Corporate Finance PowerPoint presentation. In this presentation, we will give an overview and an introduction to the concept of leverage. Get ready, it’s time to take your chance with corporate finance, leverage what is leverage use of special forces or effects to magnify outcomes given certain conditions. Let’s break that down a little bit more detail use of Special Forces sounds kind of mystical here. But there’s a couple different things that we think about with leverage. And we typically break it down into operating leverage and financial leverage. Most people when they think about leverage, they’re thinking about debt, they’re thinking about the leverage related to the debt will also have leverage related to operating leverage, which has to do with the mix between fixed costs and variable costs. So on so we have these special forces or effects have magnify outcomes. So that could magnify outcomes.

00:50

Now, when we say magnify outcomes, it could lead to magnified outcomes on the positive side, it couldn’t lead to magnified outcomes on the negative side. So when you’re thinking about leverage, obviously, we want to magnify the outcomes. On the positive side, if we have any control or our be able to do though, so and limit the risks of the magnified effects that could happen if there’s a negative circumstances or if the circumstances are such that the magnification would be in the negative direction. So it can magnify beneficial results when there are favorable conditions. And it can magnify negative results, if there are unfavorable conditions. So when you think about leverage,

01:26

When most people think of leverage, they’re probably thinking debt debts going to be the types of things or one type of leverage, that’s one of the components of leverage is can be financial leverage, the other leverage factor is going to be the operating leverage, once again, and that has to do with the mix of your costs between fixed costs and variable costs. Fixed Costs are the one that’s that act more like the debt in that they’re more risky. Why because they’re locked in those fixed costs are locked in kind of like the debt is. And that locking of them means they don’t, they don’t go upwards as easily when there’s increases in productions, but they also don’t go down when times are bad. And that leads to a possible magnification during downtime. So when you think about the leverage, you want to break it into your two components, we have the fixed operating costs, and then the fixed financial cost. So that ties into what we would think of it typically the operating leverage and the financial leverage.

02:20

When we think about the operating leverage, we’re thinking about the mix between the cost structure, the fixed cost versus the variable costs. Remember that some industries will of course, have higher fixed costs, and therefore be more leveraged just by the nature of the industry that they are in. So we’ll do comparisons, just like with any other factor as to what would be an appropriate level of leverage within that industry. Based on the benchmarks of that industry, the standards of that industry, you also could have situations where a business makes choices to affect their their leverage mix, for the operating leverage, many of those choices would have to do with something like what do they want to have more equipment that they would purchase more expensive equipment that possibly could lower the amount of the hourly labor. So hourly labor would typically be a variable cost. And the hourly labor could cost more or, or it could cost more, especially if the production goes up.

03:17

But it’s also less risky. And that if you have labor, that’s hourly labor, and you can adjust the amount of hours that will be there, then you can increase the number of hours when you have more production need, and decrease the number of hours when you have less. If you were then to buy equipment to increase the production capacity, possibly and make it more efficient. Now you have the fixed costs. So you’ve got the fixed costs related to the depreciation or cost of the equipment and possible maintenance. And you can then adjust the equipment level cost, it’s not like you can then go back in and say, Okay, I’m gonna lower the number of hours on the equipment that might have some variable cost to it. But the initial cost of the equipment, the depreciation related to it, and the maintenance of it will typically be more fixed in nature. So some companies will run into that kind of kind of situation as to whether or not they want to make decisions that will result in more fixed costs versus the variable cost.

04:13

And it could have this trade off between the labor, which is variable. So the variability of the labor labor makes it less risky, because in the event of a downturn, you can then lower the number of hours versus the fixed costs, which could be more efficient and lead to more profits once you get past the break even point which we’ll talk about in a second. But also it could cause problems. Of course, if there’s a downturn, because those fixed costs cannot be removed, and be lowered as easily as a variable cost, such as the number of hours that are worked. Then there’s the fixed financial costs. And this has to do with the financial leverage. Probably the thing that most people think about when they think about leverage when people think about leverage or thinking about how much debt typically a company has acquired. comparing that to the industry standard, as well as general overall standards.

05:04

So debt financing could magnify profit, but risk of not meeting obligations can lead to bankruptcy, or you have the selling equity can reduce potential profits but minimize this risk. In other words, if we think about the financing of the company, if you think about the accounting equation accounting equation is assets equal liabilities plus the equity. Now, when we think about the assets here, that means that they have to be financed in one way or the other, how are the assets of the company financed? Is it through liabilities? Or is it through equity, liabilities being debt equity being either the earnings of the company and and the investments of the owner, say stockholders in the company in the case of a corporation. Now, the assets are what we’re going to use in order to generate revenue.

05:53

So when we think about revenue, we’re getting a return on the assets. So we might think, well, how can we increase the assets here, if we can increase the assets and continue to get a return on it, we would like to increase the assets and get more of a return, how can we increase the assets? Well, you can either increase the debt, the liabilities, or you can increase equity. Now to increase equity, you could do that with net income or retaining the net income in the business. But that could take some time, if you want to increase the assets in the short run fairly quickly, or you can issue more stock, but that’s going to dilute the stock to some degree, because then you’ll have more stocks out there. And you’ll have more people or more owner’s equity interest in the company that have interest in the earnings of the company, or you can increase the debt, which results in interest.

06:38

But if you’re able to get a return on the assets higher than the interest level, then that can be beneficial. So you can see if you’re getting a good return on the assets, then there could be pressure, then to increase the liabilities, increase the debts in order to generate more assets, so that the assets can then be used to generate a higher return. Now, a certain level of this of this debt leverage can be beneficial, especially in a time in a period of growth, because it can increase or magnify the level of growth, that’s what the leverage does. But on the downturn, on the downside, it could be more risky as well. And if you can’t meet the debt, then of course, you’re at risk of bankruptcy. Whereas the equity if you’re selling equity, or an equity investment, that can often be kind of less risky. But again, you’re selling the equity investment in the company, you don’t have the debt out there, you don’t have the interest payments on it. But now you’ve sold equity interest in the company.

07:35

So you got more shareholders with a voting interest and equity interest in the company, and therefore the income, the net income that’s generated has to be distributed over a wider range of stocks if you’re issued stock in order to increase the equity, which would be in the case of a corporation. So these are our two leveraged kind of structures Do you have you have a similar item with them, that’s why they’re similar in nature, they sound kind of different one related to debt, when related to you know, fixed costs and variable costs and the cost structure. But they both have that magnifying effect. So when you go back to our definition here, these are the special forces that have mystical special forces that have magnify the outcomes that could happen, right, and that could be related to having more fixed costs, or related to having debt financing.

08:22

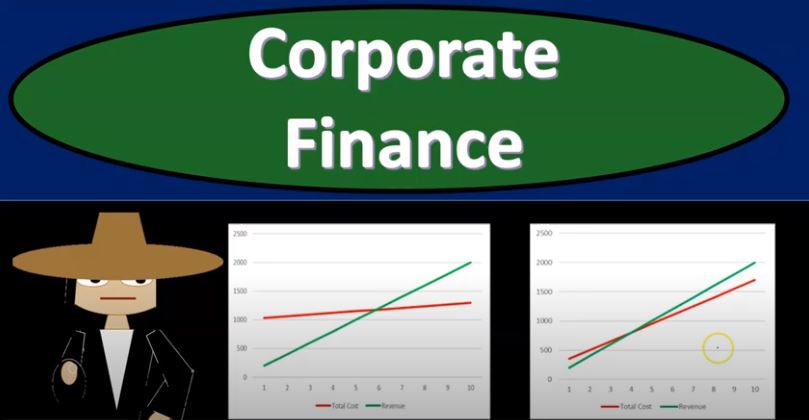

So if we were to think about this, if we’re gonna think about the operating leverage, let’s concentrate on the operating leverage, which is the breakout between the fixed cost and the variable costs, the extent to which fixed fixed assets and the fixed costs associated with them are utilized in the business. So what is operating leverage the extent to which fixed assets and the fixed costs associated with them, which when you’re thinking about property, plant and equipment were typically the depreciation in the fixed costs related to the equipment that you have are utilized in the business. So let’s just consider two scenarios from a chart to kind of standpoint, if we look at this first one, this one is going to be more highly leveraged for something that’s less highly leveraged. In other words, the first one has more fixed costs within their cost structure than the second one, which has less fixed costs and more variable costs.

09:12

First one in there cost structure, the costs lean towards fixed costs, those costs that do not change over time, things like rent, or things like the depreciation, the second one, those things that are the costs do change over time, things like labor costs, rather than a fixed cost. So over here, if you take a look at our red line, that’s going to be the cost structure notice is going up at a much more flat rate. So we as we increase these are going to be the units on the bottom as we increase the units, then the cost is going up much more slowly, because you have a large fixed cost and you can think of it like the rent, you know, if the rent doesn’t change over time or depreciation, a large amount of depreciation doesn’t change over time. So therefore the cost structure is going to be going up at a slower rate and then the Revenue.

10:00

If we think of the revenue of this green line going up at this rate, you can see that this point then is going to be the breakeven point. And as we go up from that point, the difference between the green line and the red line is basically going to be the the profit that we have. And you can see that that gap expands quite rapidly. As we move up. However, you can also see that if we were going from this point backwards, you can see that the gap starts to close up and quite rapidly as we go this way. And if we break past the breakeven point, and we go past the break even point, then we have a loss here, the costs are greater than the profits, and that loss expands quite rapidly. At this point, too, that’s where the more risk is involved. Whereas if we’re over here, you can imagine a situation where the red line is now a variable cost has many more variable costs than fixed costs. So the costs are going up with the level of production much more closely and much more parallel, Li closer to parallel, then to the revenue as the revenue goes up.

11:04

So you can see then as we hit the breakeven, here, we got the breakeven over here. And then as we move from that point, you can see that the we don’t have that magnifying effect, meaning the profits going up fairly slowly, going up this way, the gap between the green line and the red line is much smaller. But also, if you were to have a down period, where the amount of production is going down, you can see that the revenues don’t go down as rapidly either. And if you do hit it a period of loss, it’s not like the losses are magnified very rapidly, that could push you into bankruptcy in a very quick period of time. Whereas here, again, the revenue and good times, you’re like, Wow, this is great, we are expanding, like crazy, you know, when when the the production level is going up, but if the production go level goes down, then then again, it magnifies the other way, and you’re going, Wow, you have things are going down really fast, this is amazing.

12:03

Whereas over here, the downturn is going to be much more gradual. And then once you hit past that breakeven point, and if you’re still going down, if there’s a, you know, real problem in the economy, then you can hit bankruptcy quite quickly over here, when you’re highly leveraged. Whereas over here, you’re going, alright, we can we can survive losses for a much longer period of time, and wait for hopefully good times to come back and play. If you’re if you have the financing, you know, to do that you might be able to sustain out longer. So obviously, looking at these two structures, you’d say, Well, I’d like you know, I like leverage. When things are expanding, I’d like to take advantage of leverage. And then when things are detracting not to, we don’t know when things are expanding or detracting though because we don’t have a crystal ball. So we have to find some kind of balance between risk and reward. With regards to leverage, leverage, that’s why leverage is going to be a very controversial topic, because some people who are very risk, you know, they like risk, or they’ve just learned the benefits of risks when good times happen.

13:05

And just don’t understand the downtime, or people that have been really impacted or hurt by the down period when they when they got hurt by a down period in the market, and are really averse to any leverage due to that because they don’t they can’t, you know, it’s hard to see the upside, then in those circumstances are more likely to be risk averse. So the question is, is the company going to be want to risk Do they understand the risk that they’re taking on and then taking that risk factor or risk level that people naturally want to be taking within their business into account and then appropriately coming up with a degree of leverage both with regard to operating leverage and financial leverage that’s appropriate to the needs and desires of the company and the risk that they want to be taken on? So decision factors related to operating leverage, leverage economic conditions, economic conditions being the overall conditions in the economy? Is the economy going up or down, the economy is generally improving, then you’re going to say, well, we might have a period of, of increase.

14:09

And that could lead to us thinking, well, we should be getting more leverage at this point. But again, when you’re guessing a lot about the economy, that might be a good thing. But it might you know, you want to hedge that to some degree, and it depends on how much risk you want to you want to take on with predictions such as that. So then competition in the industry. So obviously, the competition in the industry is going to determine what’s going to be our level of increase or decrease how many new companies can be increasing into the industry, how many new companies might be going into the industry or being removed from the industry? And how can we think of getting basically an advantage? Is there an advantage that we can basically pick up possibly with the use or help of leverage as well, and then the trade offs between stability and market leadership?

14:52

So when you’re making these kind of decisions, obviously when you’re thinking about the leverage component, in good times, we have that multiplying effect So there’s gonna be pressure then to be the market leader and be going for the leadership position. And then there’s also going to be pressure. And you want to take into consideration the risks, especially in the case of the when there’s a downturn for stabilities, for stability, so they got that risk reward kind of trade off, that’s going to be happening all the time when things are good. And you could see this in the market too, and in businesses happens all the times when things start going good, we’re more likely to to, to think that’s going to last forever, and make decisions that might take on more risk than we would otherwise would, in this case, maybe being more highly leveraged than we otherwise wouldn’t order to magnify the good times that are happening.

15:40

And then not and at some point, good times happen for for so long that we get blinded to the fact that there could be a point where there’s, you know, the good times turn around, and we’re not, you know, we’re not ready for for that. So we have to have that kind of balance between the two, and then the desired risk level. So remember that many people, people have many different risk levels, and a lot of times entrepreneurs are much more, you know, willing to take on risk than the normal kind of people. But also, you want to make sure when you’re thinking about the risk level, that the risk that you’re taking on isn’t due to ignorance, it’s not due to the fact that you just don’t think that there’s a downside, that’s not the case, right?

16:19

You want to make sure that when you’re when you’re dealing with someone, and trying to assess what the risk level is either in yourself in the company or in with an owner or something like that, that they understand the risk level first. And again, both the upside and the downside, it’s so the risk level of of what leverage can do and then once understanding the risk, the risk that is there, if they have an understanding of it, then then deciding on what kind of risk level is appropriate for the for the business that and the business owners that are taking on the business and making the decisions for it.