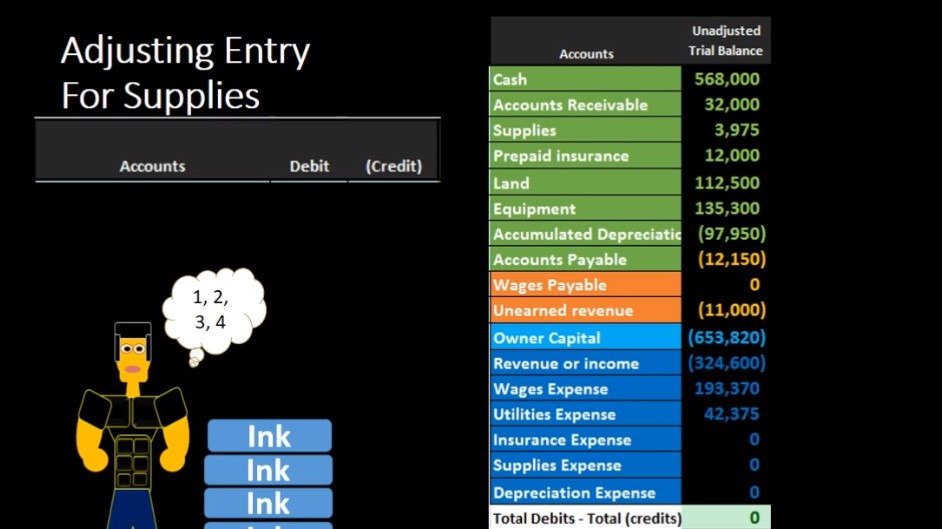

Hello in this lecture, we’re going to record an adjusting entry related to supplies. Remember that adjusting entries are going to have their own set of rules, you want to keep them separate in your head. They are still journal entries, and they follow the journal entry rules. But if we know that we are dealing with adjusting entries, we can apply an additional set of rules to help us to understand what the journal entry will be. For example, the adjusting entries will all be at the end of the time period, the end of the month or the end of the year. And if we take a look at the supplies account, we also know that typical adjusting entries will always have an account in the balance sheet section in terms of the trial balance that’s going to be somewhere up above this owner’s capital account. So we look for an account on the trial balance related to this supplies. on the balance sheet we said how about supplies and we also note that the supplies, the adjusting entries will have an account below the equity section below the owner’s capital in the income statement, revenue and expenses.

00:57

In this case if we look for a trial balance and look for an account related to supplies, we see supplies expense. Note that if we go through that series of questions, we can see which accounts are going to be impacted without even really knowing what we’re doing. And we can also see which accounts are going to be going which way by thinking about the idea that supplies expense is an expense, expenses or debit balance accounts, so they only go up in the debit direction. Therefore, we can say that expenses are going to be debited. And if we debit the expense, and the other account is the asset up here, supplies the asset, we’re going to credit supplies the asset, so we can go through all that we can see what we’re going to debit we can see what we’re going to credit without even really knowing what’s going on just knowing it’s an adjusting entry related to supplies. Now let’s talk about what’s going on. If we have supplies.

01:43

When we put supplies on the book, we have 3009 $75 worth of supplies. What we did is we said hey bookkeeper I want you to put all supplies on the books as an asset whenever you purchase it. supplies in this case being ink we’re gonna say it’s computer ink, we piled it in the corner. Every time we purchased it, we put it in the asset of supplies. What’s going to happen at the end of the time period is we plan on counting the supplies. So here we are counting the supplies. And we are then going to make an adjustment based on our physical count, kind of like we would for inventory. This is an introduction into inventory. And then we’re going to adjust the supplies to our physical account in a similar way as a periodic basically inventory system. So if we did that note, he’s counting up the supplies here, we see that there’s four units. Now note, we do have to convert the units to $1 amount. So the dollar amount we’re going to say is 1050. Although there are four units, many times in textbooks, they’ll just give you the dollar amount, they’ll say the supplies at the end of the time period is going to be 1050.

02:44

What we need to know is what’s on the trial balance the unadjusted trial balance before the adjustment and how do we get it to what the physical count was in terms of dollars, in this case 1050. Well, what we do is we take the amount that was on the original unadjusted trial And we’d subtract out what the physical account amount was, what are my eyeballs say is actually there from the count, and we get the adjustment. So if we subtract those out, then we get 2009 25. In this case, that means that we’ve got to adjust this amount down by 2009 25, in order to get 1050. How are we going to do that? Well, we can see here that we have the supplies account is a debit balance, we already know that we’re going to credit it now we know the number because we already have the transaction over here, we’re going to credit it by that 2009 25 we just calculated. If we then post that out, then we’re going to say the expenses are going to go from zero up by 2009 25 to 2009 25.

03:46

Supplies then going from a debit of 3009 75 credit down by 2009 25 to that 1050, which should tie out to the problem the physical count We have been counted assets then are going down in this case because supplies are going down, nothing’s happening to liabilities equity section is going down. Why? Because the expenses went up bringing net income down, which brings the total equity section down. If we see this in total, we can see that the net income here is going down. Why? Because the revenue minus the expenses were revenue winning by a credit of 88 855. We then added another debit in terms of supplies expense, bringing the net income down to 85 930, which brings down the entire equity section as well.