Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial management goals Get ready, it’s time to take your chance with corporate finance, financial management goals. Now, as we’re thinking about the financial management goals, we’re thinking about corporate finance, we’re typically thinking about a corporate structure. So management, how does management fit into the structure of a corporation, the owners of the corporation are going to be the shareholders of the corporation. So if you think about a large corporation, then you’re thinking, well, the shareholders shares are trading all the time, possibly on an exchange for a large corporation.

00:37

And that’s one of the benefits of the corporate structure is that you have those standardized units, and they can be traded, that means that the ownership of the corporation is actually changing hands all the time for a large corporation that’s, that’s publicly traded. So how do they tie in then to the corporate structure, or to the management and decision making process, you might think, so note that when people are trading stocks on the exchange, that they’re trading stocks that aren’t typically being issued from the company, they’ve already been issued from the company, they’re trading the stocks amongst themselves, therefore, they’re just trading the ownership amongst themselves, it’s not being issued new stock from the company, most of the time, when you think about the trades that are going to happen on an exchange.

01:22

So management of the organization, even the top management all the way up, the CEO and the CFO are going to be beholden in some way, shape or form to the owners of the company, they’re acting as agents, they’re acting as agents, just like you would in an organization, if you were an employee, then you’re supposed to be acting within that role as an agent of the ploy and of the company in acting in the company’s best interest, the same is going to be true all the way up to the top of the organization, the CEO should be acting in the best interest of the company, what’s the best interest of the company, the shareholders, the shareholders the benefit, that’s the point of the company, so they should be acting in the best interest of the shareholders acting as agents of the shareholders? Well, how does that work, you’ll recall that the shareholders will basically be able to have voting power. So they’ll typically vote for the board of directors, you can think about this similar to like an election process in a democratic country or something like that you vote for a representative.

02:23

So they’re going to be voting for the board of directors, the Board of Directors, then it’s going to be responsible for hiring management. So they’re going to be hiring management that because they’re the representatives of the owners, the shareholders, the management then, is responsible to to report vent to the board of directors. And that’s how that’s how the structure is going to work, typically within a corporation. So once again, that means that the management of the corporation are going to be agents through acting as agents just like any employee all the way up to the top, they’re acting as agents that are that are working for the best interest of the owners of the company, that’s going to be the shareholders of the company. So what does that mean? What what are the owners of the company going to want? They want, they want to maximize owner or shareholder wealth. So they obviously the reason, if you’re talking about people that are purchasing and selling stock or owning a company, then what do they want from that stock, they want to increase their wealth. Now, what’s the normal way that you would increase the wealth within the company, you would maximize profits.

03:31

So if you’re maximizing profit, that could obviously increase the value of the company. And it could also be a performance measure that would indicate future performance as well. But note that the maximizing the profit isn’t the only factor that people will look at, although it’s going to be one of the main factors, of course, that people will be looking at when they’re valuing a company, because they’re looking towards growth, they’re looking towards future valuation. But you can think of situations where maximizing profit may be a result of doing things that are maximizing profits in this period, that may actually be harmful to future periods. And if the investors of the company perceive that, then they might even though see, they see maximizing of profits in the current period, perceive that in the future, they’re doing things that are going to be harmful for the long run. And that could be bad for the shareholders wealth overall, because the value of the company is going to be dependent on what the market thinks the value of the company is, because there’s two ways that the shareholders wealth could be increased.

04:34

One is if there’s a maximization of the profits and they’re collecting basically on those profits in the form of dividends or something like that, and the other is the valuation of the company increasing because at the valuation of the company increases, then they can sell those stocks if they if they choose to, at a gain. So if the company is doing things that are actually decreasing the perceived value of the company, while still maximizing profits, Then the actual wealth of the organization of the owners could go down. Because it could be thought that the maximizing of the profits in the current time period is at the expense of the long term goals of the organization or the maximizing of the profit in the long term. And that could decrease basically the perceived value of the stock itself. So then how, how would we do that? How are we going to achieve these goals? How will we maximize the owner shareholder wealth?

05:28

Well, we’re looking to obtain the highest value of the company possible. So we want to have the valuation of the company, what’s going to be the ultimate measure of the valuation of the company, the market, the market is going to be valuing the company. So that’s going to be the ultimate valuation measure. Now, one of the driving factors will then be the maximization of profits. So we want to obtain the highest profit possible, because that’s going to be an indication of the wealth of the company at the current time period, it’s going to increase the wealth of the company, which is going to have that increased the value of the company. But it’s also a performance indicator into the future. And when you’re thinking about a market valuation of the company, they’re really they’re looking into the future, they’re trying to value what the future performance of the company will be. One indication of that, of course, is the past performance of the company, maximizing profit problems and concerns.

06:21

So note that the goal of maximizing profit is not always as easy as you would think one of the problems with it is an increase in profit could result in an increase in risk. So the items that are the areas where you’re looking to get the highest rate of return, also has basically an increase in risk. So whenever we’re thinking about the profit, we also have to take into consider the risk reward type of analysis, then we have simply maximizing profit may not take into account timing issues related to benefits. So if we maximize profit, this is a common problem. In large companies, when you especially if there’s like management turning over and whatnot, then there’s going to be a constant emphasis for the increase in the profits in the current time period to have a nice smooth up crease in the profits, because that’s what people want to see.

07:11

Because that would indicate that you’re on on basically an upward trend. However, it’s possible for things to be done once again, that could benefit the current time period, that could be at the cost of the future time period, for example, things could be done, if you have goodwill in the company, if you have a good brand name and the company that people trust, it could be possible for someone to basically increase the profit in the short run by basically producing possibly inferior goods that are still sold at higher prices, due to people’s brand name, loyalty. And that could increase the profit in the short run. And you say, well, they’re doing great, but you can’t really take that out into the future, because what they’ve really done is they’ve consumed one of their assets in order to generate the profits in the short run, that being their brand name. So you can’t really project that into the into the future, right. But in the same fashion that you might, you might be able to do to do under normal circumstances.

08:08

So that so the tendency for the pressure, for profit to be going up in the short run could lead to situations where there’s going to be things that could increase the tactics will be taken, that will increase the profits in the short run at the expense of possibly future periods. And the market should be future focused. So when you’re looking at the stock market that’s thinking about which companies to purchase and sell, then they’re usually thinking about the valuation in the company in the future. And that’s what they’re looking at with regards to the profit in this time period should be a reflection of hopefully the earning potential in future time periods. So measuring profit accurately can be difficult. So notice, we’re going to talk about different methods for measuring profit, we’ve got the accrual method, and you can you compare and contrast like an accrual method and a cash based method.

08:58

We also sometimes use, like historical costs and allocations versus fair value methods. So so the measuring of the profits can be difficult. And we also still have those timing differences that could take place. In other words, depending on the measurement process that you’re using, then the profit could be measured in one year, or it could be measured in the in the other year, you know, based on when you’re recognizing the revenue and the expenses. So that can distort when you’re comparing year over year. The comparison for year over year so the actual you would think it’d be fairly straightforward to measure the profits for one period versus another period. But those cut off especially the cut off periods, and determining you know, which profit when to cut off the profit in one period versus another can can lead to large, you know, distortions within the numbers which could cause measuring problems. Of course, the goal is to kind of standardize those types of things, so that we have some some standardization across the industries and then

09:59

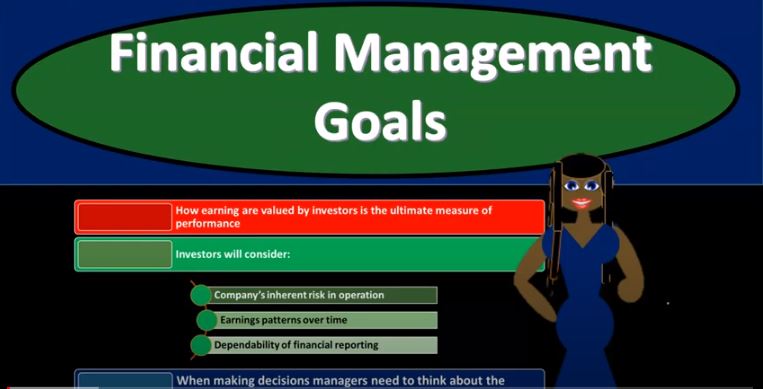

We can do comparisons based bake, comparing same for the same thing, apples to apples value approach, how earnings are valued by investors is the ultimate measure of performance. So notice when you’re thinking about the company, and this is true with any kind of valuation type of type of thing, you know, if you’re thinking about your house, what’s the value of your house? Well, the the valuation depends on the market, how much could you sell the house for? And the same thing is going to be true with the valuation of the company that when you’re thinking about what’s the value of this company? Well, if you were to sell it, how much would it sell for. And of course, if you’re talking about publicly traded companies, then that valuation is going to be easier to see because the trading of the corporate stocks are actually being done. So you can do it. So you can actually do the valuation as opposed to your home, where you only have one unique home.

10:49

And although you can try to make an appraisal on on what it would sell for, it’s still just basically an appraisal. But note that at the bottom line is when you’re trying to figure out what the value of your stock is, what the value of what you have is, whether it be stock or home or anything else, the real value will depend on what it could what people perceive the value to be in a market. So that means so we have to keep that in mind when considering our approach for management. So investors will consider when they’re considering this valuation of a company, the company’s inherent risk and operations. So in other words, some companies are just more inherently risky than other companies. So there might be some kind of risk that’s just part of just part of a nature of the company and maybe the company’s in an industry that’s more volatile, it goes up and down, based on based on conditions in the environment, less so than other companies that might be kind of more stable type of companies. So that’s something that management doesn’t have any control over the inherent risk.

11:50

Although they can then once they recognize the inherent risk, they can take steps to mitigate the inherent risk that they are now are aware of. And then we have the earnings patterns over time, this is going to be one of the most clear indicators that the market is going to be looking at, they’re always going to be looking at earning patterns. Note again, when they’re looking at earning patterns, they’re looking at past earning patterns in order to predict future earning potential. And if there’s more future earning potential, then you the market, the investors will then value the stocks at a higher at a higher point than they would otherwise do. So notice the financial statements, you can think about the financial statements given value assets minus liabilities equals the net value of the company. But really, the valuation of the company is based on the market.

12:37

And the market is going to be taken into consider multiple factors, including the financial statements, not just the balance sheet assets minus liabilities being the net value, but also their perception of what kind of future earnings percent potential is there within the organization, and therefore the valuation could be higher, of course, then simply the net assets that would be represented on the balance sheet. So when making decisions, managers need to think about the impact of overall valuation. So when management’s making decisions, and you know, there’s a tendency, again, for management to have pressure for short term decisions, short term performance revenue numbers, in the next quarter, and so on and so forth. But from but management also needs to think about and take a step back and look at the long term valuation, because they want to make sure that they are actually actually creating wealth over the long run, which is to increase the value of the company, basically, over the long run not in other words, to be tried to try to increase revenues, this time period at the expense of revenues that would otherwise be earned, and possibly increase revenues over a longer period of time.