This presentation we’re going to start our bank reconciliation for the first month of operations entering the deposits or reconciling the deposits for month one for January. Let’s get into it with Intuit QuickBooks Online. Now. Here we are in our get great guitars file. Let’s start off by opening up our report. So I’m going to go to the report down below, we’re going to be taking a look at the balance sheet report because we will be focusing in of course on cash. So I’m going to go up top and change the date. So we’re just going to look at the first month so Oh, 10120 to 12. I’m sorry, oh 131 to zero, so January 1 to January 31 2020. Let’s go ahead and run that report. Then I’m going to go up top to the tab up top, right click on it, duplicate that tab.

00:46

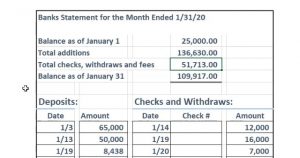

Now let’s hold down Control. I’m going to zoom in just a little bit to that one to five. I’m going to hold it close the hamburger. So here’s the checking account. Here’s our checking account. Now the process for the bank reconciliation is you want to get the bank statement. Not not a transcript of the bank’s account for a certain time period, but the actual bank statement that has the beginning and in the numbers. So this is what the bank is a mock bank statement that we have here. So we have the bank statement for the end of January, we got the beginning number, that was the end number of the prior month beginning number of this month 25,000.

01:20

Then we have the additions, deposits, then we have the decreases, which are going to be the checks and other decreases, then we have the ending balance. This indeed balanced you would hope ties into this tie into our report, but go back to our report. No, it doesn’t. Why wouldn’t it It’s as if the same date as of January 31. Because there’s outstanding deposits and outstanding checks. And probably because there’s stuff that cleared the bank which we didn’t enter we we probably made a problem and maybe the bank made a problem. Probably not. We probably have some things maybe that we that we spent on that didn’t get into our bookkeeping system. That’s why let’s fix it.

01:58

Okay, so here’s the balance. How are we going Do it, we’re going to go into the first tab, then I’m going to hold down Control and scroll back down. And we’re going to go to the reconciling item, the reconcile, and it’s going to be in the accounting tab on the bottom. Now I’ve already gone into this, so your screen might look a little bit different, but we’re going to be reconciling, you’re going to choose to reconcile, and you want to reconcile the checking account, which is the first account, that’s going to be the normal reconciliation that’ll be showing up by default, I’m going to resume the reconciliation because once again, I’ve already kind of looked at it a bit so it’ll, it’ll already have some information in it.

02:34

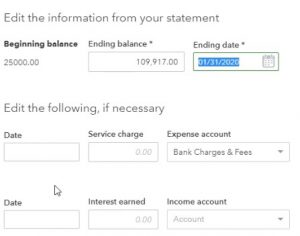

So but the next screen that you’re going to see is if I go to Edit up top is going to be something like this, you’re going to have the beginning balance which will be there by default. Notice you cannot change the beginning balance because it was in their last lap is the nd bounce the last period. This is the first reconciliate filiation we did how did that number get there? Because we put it in the opening balance section. We put it in as of the opening band Now the first bank reconciliation, you might have a problem that that number doesn’t tie into what’s on your bank statement, or you might have just zero there and nothing on your bank statement.

03:10

One way around that is to just is to just enter the beginning balance into the register, right, just like we did here, when we entered this beginning balance, we put the other side we increase checking account, we put the other side to equity, or we put it to the right or we put it to the prior year, that rolled into equity. So you could do that you could do the same thing. Instead of using the beginning balance, for example, this is zero, I got to do what I gotta do to reconcile in the first time period.

03:38

So what you would do then is just enter as of the last year, or you can enter it this year, as long as you make sure you hit equity and not an income statement account that 25,000 In that case, you’ll have a zero here, but it’ll reconcile if you just check it off as we go to the reconciliation process which will be seen in the next screen. So that’s one one issue you could have. And just Just be aware, that’s kind of the workaround. Once you get that done, once you do what you got to do to get reconciled in the first month, then the reconciliation will be will be fine going forward, because the ending balance will always tie out to the beginning balance once you’re on your system is lined up. So what we need here is the ending balance then, on the bank statement, which is the 109 917 for us.

04:24

So I’m going to put in the 109917 that I want the date in this is going to be the as of the end of January. So we’re doing the first bank reconciliation for the first month, then we’ll do the second month next time. Then we have the added information down here. Now if you have these service charges or any interest that was earned, you could put those in here and QuickBooks will basically do a transaction for you and and put that into the bank reconciliation. I don’t like doing that personally because it doesn’t always show up on the bank reconciliation, the same format. You know, I want to go into the bank. reconciliation and check everything off one at a time. Because that way I can make sure that I checked everything off and that everything reconciles. If there are items that kind of magically check themselves off, then I get confused if you know whether they’re included or not.

05:15

So I would rather not do this and then just go back into the register and manually inputted into the register. And that’s what we’ll do, I’ll show you how to do that. So I just basically ignore these, it doesn’t mean we don’t have service charges or possibly interest earned, it just means that I’m going to manually put them into the register. Rather than do this, use their little thing here to do it. So I’m going to say save them. And we’re going to have a screen then that looks something like this. So I’m going to close the hamburger here. And let’s just the main number you’re kind of looking at over here is this number, this difference needs to basically go down to zero.

05:50

So at the end of this that should go down to zero. And that’ll mean that you’re that you’ve reconciled you’ve matched up everything that has cleared on the books and In the bank, so that’s what we’re considering if that’s anything other than zero, you can force it to reconcile. But even if that is down to like one or two, you’re not really sure, because that one or $2, that it’s off by, could be, could result it could be because there’s like five deposits and 10 checks that aren’t entered that resulted in a $2 difference. So unless you’re down to the penny really, or, you know, down basically to the penny, then you’re not your your level of insurance goes way down.

06:28

If you’re, if you’re off by just about anything, if you’re exactly on your level of insurance is pretty good. And you should be able to get exactly on even if you have a pretty pretty large account, because we’re just ticking and tying off the number that has to match up if the numbers are the same, that the same. So so then over here we have the statement ending balance. This, of course comes from the bank statement. So there’s the ending balance on the bank statement. We have the balance for us to 25,000. And then we have basically the payments and deposits that we’re going to check off.

06:57

So here’s the beginning balance. that we have that matches up, this is the cleared balance that we have, then we’re going to be having the payments and deposits, those will be recorded as we check them off down below. Now the default down below, this is all of our activity down here. The default is basically to have this all checked off half the All button kind of checked off. Or you can look at it by it, which is probably easier first checking off the deposits and this format, looking at the deposits only, and then looking at the payments, and then we can go in and check them off in that format. That’s what we’ll do here. I’m going to go to the deposits first.

07:34

So I’m just going to check the deposit item. And then I’m just going to go back and forth. And remember i would i would recommend for you to go from the bank statement to to the books. So I’m always going this way. I’m saying here’s the 65 over here, and then I’m going over here, here’s the 65 over here. In other words, I’m not finding the 65 over here, and then going over here you could do it that way. You could go back and forth and whatnot, but your mind will get caught messed up if you’re not doing that used to doing this for a while. And the reason I recommend going from here to the bank statement is because everything that’s not from here to the books is because everything on the bank statement should be on the books.

08:12

Everything on the books is not necessarily on the bank statement. So so if you go this way, then you’re always you should always find the number over there. And if you can’t, then you recognize you have a problem of some kind that you’ll have to figure out what went wrong. So once I once I click them off, I’m going to right click and make them a color, I’m going to make this green, because that means it’s good. Green means it’s good. And also note the dates here that the date on the bank statement should always be a little bit after you would think that on the books because when I wrote when I deposit something in the books, it’s because I walked over to the bank, and I put the deposit in the bank. And that’s when I recorded it in the books and my books and QuickBooks quickly.

08:51

I did it quickly in QuickBooks. And then in the bank, though it takes them a little while to process it now a deposit they should be able to process in a couple days. So that so you would think that deposits going to clear the bank a couple days after the deposits in our books, because deposits in our books we put in there right when we put it in the bank, and it takes a couple days to clear. So the dates always going to be a little bit off, but it should be pretty close with the deposits, you would think the checks could be quite off, right? The checks can be quite off because someone could be holding on to your check for like a month or like five months before they cash it. And then you’re like, why did we hold on the check for that long, because, you know, didn’t clear my bank forever, and whatever.

09:27

So then over here, we’re going to save then we have the 50,000. And then we have the 50,000 over here, so that checks off. And so I’m going to go back over and make this one green. Here’s the 8000 for 38. And I go back over here, here’s the 8004 38. And then I go back over here and make that green. And then here’s the 13 192. And then here’s the 13 192. And then I go back over here and make that green. And then there’s no more here. There’s none more here, but there’s another one over here. So why is that one here? And not on the other side. It’s because this one hasn’t cleared.

10:06

So this one hasn’t cleared when? When did we put it into our books? We put it in there as of 128, which is put pretty close to the end of the month. So it might be possible it didn’t go into it didn’t get to the bank yet. So that would be reasonable that it didn’t cleared. What if I’m worried about it? What am I going to do? It will normally I’m doing the bank reconciliation, not as of January 31, they had to give me the statement. So it’s got to be sometime in February. In other words, when I actually got this statement wasn’t January 31 is sometime in February. Therefore I can go to the banking online or something like that. And I can just say, well, it didn’t clear in January. The bank did it clear in February.

10:43

I would expect that to clear in February. If it cleared in February, then I feel okay. I’m like Ah, that’s fine. It cleared it clear just cleared in February. I’ll see it in the February bank reconciliation on the bank statement for February. I will then see it and I will then check it off in February. When we do the bank reconciliation, alright, so that’s all the deposits just want to point out a couple other kind of filtering options, notice that you could, you know, sort this information in different ways you can, you could filter this information, you can, you can actually see the transactions, you know, past January, so the February transactions, you shouldn’t need to, because if they were entered in January, they wouldn’t have cleared the bank.

11:23

You know, if they were entered in February, they wouldn’t have cleared the bank in January. But if you’re if you want to look at the February transactions, you could do that as I’m going to close this back out. And you’ve also could sort the information in different formats, you could try to, like sort by type or something like that, or over here sort of in a different way. The date is typically going to be the default it’s going to typically sort by by date. Now these other options of sorting the information aren’t as useful with the deposits usually there aren’t as many deposits so it’s not as as difficult and all you have is basically the date when we get to the chip.

12:00

However, maybe you can support by or sort by, if you write a lot of checks, the check number might be more helpful. Because remember, when we when we go to the checks, and we think about when the checks cleared, they they may not have cleared in an order. that’s similar to when we entered the checks because people could hold on to the checks. So the dates on the checks, the dates on the checks on the bank statement, may be completely you know, different order than the dates that we’re going to put into our system.

12:29

So that’s one of the problems with the with the bank reconciliation, you’re going to have to kind of think about if you have check numbers, like if, if a lot of your most of your chat transactions are with checks, then you can sort that information by check. And if your bank sorts by check to that would be nice. You can line up to try to line up or find your bank or ask your bank or work with your bank or find a system where the bank’s source the information in a similar fashion as you do to make the bank reconciliation as easy as possible.

12:57

No, I was obviously we’re still out of balance because we haven’t entered the decreases yet. But we’re going to do that next time. I just want to also point out that you can leave and come back and you don’t like if I if I’m not reconciled you might be concerned Can I get up and go get some coffee or something will let the little thing you know, delete itself or anything like that. No, typically, you can, you can leave and you might even leave to go into it you like you might need to go back into the system and enter other transactions to reconcile and whatnot. So if you were to go out and say, Okay, I’m going to, I’m going to go back up to the dashboard, and then I’m going to go back and reconcile, you know, after lunch or something, that’s fine. We’re going to pick this up next time.