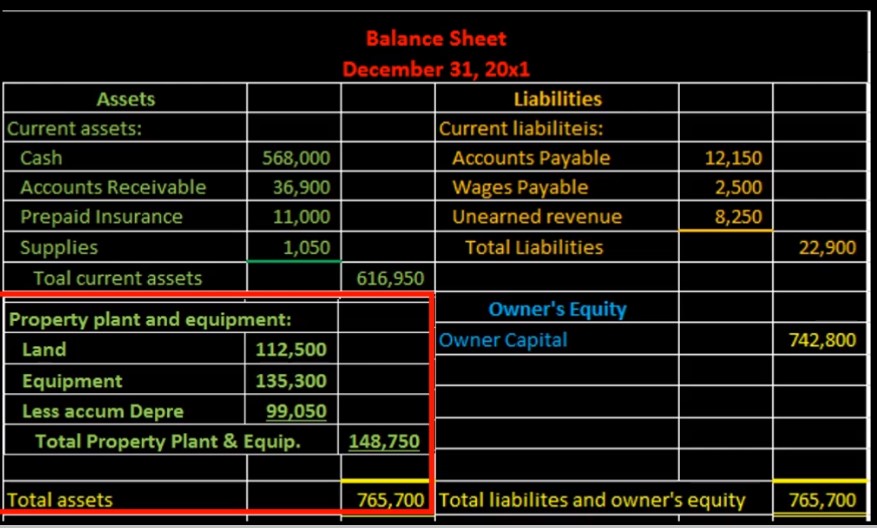

Hello in this lecture we’re going to put together the section of the balance sheet of property plant and equipment from the trial balance property, plant and equipment will be part of the assets can be the subcategory of assets, we talked last time about the creation of the current assets. And now we’ll be moving on to property, plant and equipment, which will then sum up everything for total assets. We will be picking these numbers up from a trial balance. And once we have completed all the financial statements, what we’re basically doing is taking a debit and credit format from the trial balance, converting it to a plus and minus format in terms of the financial statements, assets, equal liabilities plus owner’s equity so that people can read it even if they don’t understand debits and credits. In this lecture, we’re focusing in on this section here, which will be a land equipment and each cumulated depreciation.

00:52

So we’re going to start off with the subcategory remember that it’s going to be part of the assets we’re going into the subcategory of property, plant and equipment. Those are going to be the longer lived assets, it’s going to include the depreciable assets, assets that have a longer life. We’re going to list this out by saying property, plant and equipment, then having a colon, and then we’re going to indent so we’re going to pull in the land the first section, everything above that was in the prior category current assets. And note that we are indenting. And we’re putting it in the inner column, not because it’s a debit, but because we want to list them on the inner column and then sum them up on the outer column when we’re talking about financial statement preparation. So we’re gonna do the same with the equipment, we’re going to list that indented, listed on the Enter column. And that number of course, is coming straight from the trial balance.

01:40

Then the kind of tricky one is we have accumulated depreciation now, this is a credit balance account, even though it’s an asset, it’s called a contra asset account because it’s an asset account which normally have debit account balances, but this one has a credit account balance, contra to the norm, hence the name contra account and when we pull that over here, What that means is we’re not going to put debits and credits, we want to remove the credit factor of it. But because it’s a credit, and it’s contrary to the norm, it’s going to subtract from the normal debit balance account. So when we take it to a plus and minus format, we need to tell our reader Hey, we’re subtracting that number out, it’s gonna be a subtraction problem. We could do that with a minus sign. But oftentimes, it’s done with words, we’ll just say less this number. So notice that it does not have a credit here, we need to represent it’s a subtraction because it’s reducing the asset accounts.

02:34

Then what we’re going to do is we’re going to sum this up, and that won’t sum it up, we’ll calculate it and that’s going to be the land of 112,500 plus the 135 300 equipment mine is the 99,050. That will give us the total property, plant and equipment of the 148 750. Notice again, the format we’ve got the colon subcategory of acids, then we list the assets, we indent them, pull them to the inner column, Not because it’s a debit, but because we want to list on the Enter column. And then we’re going to sum them up in the outer column in this format, not because it’s a credit, just because that’s the format of the financial statements. Now, what we then have is the current assets we calculated last time as part of our assets, obviously, and we sum those up to the outer column. And now we have the property plant and equipment, which we send up to the outer column or calculated out to the outer column. Not exactly, it’s some because of that subtraction problem.

03:31

And be careful because that’s where the common error happens, people get this going the wrong way, and that’ll put the balance out of balance, then, of course, if we add up the outer column, we will then get the total assets. So remember, what we’re always going to do in the financial statements is not jump around, we’re not going to be jumping around from column to column when we add things up. Now that we’re down here, it’s not like we’re going to jump from this column back to this column, adding things up. We’re only adding up the outer column numbers which is total current assets plus property plant equipment, value. Give us the total assets. For as a whole at this point in time, we could double check that by adding up these accounts, we could say this plus this plus this plus this plus this plus this, minus this, the debits minus the credits for the assets that will then equal this number.

04:17

That’s how we can verify that number independently before we verify it through the double entry accounting system, which is, of course, assets that we have figured out equaling liabilities plus owner’s equity, we want to check them have many checkpoints as we go to make sure that we know what’s going on. And if there’s an error, we want to be able to segment those errors so we can kind of figure out where the error is, instead of doing the whole thing over again. We will move on next time to the liability section.