invoice & AR Adjusting Entry Part 2 Solution 10.26

This presentation and we’re going to continue on with our adjusting entry related to an invoice that was entered into the wrong period. We laid out the problem last time. Now we’re going to enter the adjusting entry of this time. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to open up our reports.

Accrued Interest Reversing Entry 10.25

This presentation and we’re going to enter a reversing entry related to accrued interest. Let’s get into it within two, it’s QuickBooks Online. Here we are in our get great guitars file, we’re going to go down to the reports on the left hand side, we’re going to be opening up this time the trusty trial balance, we’re going to be typing in up top to find the trial balance the trial balance, and then we’ll find it and then I’m going to open that up. Then we’re going to change the dates up top, we’re going to change the dates from Oh 1120 to 202 29 to zero.