Corporate Finance PowerPoint presentation. In this presentation, we will discuss the nature of asset growth, get ready, it’s time to take your chance with corporate finance, the nature of asset growth, we’re going to start off with working capital management, what is working capital management, the financing and management of current assets of the company. So when we consider this, let’s think about the accounting equation assets equal liabilities plus equity, remember that the assets are what the company has, why does the company have them in order to help generate revenue to get a return on the assets in order to help generate revenue?

Posts with the increase tag

Financial Leverage 520

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial leverage, get ready, it’s time to take your chance with corporate finance, financial leverage. Now remember, when you hear the term leverage, you’re typically thinking of two different categories, that being financial leverage. And then the operating leverage the financial leverage, usually the one that most people think of when they think of leverage having to do with the leverage related to the debt, the operating leverage having to do with their leverage related to the cost structure between the variable cost and the fixed cost, the operating leverage having the leverage component when you have the in the fixed costs.

Leverage Overview 505

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview and an introduction to the concept of leverage. Get ready, it’s time to take your chance with corporate finance, leverage what is leverage use of special forces or effects to magnify outcomes given certain conditions. Let’s break that down a little bit more detail use of Special Forces sounds kind of mystical here. But there’s a couple different things that we think about with leverage. And we typically break it down into operating leverage and financial leverage. Most people when they think about leverage, they’re thinking about debt, they’re thinking about the leverage related to the debt will also have leverage related to operating leverage, which has to do with the mix between fixed costs and variable costs. So on so we have these special forces or effects have magnify outcomes. So that could magnify outcomes.

Percent of Sales Method 425

Corporate Finance PowerPoint presentation. In this presentation we will discuss the percent of sales method, the percent of sales method been a tool that can help us with our projections out into the future help us to think about where we will stand, think about what our balance sheet accounts will be in the future. If we, if we estimate some type of growth into the future also help us to determine whether or not we may need additional funding to support our growth plans that we have set in place. Get ready, it’s time to take your chance with corporate finance percent of sales method. Now this method can be a little bit confusing when you first look at it in the calculation or formula for it can be a little bit intimidating as well, I highly recommend to get a better understanding of this formula and how to apply it to go through the practice problems, we will have practice problems related to this formula in terms of Excel problems, as well as working through the practice problems and presentations in one note.

DuPont System of Analysis 315

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the DuPont system of analysis Get ready, it’s time to take your chance with corporate finance, the DuPont system of analysis, the DuPont system of analysis is going to be focusing in on a key financial ratio, that being the return on equity or our OE, the ROI he is calculated most simply as net income divided by equity, what we’re going to do is take this return on equity and break it out into components, those components drilling down on areas in the business, allowing us a better analysis in those areas and given us some opportunities to improve different components of the business. So it allows us to basically drill down and get more detail on the return on equity.

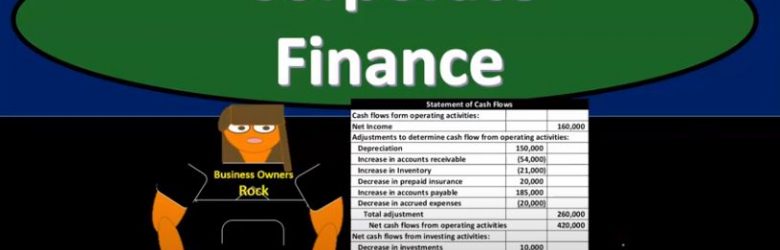

Statement of Cash Flows 235

Corporate Finance PowerPoint presentation. In this presentation, we will discuss Statement of Cash Flows Get ready, it’s time to take your chance with corporate finance statement of cash flows. So remember when we’re thinking about the financial statements, we can think about them as answering two major questions to users of the financial statements. For examples, if we’re thinking about investing to the company in some type of way, and are using the financial statements to help us make a decision with regards to that, we want to know where does the company stand at this point in time, what’s basically their worth at this point in time. For that we get help from the balance sheet, which is going to give us the assets liabilities, equity, assets, minus liabilities equals equity, which is basically the book value as of a point in time.

Financial Management Goals 125

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial management goals Get ready, it’s time to take your chance with corporate finance, financial management goals. Now, as we’re thinking about the financial management goals, we’re thinking about corporate finance, we’re typically thinking about a corporate structure. So management, how does management fit into the structure of a corporation, the owners of the corporation are going to be the shareholders of the corporation. So if you think about a large corporation, then you’re thinking, well, the shareholders shares are trading all the time, possibly on an exchange for a large corporation.

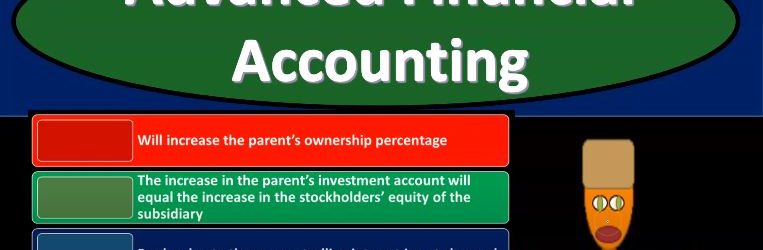

Subsidiary Sells Additional Shares to Parent

Advanced financial accounting PowerPoint presentation in this presentation will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to the parent. So we have a situation where we have the subsidiary selling additional shares to the parent, what’s going to be the effect on the Consolidated Financial Statements get ready to account with advanced financial accounting. We’re talking about a situation here where the subsidiary is going to sell additional shares to the parent and the price is going to be equal to the book value of the existing shares. In that case, it’s going to increase the parents ownership percent, because the parent now has more stocks and no one else got more stocks. Therefore, their percent ownership is increasing. The increase in the parents investment accounts will equal the increase in the stockholders equity of the subsidiary the book value of the non controlling interest is not changed and the normal consolidation entries will be made based on the parents and new ownership percent. So obviously when we do The consolidation entries, we’re going to be basing them on the new ownership percent, that’s going to be the more simple kind of situation where we have the price equal to the book value. What if there’s a sale of additional shares to the parent at an amount of different than the book value, so we still have shares going from the subsidiary to the parent, but now the amount is different than the book value. This increases the carrying amount of the parents investment by the fair value of the consideration. So in other words, the carrying amount of the parents investment in the subsidiary is going to go up by that what was paid for it that consideration given whether that be cash at the fair value of something other than cash. At consolidation, the amount of a non controlling interest needs to be adjusted to reflect the change in its interest in the subsidiary.

Subsidiary Sells Additional Shares to Nonaffiliate

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to a non affiliate. So we have the subsidiary selling shares not to the parent, but to a non affiliate what will be the effect on the consolidation process? Get ready to account with advanced financial accounting. We are talking about a situation here where the subsidiary is selling more stock or additional stock to someone outside of the organization, someone who is not affiliated not to the parent or some other subsidiary, what will be the effect in the consolidation process? It’s going to increase the total stockholders equity of the consolidated entity by the amount received by the subsidiary in the sale. That of course would make sense because if you imagine the transaction taking place, then if they got cash for it, for example, cash would be going up the other side going to the equity so it’s going to be increasing the total stockholders equity will increase total shares outstanding for the subsidiary reducing the percent ownership of the parent company. So if the subsidiary then issues more shares and they didn’t go to the parent, then that means there’s going to be more shares outstanding. That means the shares that the parent owns will go down, therefore, their percentage ownership will typically go down. In that case, we’ll increase the amount assigned to the non controlling interest.

Requirements for Management Reporting Laws

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss requirements for management reporting laws. We’ll discuss major laws and the reporting requirements related to them get ready to account with advanced financial accounting requirements for management reporting laws, we’re going to be starting off with the Foreign Corrupt Practices Act of 1977. The fcpa Congress passed it as a major amendment to the Securities Exchange Act of 1934, which we’ve discussed in prior presentations. It has two primary sections first section Part One prohibits bribing foreign governmental or political officials for the purpose of securing a contract or otherwise increasing the company’s business and part two requires publicly held companies to maintain accurate records. It also requires an adequate system of internal control. So internal controls again, taking more of a central point focus a lot of times with the regulations related to large companies, we have then the Sarbanes Oxley act of 2002, also known as s o x Sox signed to law July 30 2002. So July 30 2002, Sarbanes Oxley gained traction after the accounting and financial mismanagement of Enron, WorldCom and other large companies. So there’s there’s big large scandals that were happening. And it was feared that and I think rightly so to a large extent that there was going to be faith lost in the financial reporting system. And once again, that’s the foundation really, that’s a huge component to why people invest in US companies because they have some more measure of trust than many other areas where they can put their money in. So if the financial statements are going to lose, lose that trust, that’s going to be a very big problems. So Sarbanes Oxley was a reaction to some of these large scandals which were reflecting missed. statements in the financial statements that looked like deceptive misstatements in the financial statements in an attempt to regain security to people who are investing and users of the financial statements to have faith in the contents of them, they’ll help the law has many implications for accountants. So there’s going to be a lot of changes. accounting firms have many implications related to it. We’ll go through it in some detail here. Not a whole lot of detail, but some detail we’ll go through some of the major parts of it. It was intended to minimize corporate governance, accounting and financial reporting abuses, resulting in restoration of investor confidence in the financial reporting of publicly traded companies.