https://youtu.be/H1D3e6dKlTI?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

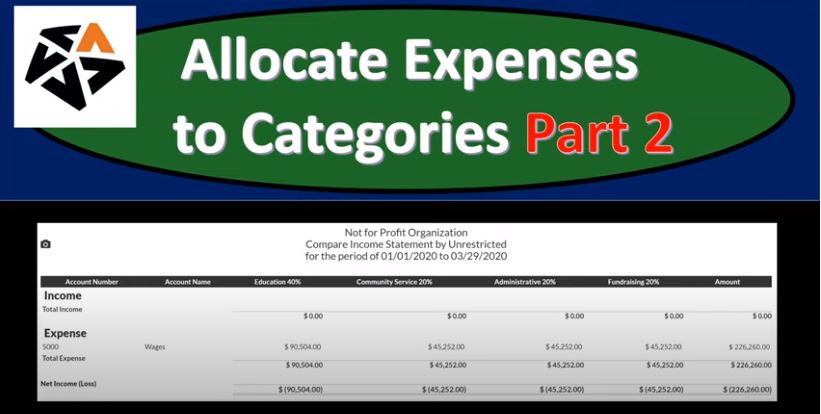

This presentation, we’re going to continue on allocating our expenses by category by function, including by program, admin, and fundraising with the use of our tax feature within our accounting software, get ready to go with aplos. Here we are in our not for profit organization dashboard, we’re going to go on over to our Excel file to see what our objective will be. We’re continuing on with the allocation of our expenses, you’ll recall the objective being that normally we have our expenses broken out in the statement of activities here. And we need to break them out both by function and what they’re used for by nature and by function.

00:42

So for example, here, they’re broken out by function, including the programs, and then the manager, or admin, and fundraising. And that’s important for not for profit organization. So you can do a comparison of you know, how much of the monies go into the programs versus the other supporting information. But we also want to see them by function. So we typically will want another report to break that out. And that allows the readers of the report not to be overwhelmed by see them being seen them just by either nature or function, and then seeing another report that will break them out. That’s going to be our objective here. If we go back over to aplos, let’s open up our report. We’ve started this thus far. So I’m going to open up the reports, I’m also going to set this up in such a way that we can do this as efficiently as possible.

01:30

All right, so we’re going to go to the reports we’re going to and we’re going to be drilling back down on the from the reports to the details within them, we’re going to be opened up our favorite one of our favorite reports that being the income statement by fund, it should be up in your favorite reports. By this time, if it’s not, you know, put it up there, I think it’s really should be there at this point, we’re going to go to the this month is going to be this year to date, we’re gonna say this year to date. So there we have it. So now we have the restricted items and the unrestricted items. Now we’re concentrating here on the on the unrestricted items, and more specifically on the expenses. So we’re going to go to all these expenses.

02:07

And we want to break them out to the unrestricted categories, which includes the two programs, the admin and the fundraising. So to do that, I’m going to break I’m going to right click on this tab again, duplicate that tab. And then we’re going to be opening up another report. So let’s go to the reports to the right, once again, reports to the right once again. And we want to go down to the reports that are by tag now. So we want an income statement by the by the unrestricted tags. And then you have your filtering option up top, it defaults to only having like three up up at a time, because it’s probably too many if you have more than that.

02:46

But we want four of them. So we’re gonna go to the unrestricted item here, make sure you have all four of them that will be showing, we need to see all of them here. So then we’re gonna say okay, and then we’ll change the dates once again to the year to date, so this year to date. Alright, so we’ve already allocated over the wages here. So the wages are here, once we’re done, we will have broken these out between the education, community service, admin, and fundraising. So now let’s go back to the prior Report, I’m actually going to take this tab, pull it, I’m going to left click on it and pull it to the right. So now I’ve got this report to the right. And then every time I drill down on this data to adjust it, I’m going to open up another tab so that I can always go back to this tab.

03:31

So I’m going to go up top, I’m going to right click on this tab, then duplicate this tab. And then here’s gonna be our same report. Now notice as it’s refreshing, I might want to pull this tab from the left to the right. And these two tabs are the same now. But by doing that, I can work on this tab while this other ones refreshing, right so and then I can go back down here instead. All right, we did the wages. Let’s take a look at the rent. Now let’s go into the rent. See what we have there, we only have one transaction here. So again, you could go on here and make another make another tab so that this tab is is open, you could see that the difference, let’s do it, let’s right click on this tab, duplicate this tab. So every time I drill down on it, I’m going to duplicate, I’m going to pull this tab to the right, because these two are the same, but this one I don’t have to wait for it to upload.

04:24

And then I’m going to go down here and we’re going to drill down on this tab. So let’s drill down on this tab and look at the source document. Okay, so then we’re going to go down to the bottom here. And so we don’t we see down in the bottom, we have our activity. Now this one was that one that’s a little bit funny as well because no again, this one is that one where we had using that deposit form but someone gave us the use of property. So we use the deposit form to basically enter a journal entry so we have the contributions and the rent. What we’re looking at is this rent we want to break this rent item. Now into its components. So what I’m going to do is do the same thing I’m going to add, I’m going to add three more rows, I’m going to 123. And then I’m going to say that this and then we’ll add our categories, which are going to be over here for the unrestricted, I’m going to say 100.

05:21

And that’s going to be 40%. And then 200, here, and that’s going to be the 20%. And then 300, here, and that’s going to be the 20% admin, and then 400 here, and that’s going to be the 20%. For the fundraising, then I’m going to, I’m going to adjust this number that this number is going to be the negative amount. So we need a positive amount that adds up to the same thing. So I’m just going to try to adjust this number. Now note, you could try to use the percentages, but it’s not going to work perfectly here because you can see that I want on this tag 40% 40%. But it’s not pulling anything over, because there’s nothing in this deposit line up there. So that’s what’s kind of kind of messing this thing up. So we can’t really use that method in the same format here. So I’ve added the negative 35, eight back here, what we need to do then is is pull out the trusty calculator. So we’ll pull out the trusty calculator here, and there’s the huge calculator.

06:19

And then we’re going to type in 35800 times point four, and that’s going to be the 14 320. So I’m going to say this one needs to be 14320. So 14320. And then we’re going to pull up that trusty calculator again and say 35800 times point two, where’s the point the point got lost, this is going to be 35800 times point two, and there’s the 1760. So I’m going to say, then here is going to be the, or the 7160, slightly different there. And then we’re going to say here, this will be the 7160. And this year, also 7160. And that should do it. So that should bring us back down to zero. So let’s go ahead and record this, and then we’ll check it out. So I’m going to say Save, and see if it gives me any any kind of error message on that. It does, because I didn’t add the account over here, which is kind of important. So I’m going to add the account, they’re all the same account. 501 is the account. And so I’m going to say 501, and then 501. All right, so I think that should do it. Let’s try again. And so I’m going to go ahead and submit.

07:37

And then we’ll I have this still open before I close the tab, I’m going to go back to the prior worksheet, I’m going to refresh it, I’m going to refresh this. And the one line item we had should now be appearing in four line items, right, so then we’d have four line items here, because we broke it, we broke that item out into basically four four line items. And then if we go back to the to the prior report, there’s not going to be any change to the unrestricted items here, it should be the same amount. So this amount should be the same. So if we refresh that, there should be no change, it should still be the 35 eight. And then if we go back over to this report, we should see this one, once we refresh, it’ll show up over here. So I’m going to say refresh this report showing us the detail for the unrestricted categories. There’s the rent, there is totally an EPA 35, eight, we’ve got the 14 320 and the 716 zeros.

08:34

And so that should tie out to our worksheet over here in Excel as well. So if we take a look at Excel down here, we’ve got the rent to 14, and the 7160. So that looks good. So let’s go back on over it. Now I’m going to go back over and I’ll delete this so so I’m going to delete this tab. Now that I said, now that we’ve checked it, I’m going to say all right, that’s good. And then I’m going to delete this tab, say that’s good. And that’ll pull us back over to the unrestricted. Now we’re looking at the office supplies, same thing, I’m going to right click on this tab, I’m going to duplicate it, I’m going to pull the tab from the left to the right, even though they’re the same, so I don’t have to wait for that one to think. And then I’m going to go down to the office supplies, I’m going to go into the office supplies that 5000. And then I’m going to do the same thing, I’m going to right click on the tab up top duplicated, pull the tab from the left to the right.

09:28

And so we don’t have to wait for it to think and then I’m going to go into these and do the same kind of format. So I’m going to go into the 4500 here. And then same type of format. Now I’m going to add our our columns down below. And note this one, I’m going to add three more. This is a standard format, which should be easier because it’s a bill. So we have the 4500 and I can use the percent allocation. So that’s really nice. So I’m going to say okay, add 123 see if I could do this a little bit faster. This time. This one’s gonna be five 300 for the account, this also 5300 for the account, and then this one also 5300 for the account. And then we’re going to say that the categories are going to be 100, tab, and then this one’s going to be 200, tab, and then actually didn’t pick up 200, down tab. And then this one’s gonna be 300, and then down, tab, and then 400. And down tab, Art 4020 2020.

10:36

And then we can allocate our percentages, which we see right here. So that’s why I kind of put them in the tag. So now I can with this form, I could just say, Alright, this is going to be 40. And then it should do the allocation for us, which is really nice. So 20. So all the normal kind of forms should do this allocation in a very nice way. And again, this is something that other software’s don’t typically have, it’s not geared specifically for not for profit organizations. Let’s go ahead and submit that and see what we have there. So I’m going to say Submit. And so I think that is good. Now before I close it, I’m going to go to the prior tab, I’m going to refresh it, let’s refresh this and it should have that one line item change to four now. So we have that four line items, and then another one that we’ll have to do, and then I’m going to go back to this line, this one should be the same. So if I refresh this, there should be no change.

11:30

And then if I go to the first tab, and I refresh this one, we will see a new expense item appearing here. And that’s going to be for the office supplies. Now I’m going to go back to the to the tab to the right, I’m going to close it now that I’ve checked it, I’m going to do this again for the 500 to 500 needs to be broken out. So I’m going to right click on this tab, duplicate the tab, pull the tab from the left to the right, so I don’t have to wait for it to think then go into the 500 here. So we’re going to open up the 500, we’re going to do our reallocation again. So we’re going to scroll down. And once again, we have a payment.

12:08

So it should be an easy kind of breakout for us to be making. So I’m going to say one, two, a new rows here, three, four, so there’s four new rows, or three new rows, and we already had one there, the accounts are going to be 5300, all of them 5300 tab, next to count 53005300. And then the next account is going to be 5300. And then we’re going to say the tags are going to be 100.

12:39

Down on the arrow, enter, the next one is going to be 200 down with the arrow, enter, the next one’s going to be 300 down with the arrow and into the next one’s going to be 400 down with the arrow and enter. Then we can enter our percentages which we can see right to the right, which is going to be 40%. Here, there’s the 200, this one’s going to be 20%. There’s the 100, this one’s going to be 20%. There’s the 100. And this one’s going to be 20%. And then let’s go ahead and submit that. So I’m doing this a little bit faster here. So we’re gonna say submit, and see if it gives me any problems. So I’m going to scroll down, and then I’m going to check, I’m going to go to the second tab and say, All right, let’s before I delete that tab, I’m going to update this one. And it should break out that line item into four lines. That looks right. And then I’m going to go back to the prior tab. I’m going to refresh this one, but there should be no change.

13:37

What I want to note on this one, however, is that the office supplies are now at 5000. If I go to the first tab and refresh it, we should then have the office supplies at the 5000. So I’m going to refresh that. And there’s the 5000 total breaking out 2000 111 breakout, that seems right checking out our Excel worksheet. For this applies we to 111 and the 5000 total. So that looks good. So now I’m going to do the next one, I’m going to close this one back out to the right, I’m going to close this back out. We’ve done this. So I’m going to close this one back out. And now we’re going to be on the telephone, I’m going to right click on the tab up top, duplicate the tab, pull the one from the left to the right, these two tabs at the same so we don’t have to wait for it to think. And then we’re going to go into the 6200. So 6200, we’re going to drill down on that one.

14:32

And then I’m going to right click on this tab, duplicate it, pull the tab from the left to the right, so I don’t have to wait for it to think. And then I’m going to go down and go into that 6200 This is a check type of form. So this should be a fairly straightforward one. So there’s the number we just need to break it out now so I’m going to say plus, plus plus new line, then we’ll take the amounts 5320. Next amount is going to be four 53205320, maybe hitting the down and then enter, and then or tab 5320 and then down tab. And then I’m going to say the unrestricted 100, Down Arrow tab. Next one’s going to be 200, Down Arrow tab. Next one’s going to be 300, Down Arrow tab. Next one’s going to be 400. Down Arrow and tab breaking out the percentages are going to be 40%. Next one’s going to be 20%. Next one’s going to be 20%. Next one is going to be 20%. tab. Looks good. Let’s go ahead and submit and see if it does what we expect it to do. And then I’m going to go back to the tab to the left, check it out by refreshing the screen that one line item should change the for line items.

15:54

So there it is, that looks proper, then we’re going to go back to the prior tab. No change should happen here when we do the refreshing so I’m going to refresh it anyways. And then we have the telephone after 6200. Back to the next tab. If we refresh this tab, then we should have the 6200 telephone appearing magically. So there it is, the 2480 and the 1240. Let’s check out our Excel sheet for the telephone. And it looks like I think that’s right. 1240 shipped with a telephone. Yeah. Okay, so let’s go back to the this tab to the right, close this out, closes out. And now we’re on what are we on postage, now postage. So now I’m going to make another tab, I’m going to right click on this tab, duplicate the tab, both the one from the left to the right, so we don’t have to wait for it to think going into the postage, drill down on the 12,900. Duplicate the tab, right clicking on the tab, duplicate the tab all the one from the left to the right.

16:59

So we don’t have to make it think or wait for it to think then go into that 12,900. And now we’re going to be allocating, so we’re going to scroll back down for the allocation here. So there’s the payment 12,900. We’re going to say new row, new row, new row. And then we’re going to say 5340, Down Arrow tab, and then 5340 Down Arrow tab. And it might be easier to tab all the way through actually I’m wondering, and then 5340 Down Arrow tab. And then we want the unrestricted is going to be 100. Down Arrow, tab, tab, tab, tab, tab, tab, tab 200, Down Arrow, tab, tab, tab, tab, tab 300, Down Arrow, Down Arrow, tab, tab, tab, tab, tab, tab, tab 400, Down Arrow tab. And then we’re going to break out the percentages which are going to be 40%, tab, tab, tab, tab, tab, tab 20%.

18:00

That’s a 320 percent tab, tab, tab, tab, tab, 20%, tab, tab, tab, tab, tab, and 20. And then we’re going to go ahead and submit that. So we’re going to submit and then go back to the prior tab. And then we’ll refresh the screen here and see if that one line item turns into four line items as would be the expectation and it does, then we’re going to go to the next tab over we’re going to refresh that screen. And we’re going to see that the postage down here does not change because we didn’t notice the 12,009. Then we’re going to go to the next tab, we’re going to refresh that screen. And then we should see the post office appearing magically once again. Right there. So they’re in the 12,009 times out to the other tab 5160 and a 2580. Let’s check that to our Excel worksheet, post office, the post office printing and postage 512 to 580. Is that what they were? I think it’s I think so. Yeah. Okay.

19:02

So then we’re going to go back to our first tab closes out, close this out. Then we’re going to duplicate this one, right click and duplicate, pull the tab from the left to the right. Next one we’re going to be on is the utility. So we’re going to go into the utilities. We’re going to then duplicate the tab, right click on the tab up top duplicate, pull the tab from the left to the right. And then I’m going to go into this item it’s going to be a check. So this would should be as nice easy, straightforward one to do. So we’ll go into it. If it lets me click on it. There. It’s gone. It’s thinking I’m just rushing it. So there’s the 91800. So I’m going to add 4123 columns. Then I’m going to save the account 5360 down tab, tab, tab, tab, tab, tab, tab and then 536 zeros Down Arrow, tab, tab, tab, tab, tab, tab, tab, and then 5360, Down Arrow tab. And then I’m going to go over to the unrestricted, we’re going to say 100, Down Arrow, tab, tab, tab, tab, tab, tab, tab. And then 200, Down Arrow, tab, tab, tab, tab, tab, tab, and then 300, Down Arrow, tab, tab, tab, tab, tab, tab, tab, and then 400, Down Arrow tab. And then we’re going to add the percentages, which are going to be 40%, tab, tab, tab, tab, tab, tab, 1%, tab, tab, tab, tab, tab and 200%. And then one more app, the 20.

20:41

Alright, let’s go ahead and submit that one. And then we’re going to go and see in the in the next tab, let’s update and refresh. See if that one line item turns into four as would be the expectation. And so there it is, the expectation has been fulfilled. And then we’re going to say the refresh of this screen. And and we’re going to say utilities didn’t change. So there it is that the nine one. And then if we go to the next screen over and we refresh it, we should see utilities magically appearing once again. So utilities magically appears. And there’s the nine one timeout, the 3640, and the 1820. So the 3640 and the 1820 for the utilities there and veter. All right, I think everything’s working as it should be. So I’m going to go back to the tab to the right, I’m going to close it, I’m going to close this one. And then I’m going to right click on this one and duplicate it again, and then pull the one from the left to the right. So we don’t have to wait for it to thank and then we’re down in the provision.

21:44

Now this one’s going to be a journal entry. So this one’s going to be a kind of a Messier right, because as you’ll recall that it was a little bit finicky, a little journal entry thing was a little bit finicky last time. So what I’m going to do this time, so it doesn’t, so it doesn’t get get get upset, is I’m going to put the debits on top and, and so we’re gonna have to reenter this, this allowance and put that on the bottom. So what we need is for line items, and then put the allowance on the bottom. So So to do that, so I’d like to add another row. So I’m just going to put like another hundred here in the debit. And that allows another row to happen. So now I’ve got 1234 rows, and I want 1234 actually want one more, so I’m just gonna put 100 here, and debit. And now I’m going to put the credit on the bottom now. So now I can start with the credit. So I don’t kind of lose that one, I don’t have to reenter it. So I’m going to put the credit on the bottom and say that’s going to be the 1102. So if the 1102.

22:47

And these are all going to be unrestricted, so it’s going to be unrestricted. And then I’m going to put the credit at the 21 600. All right, so now we can put all the debits on top, which are going to be this 5410. So I’m going to then put in all the accounts. So this one’s going to be the debit of 54110. And then this one’s going to be the debit of 5410 and down tab, and then this one is going to be 5410. So we’re going to pick that one up. They should all be unrestricted, so unrestricted, unrestricted, unrestricted, this should be unrestricted. And so we’ve got 1234. And then this is the fifth one. So that looks good. So now we’re going to say that the fund should be unrestricted, we have the tags are going to be the 100. I’m going to say down and enter. The next one’s going to be 200. I’m going to say down and enter. The next one is going to be 300, we’re going to say down and Enter. And the next one will of course be 400. So we’ll say 400. Down, down and Enter. And then we’ll pull out the trusty calculator.

24:13

So trusty calculator, and the huge calculator covers the whole screen and we’ll make it a little smaller here. And then we’re going to say that we want the the 21600 times point four To start off with, that’s going to be the 8640. So I’m going to say all right, this one needs to be 864 zeros, so we’re gonna say 8640. And then we’re going to go back to the trusty calculator and say 21600 times point two, and we got the three, we got the 4320. So this one’s going to be the four three to zero, and then this one’s going to be four three to zero. And then this one’s going to be For three to zero, and so there’s that.

25:04

And then the credit is still at the 21. Six. So that looks good. So all we did was basically break out the debit amounts. But to do that, we had to push this one to the bottom. And you’ll recall last time i, you may experiment with this, because, I mean, technically, you could put the credit on top, and it shouldn’t matter unless the software gets a little bit finicky. So last time, we had a boy column up top, and the software got a little finicky on it, and it, it recalculates, we had to go back into it. So the safest thing would be to reconstruct this thing. So you have the four debits on top like this, and the credit on the bottom. Alright, so then let’s go ahead and record this, we could, let’s go ahead and record it, we’re going to say post that. And then we’ll go back to the prior tab. And it looks like I deleted this item.

25:58

So I’m going to go in, I’m going to, I’m going to click on it, and that should see our four items there. So that looks good. I’m then going to go back to this report. And we see the 21 six. So that looks correct. I’m going to go back to the to the prior reports. And then refresh that one, let’s refresh the screen, we should see another account populating down below which is going to be the provision. So there it is. And it adds up to the 21. Six that looks right, the 8640 and the 4320. So let’s go back to excel and just double check that 8640 and the 4320. All right, everything’s looking good, everything’s looking good. Let’s go back to the last tab, delete that one, we’ve got one more with a depreciation, which is another journal entry.

26:42

So it’s another journal entry. So it’s gonna be another one of those kind of, kind of touchy ones kind of, you know, and then we’re going to go into this journal entry, we can’t use the percentages here, like, like we like to use, so but that’s okay, I’m not going to duplicate the tab again, I’m going to go right into the journal entry, and this, and then we’re gonna have what I want to do, we got the debit and credit, I want to move this credit to the bottom and put that in there first. So I can keep that 4400 in place as I adjust the accounts up top. So to do that, notice, I can’t just add another account down here, I can’t add another line item without it needing to be there. So that’s why I’m putting this 100 I’m saying all right, 100, I’ll just put 100 there. And then I’ll just put another 100 here, just to get another couple lines. So now I’ve got 1234, that’s going to be our debits for debits.

27:33

And then the credit is going to be over here is going to be that 4400. And I want this one this account to be the 1520, which is the allowance. So all I’ve done is just pull this one did push this one down to the bottom. And now these numbers are now irrelevant, right? This number is now irrelevant, this numbers irrelevant, this number is irrelevant. And we’re going to break out the debit here. So we’ve got that for 400. Now we’re going to break out the four debits. Let’s do that systematically. Now I want the debit accounts to be the 5430. So I’m going to put in in this one, I’m going to say this one needs to be 5430. And then we’ll say down tab and then this one needs to be 5430 and then down tab and then this one needs to be 5430 and then down tab, then we’re going to add our tags 100, down tab, and then this one’s going to be 200 and down tab and then this one’s going to be 300 and down tab and then this one’s going to be 400, down and tab, then we’ll break out the good old calculator.

28:50

And the huge calculator says here I am here I’m a huge calculator. And then we’re going to say this is going to be the 4400 times point four. And that’s going to be the debit up top, which is going to be the 1760. And then we’re going to say that the 4400 times point two is going to be the ad so we’re going to say this won’t be eight zero, and then this one’s going to be eight, zero, and then this one’s going to be eight, zero. And now if we go down the debits equal the credits, so now I’m just going to copy the little note that we have here. So the adjusting entry, adjusting entry, adjusting entry, adjusting entry, adjusting entry and adjusting entry. So that should do it. So I think that looks good. So let’s go ahead and it says it says the restricted one of them is restricted. They should all be unrestricted. They should all be unrestricted. Let’s change that. All right, they all go to the unrestricted category.

30:01

Okay, so no red things, no red things debits and credits are equal. So let’s go ahead and post it, post it out. Alright, that looks good. Let’s go to the prior tab now. And then let’s go into that depreciation, see what happens with it, there’s the four line items. Let’s go back on over, we’re at 4400. Let’s go back to the prior tab, and then refresh it depreciation should magically appear at the bottom, which is just miraculous. So there it is. And now we have the 4400 total, the 1760 and the 80. Let’s check that to our Excel worksheet over here. So that looks right, it looks correct there. Now the total on the Excel worksheet is the 321 260. So that tie out 321 260 here, and if we go back on over here, then we of course, have the total expenses 321 260. So that’s our objective, right?

30:59

We’re going to say, All right, here’s the restricted items. Here’s the unrestricted, here’s the total expenses, they’re going to be broken out first by their nature, like you would normally see them. And then the question is, well, how are they broken out by function? What are they used for programs versus admin and fundraising, if we go back on over, okay, here it is programs versus the admin and fundraising. And also note that an alternative we might experiment with is with this report, what people are really looking at, it’s kind of like the ratio, oftentimes, of the expenses here for the two programs, versus the ratio of the admin and fundraising, because these two are what you’re supposed to be spending the money on. And, and that’ll give you kind of like an idea of how efficient the organization is. So you could then say, well, maybe I should have another subtotal. And here, it might make the report longer.

31:50

But people might want to see the subtotal of the total programs, so that they can then compare that to basically the admin and or the expenses. So to do that, you could use sub tags, right, so we can think, think about the idea of sub tags. But in any case, we’ll then check out our numbers here, we’ll say that, let’s just compare these to our Excel worksheet. Now we’re gonna say 128 504, and the 64 252. So education, 128 504 and the 64 55252. So that looks right, everything looks like it’s going to be tying out here. So we’re going to make some of these reports will be available for you in our in our check sheet so you can kind of check with them if you have the checking worksheets for that. And that’s going to be it for now. Let’s get out of here.