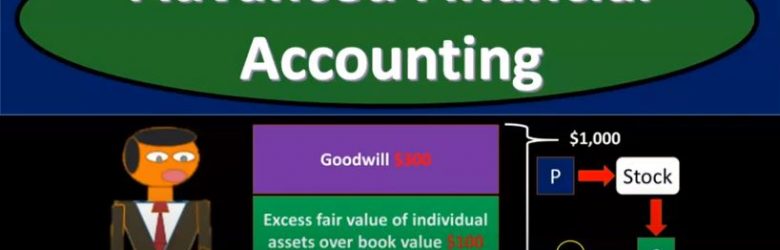

Advanced financial accounting. In this presentation we’re going to talk about the consolidation process with a differential we’re going to look at the component parts with a simple example a simple calculation, you’re ready to account with advanced financial accounting, consolidation with differential example. So here’s going to be the basic scenario for many of the practice problems we will be looking with. We have P and S, there’s going to be a parent subsidiary relationship in which we will be making consolidated financial statements. How did this situation take place what constituted this situation, we’re going to say that in this example, P is purchasing the stocks of S. So notice they’re purchasing the stocks of s and therefore negotiating the stock price, which we’re going to say is $1,000 here. Now to simplify this example, you first want to think about this as p purchasing 100% of the stock of s for $1,000. And then once they have control, anything over 51% would then be controlled.

Author: Bob Steele CPA - Accounting Instruction, Help & How To

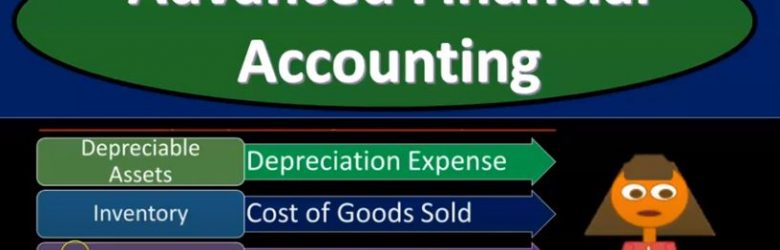

Consolidation When There is a Book & Fair Value Difference

Advanced financial accounting. In this presentation we’re going to take a look at a consolidation process when there is a book and fair value difference. In other words, we’ll have a consolidation. We have two companies, we have a parent subsidiary type of relationship, and the parent has a controlling interest of the subsidiary. Therefore consolidation is what we’re going to be doing. That means we’re going to take two separate sets of books combine them together as if they were one. And we had some complications with the fact that when the purchase took place, there was a difference between the book value and the fair value, what will be the effect of that difference on the consolidation process, elimination entry example. So when we consider this difference, we want to think about what’s going on with the parents books and the subsidiaries books and then what would be the process to consolidate them and what type of problems would be caused if there was a difference between the book and fair value of the net assets so the parents books investment accounts starts out containing the acquisition costs at the fair market value of net assets and goodwill, so we have, that’s basically what’s going to be on the parents books, right. And we’re thinking here typically have an equity method being used. So we have the parents books, we have the subsidiary books that we’re gonna have to consolidate together, and then do our elimination entries. And on the parents books, you’re accounting for the subsidiaries.

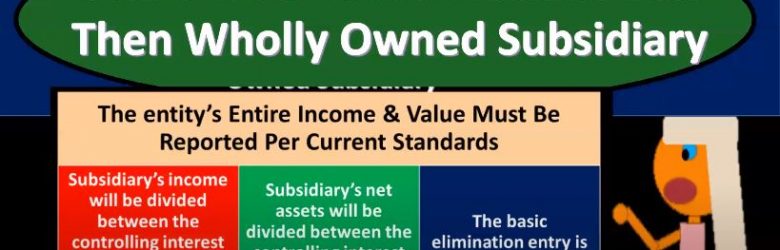

Consolidation Calculations Less Then Wholly Owned Subsidiary

Advanced financial accounting. In this presentation we’re going to talk about consolidation calculations for less than wholly owned subsidiaries. So we have a parent subsidiary relationship, we’re going to be looking at the consolidation process to put the financial statements of the parents and the subsidiaries as if they are one entity, but we don’t have a wholly owned subsidiary. In other words, the parent does not own 100% of the subsidiary. How do we do the consolidation? in bad case, consolidation calculations less than wholly owned subsidiaries, that entities entire income and value must be reported per the current standards? So in other words, once again, we might think, well, on the income statement, maybe we would just report the part of the subsidiary that belongs to or is controlled by the parent, but that’s not typically the case. That’s not the case under generally accepted accounting principles.

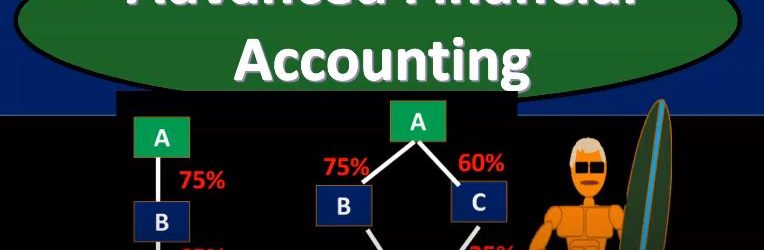

Direct & Indirect Control

Advanced financial accounting. In this presentation we’re going to talk about the concepts of direct and indirect control. If you’re ready to account with advanced financial accounting, we want to consider these concepts within the context of financial statements and consolidation. So you’ll recall that when we have consolidated financial statements, the idea is to put two financial statements together when one company has basically control over another company that being defined typically by having more than 51% interest because if you have more than 51%, then you have basically a voting share for you to vote on anything, then of course, you would win the vote at that point in time. So let’s consider then direct control and indirect control direct control when one company has a majority of another company’s stock common stock. So that would be a situation where you got a and b, one company has a majority interest over 51% control is pretty easy to see at that point. When you start to get into indirect control. This can get more complicated things can get more confusing here. So indirect control, one company’s common stock is owned by one or more other companies that are under common control. So this can get a lot more detailed structure in terms of what is going to constitute control. So for example, if we have direct control, then you have just simply a parent subsidiary type of relationship. And, you know, the parent has more than 51% of the subsidiary, interest common stock. So and that could happen if we have to, we could still have a little bit more complexity here, where we have two subsidiaries, right. But they’re both going to be consolidated in this case, because there’s 75% over 51% direct control is parent over as one direct control over as to here because it’s over the 51%. So both of these cases would be direct control.

Consolidation for Non Wholly Owned Subsidiary

Advanced financial accounting. In this presentation we’re going to talk about a consolidation for a non wholly owned subsidiary. So in other words, we have a parent subsidiary relationship, but the parent doesn’t own 100% of the outstanding common stock of the subsidiary but something other than 100%. In other words, over 51% controlling interest less than 100% get ready to account with advanced financial accounting. Non controlling interest often will be represented NCI non controlling interest. So notice if we have a parent subsidiary relationship we’re talking about there is some controlling interest, the controlling interest is the interest that’s going to be over 51%. However, if we don’t have 100% ownership, then we have the amount that’s not in control and that of course is going to be the non controlling interest. So non controlling interest. NCI controlling interest is needed for consolidation. Obviously, if we’re going to consolidate this thing, that means typically that A parent has some controlling interest over 51% a 100% is not needed. So 100% of ownership, in other words, by one parent to the other is not necessary for a consolidation to take place control is necessary, which is typically over 51% less than 100% ownership will result in a non controlling shareholder, those other than the parent.

Usefulness of Consolidated Financial Statements

Advanced financial accounting. In this presentation we’re going to take a look at the usefulness of consolidated financial statements. In other words, consolidated financial statements taking two or more companies where there’s a parent subsidiary relationship, putting them together representing financial statements as if those entities were one entity. What are the pros and cons of using consolidated financial statements? Get ready to account with advanced financial accounting idea of consolidated financial statements? In other words, why did we come up with the consolidated financial statements? So remember, we’re talking about a situation where there’s a parent subsidiary relationship, there’s a controlling interest, we have one company that has a controlling interest in over 51 interest in the other company. And then we’ve come up with this concept of showing the Consolidated Financial Statements showing the entity the parent and the subsidiary entities of which there’s a controlling interest as if they were one entity. Why do that? So when company creates or gets controlled Another company, that’s going to be the scenario we have. So we have a parent subsidiary relationship due to that fact due to one company having control than another company. You can think of that, of course in a stock situation owning for more than 51%. The result is a parent subsidiary relationship. So if we just have the two entities, it would look something like this.

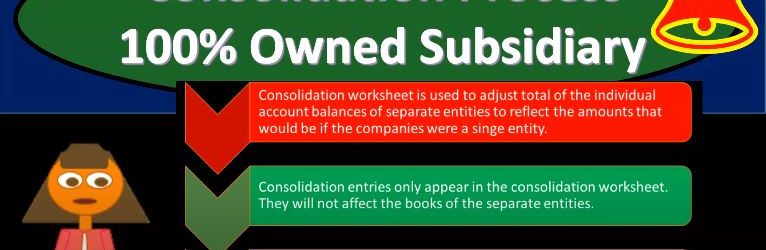

Consolidation Process 100% Owned Subsidiary

This presentation we’re going to take a look at the consolidation process for a 100% owned subsidiary. In other words, when we’re thinking about one company owning another company in advanced financial accounting, we’re usually looking at the situation and spending most of our time where we have some kind of consolidation process. So we want to Vin take the consolidation process and look at it in levels of complexity. So we’re going to start with a level of complexity, that’s going to be an easier setting where we will have 100% owned subsidiary, and then we’ll go from there and add more complications to it. Get ready to account with advanced financial accounting to ownership and control and prior presentations, we took a look at different methods based on different levels of ownership and control. We said in general, if we had zero to 20%, we use the carried value and then 20 percents kind of an arbitrary number, but if we’re over that amount, we’re really looking at the term of significant influence it for over the 20% from 20 to 50% then The assumption is that we would be using the equity method because the assumption would be if over 20% unless spoken otherwise, unless some unreal, some reason, otherwise, we would then have this significant influence and therefore be justified to use the equity method. And then if you’re over 51%, then you may have the consolidation. Now, when we think about these two methods that they carried value in the equity method, we can basically explain those as we go, you know, if you got anything from zero to 20%, then we could just basically say, yeah, then you fall into this category, let’s talk about the accounting in general.

Foreign Currency Transactions

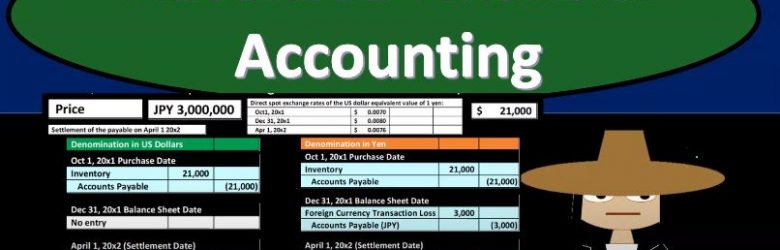

Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss foreign currency transactions get ready to account with advanced financial accounting, foreign currency transactions. So remember when we’re thinking about foreign currency transactions, we’re thinking about them from the perspective of the US company in US dollar. So we’re have our currency that we’re making our financial statements in, we’re measuring all the stuff on our financial statements with the measuring tool that we need to be using, that’s going to be the US dollar, that’s going to be our standardization. And then anytime we have foreign currency transactions with something other than US dollars, then we want to see them from that perspective, right? Because when we put them on our financial statements, just like anything else, just like inventory, if we were to value units of inventory, or to value stocks and whatnot, we need to value them in terms of our measure into a which of course is the US dollar.

Foreign Currency Exchange Rates

Advanced financial accounting PowerPoint presentation. In this presentation, we’re going to discuss foreign currency exchange rates get ready to account with advanced financial accounting, foreign currency exchange rates, let’s first define foreign currency transactions. So what are from foreign currency transactions? When are we going to need to account for foreign currency transactions. So from our perspective, we’re going to be looking at this from the perspective of a US company US company that is having their books then accounted for or measured in dollars. And when you think about the foreign currency transaction, it’s just like anything else, but it can be a little bit more confusing. So you want to remember, of course, that the dollar is basically the measuring tool.

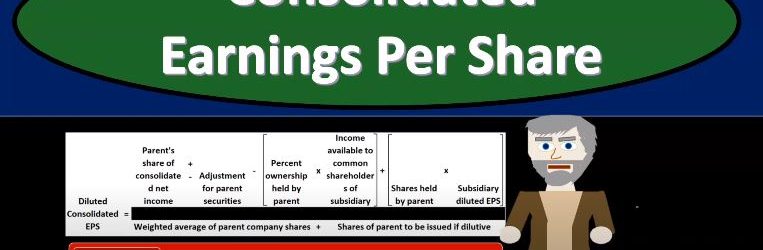

Consolidated Earnings Per Share

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated earnings per share, get ready to account with advanced financial accounting, consolidated earnings per share, how do we calculate the earnings per share for a consolidated entity, the basic calculation for the earnings per share will in essence be the same as for a single Corporation. So there’s not too much difference between the consolidated earnings per share calculations and the basic earnings per share for one entity one Corporation. So the basic earnings per share is is computed by deducting income to the non controlling interest and any preferred dividend requirement of the parent from the consolidated net income. So we’re going to take the net income and then we’re going to deduct income to the non controlling the non controlling interest and any preferred dividend requirement. In other words, we’re going to take the consolidated net income and then remove or deduct income to the non controlling interest and and in preferred dividend requirement, then we’re going to take that number, the amount resulting is divided by the weighted average number of the parents common shares outstanding during the period covered. So it’s a pretty straightforward calculation for the basic earnings per share, we do have practice problems on it. However, if you want to brush up on calculating the basic earnings per share, we have that there. diluted consolidated earnings per share is going to be a more complex calculation.