Corporate Finance PowerPoint presentation. In this presentation, we will give an introduction to ratio analysis. Get ready, it’s time to take your chance with corporate finance, Introduction to ratio analysis. So once we have the financial statements, then we want to think about how best to use those financial statements for decision making purposes. So remember, then the two primary financial statements being the balance sheet and the income statement, we can think of them answering primary questions that a user of the financial statements may have, such as an investor or someone who’s thinking about investing into the company may want to know where the company stands as of a point in time, that once again, is the balance sheet.

Author: Bob Steele CPA - Accounting Instruction, Help & How To

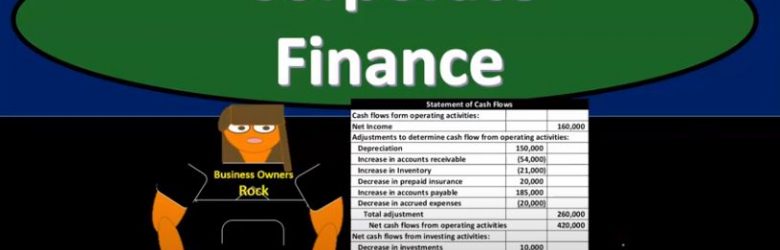

Statement of Cash Flows 235

Corporate Finance PowerPoint presentation. In this presentation, we will discuss Statement of Cash Flows Get ready, it’s time to take your chance with corporate finance statement of cash flows. So remember when we’re thinking about the financial statements, we can think about them as answering two major questions to users of the financial statements. For examples, if we’re thinking about investing to the company in some type of way, and are using the financial statements to help us make a decision with regards to that, we want to know where does the company stand at this point in time, what’s basically their worth at this point in time. For that we get help from the balance sheet, which is going to give us the assets liabilities, equity, assets, minus liabilities equals equity, which is basically the book value as of a point in time.

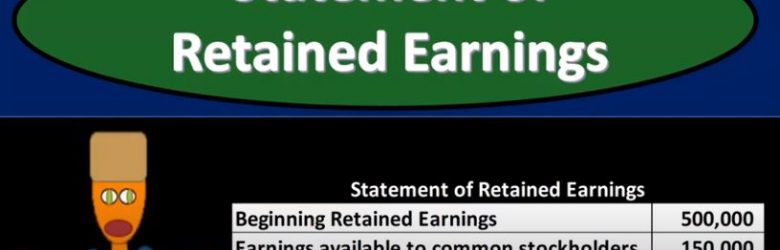

Statement of Retained Earnings 230

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the statement of retained earnings Get ready, it’s time to take your chance with corporate finance statement of retained earnings. So remember that as we think about the financial statements in total, the financial statements are basically answering questions that users of the financial statements would have. So for example, if we were thinking about investing into a company, the financial statements would help us answer the question as to how does the company stand at this point in time? How does the company look from a financial standpoint at this point, that is the balance sheet, the balance sheet gives you the assets, liabilities, equity, assets minus liabilities, being basically the book value being basically where the company stands at a point in time.

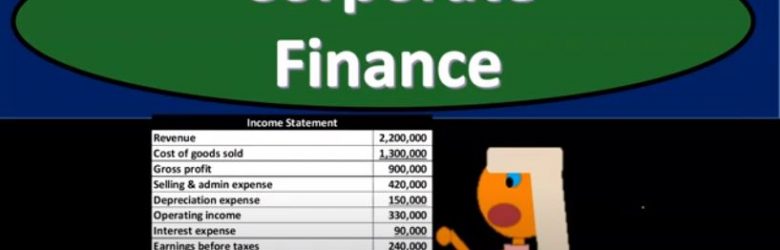

Income Statement Overview 225

Corporate Finance PowerPoint presentation. In this presentation, we’re going to continue on discussing the income statement. Get ready, it’s time to take your chance with corporate finance income statement continued. Remember that as we think about the financial statements, we can break them out into basically two objectives that an investor might have the investor would want to know two general things one, where does the company stand at a point in time with their approximate value as of a point in time? And two? What is the likelihood of their performance in the future? What how well, will they do in the future? How can we predict how well they will do, we’re going to base it on past performance. So the point in time statement is going to be the balance sheet. So remember, if you’re looking at financial statements, for the year ended, say, December 31, the balance sheet will be as of a point in time and therefore as of December 31, it will not be a range. Whereas if you’re looking at a time frame, meaning the beginning to the end of the period, so if you’re looking for financial statements for the period ended, or the year ended, December 31, then the income statement, the primary timing statement, will be represented, it’ll say January through December or for the year ended December 31.

Income Statement Overview 220

Hello in this presentation we will discuss the income statement objectives. At the end of this presentation, we will be able to describe what an income statement is list the parts of the income statement and explain the reasons for an income statement. First, we’ll start off with a question we’ll which will explain the timing of the income statement or introduce us to an explanation of the timing of the income statement? And that is the question of asking somebody, how much do you make when we work through if we were to ask somebody how much they make? They would mentally make some type of assumption in order to answer that question, or they would ask you the question if they chose to answer at all. The question, What do you mean? Do you mean per month? Do you mean per year? Do you mean per week? And this is going to be something that needs to be answered in order to answer the question.

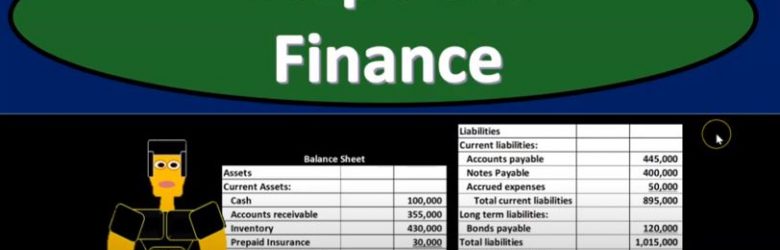

Balance Sheet Continued 215

Corporate Finance PowerPoint presentation. In this presentation, we will go into more detail about the balance sheet. Get ready, it’s time to take your chance with corporate finance, balance sheet continued. Remember when we’re thinking about the financial statements, we can break them out to two separate objectives. If we’re considering this from an investor standpoint, that is, where does the company stand at a point in time, and what’s the likelihood or their earnings potential in the future, which we will typically based on past performance, therefore, you’re going to have the timing statement and the point in time type of statement. So when we think about the balance sheet, that’s going to be the point in time type of statements. So if you’re looking at the financial statements for the year ended December 31, the balance sheet will be as of the end of the period, in this case, December 31, as opposed to the timing statements, which are going to be the income statement being the primary statement that should come to mind measuring performance, which will be as of January through December 31 measure and how well we did for that range of time. So our focus over here is going to be on the balance sheet.

Financial Statements Overview 205

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview of financial statements Get ready, it’s time to take your chance with corporate finance, financial statement overview, the financial statements will be the primary tool that will be used to value the company, the financial statements are going to be generated from the company.

Financial Markets 130

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial markets Get ready, it’s time to take your chance with corporate finance, financial markets, financial markets help to provide indicators for maximizing shareholder value. So when we’re thinking about financial markets, we’re thinking about markets. In general, we’re thinking about purchasing and selling things, a place where people purchase and sell items, that means there’s competition, there’s different people competing within a market, that will typically lead to better information about the value of the items being sold.

Financial Management Goals 125

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial management goals Get ready, it’s time to take your chance with corporate finance, financial management goals. Now, as we’re thinking about the financial management goals, we’re thinking about corporate finance, we’re typically thinking about a corporate structure. So management, how does management fit into the structure of a corporation, the owners of the corporation are going to be the shareholders of the corporation. So if you think about a large corporation, then you’re thinking, well, the shareholders shares are trading all the time, possibly on an exchange for a large corporation.

Types of Business Organizations 120

Corporate Finance PowerPoint presentation. In this presentation, we will discuss types of business organizations, including the corporation, partnership, and sole proprietorship Get ready, it’s time to take your chance with corporate finance types of business organizations. Now, as we go through here, note that we’re focusing in on corporate finance, and therefore on the corporate type of business organization, but many of the concepts that we will learn will be applicable to all types of business organizations. Therefore, we want to have a general idea of the different main kind of components or main types of business organizations. So those will include a sole proprietorship, partnership, and a corporation.