In this presentation, we’re going to continue on with our bank reconciliation for the first month, part two, we’re going to be focusing in on the decreases this time last time we focused in on the deposits. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Also note that I still have the balance sheet open over here. So if you want to open the balance sheet, I won’t go through it, but you can open the report to the balance sheet, and then and then duplicate the tab as we’ve done in the past. And here is our balance sheet.

00:29

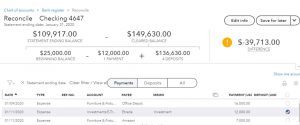

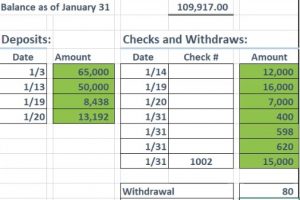

Our goal here once again, is to be reconciling the checking account checking account here with what what’s in the bank statement. Our bank statement looks like this. We have done this so far for the deposits are we’ve checked off the deposits. So we basically looked at the beginning balance at this time because we’ve checked that off we can kind of check that number off and note and and we’ve checked off the deposits. So then we kind of got hungry and we went to lunch and whatnot. Now we’re back.

00:55

Now we’re back and we’re going to do the checks or the decreases at this point. I’m going to minimize this, I’m going to go back to the first tab. And we’re going to go back into the reconciliation. And we’re hoping it’s still there. We did some work before lunch. And we’re like, I hope it’s still there. Hope it didn’t like, disappear anything. And we’re going to go down to the counting down below. And we’re going to go to the reconcile. And we should now have this thing that says resume reconciling. So that’s good stuff. Sounds like it’s gonna take us where we were last time.

01:25

So there we have it, and then I’m going to close up the burger up top. And we have reconciled the deposit. So then if I go to the deposits side of things, then we see those deposits. So there’s the deposits, we had one that didn’t clear. Now we’re going to be focusing on the decreases or payments. So now we’re going to be doing the payments. We’re going to be doing the same objective over here. We’re going to be going from the bank statement back over because remember that if it’s on the bank statement, it should be on our books. If it’s on the bank statement and not on our books, then it’s probably us that has a problem and we should enter it into our books.

01:59

Most likely, if it’s on our if it’s on our books, it may not be on the bank statement, because it might be a check that has not yet cleared. Therefore, it’s usually better to go from the bank statement to the books. If you’re getting confused on which way you’re going, this is the way you kind of want to go until you get not confused about that. So note, when you talk about the checks, we still have the date that we can use to reconcile but the date is much less reliable, the deposit should be like within three days, the deposit should be in the system, the checks are way less reliable, because someone could be holding on to the check forever. And you know, so you don’t know you don’t know when the checks gonna be in there.

02:36

We also have the added information, however, of the check number. So so the checks, could could lag a lot more. But we have that check number to give us that added kind of reference tool. And that’s something that we can tie out within the bank statement and our books, that’s why you want to use those check numbers. If you’re talking about electronic deposits, then those typically shouldn’t have a problem with the timing difference. Those are would be pretty straightforward, they should be pretty close to when we put them in our books, that they’re in the system if we’re putting them in our books at the same time period.

03:08

So also note that if we sort the information in, in this system, by by date, it may not line up as easily, because like I say, the checks could be out of order. If you’re using electronic transfers, then it should be pretty close. So then you could sort by check number if you wanted to. And that might be another way that you can kind of sort your data just to make this as easy as possible. All right, so let’s do this. We’re going to go over here.

03:36

Obviously, this is the most tedious point, if you had a lot of checks a lot more, you know, obviously, a bank statement could have a lot more checks than this. It’s tedious, but it’s totally doable. I mean, it’s not that difficult to do you just tying out the two numbers, you’re just matching them up, they have to match. If they don’t, there’s a problem, you’re gonna have to fix it some way or the other. Either you entered it into our system, or it’s an outstanding check, or something’s outstanding. And and that’s it. So it has to kind of work, it just takes a little bit of time, but it has to tie out. So in any case, so here’s the 12,000. And let’s see if we can find that on our books. There’s the 12,000. So I’m going to check that off,

04:12

I’m going to go back to our books, I’m going to right click on it, I’m going to highlight it, make it green, because that looks good. I’m going to see if I can make this a little larger. Without it messing anything up. Didn’t seems like everything’s okay, everything’s still okay. So here’s the 16,000, we’re going to go back over and check off that 16,000. Go back over here, and I’m gonna make that green. Here’s 7000. I’m gonna go back over here, here’s 7000. You’re gonna check that off. Notice I’m kind of just going by the numbers because if you tie up the numbers, it has to work.

04:44

You could double check it though, the numbers and you do want to verify that it’s in the range of the date that you would think because if it’s a repeating check, you may always be checking off the future check, you know, you know, not the same one. That’s why check numbers are still kind of nice, you know, to have the actual Written check that is that actual verification of a check. electronic transfer is not having that benefit. So we’re going to go back over here, but electronic transfer can some gifts sometimes give you like the name of who you can, whatever. So here, we’re going to go with the seven that they 4000, so forth that far 400. Here’s the 400 here.

05:19

So notice is not in the same order, that could quite well be the case, it could be, you know, differences in in the order in as you go back and forth, because the dates aren’t going to going to tie out perfectly. And so I’m going to undo that and highlight the 400 because we’re tying from here to there. Here’s the 598 and there’s the 598. So that works out Now, obviously, you can do this faster. Once you get good at this, you can go back and forth and not do it just up but I’m getting in the practice of going from the bank statement over there.

05:49

So here’s the 620 we’re going to the 620 over here, so there should be a 620 there it is way down here. So again out of order but that’s okay. Looks still looks like it’s The range the 30th of the date there, and the 31st here. So that would make sense. Then I have the 15,000. And that has a check number. So we see a check number, the the rest of assuming our electronic transfers. So that that one’s 102. Look how easy it is to kind of pinpoint. You know, the check number is helpful. So we’ll check that off. And there we have it. So now we’ve checked all those off, we’re still off by the $95. So we’re still off by 95. If I go back over here, and say, all right, that would that are these transactions. And if I look for them, here’s a here’s a withdraw meeting.

06:37

I’m just gonna say we took cash out of the out of the account. If I go back over here, I don’t see that amount. I don’t see that amount. So is that the bank’s fault or our fault? Probably our fault, right? I probably took the money out and I didn’t record it, right. So that means that that I have to fix it. So if it’s on the bank statement, and it’s not on our books, unless I’m going to argue With the bank statement, whether that’s legitimate or not, then I have to include it in our books. And that’s what I’ll do. And then the charges of the same thing. If they charged us money on the bank statement, bank service, or I didn’t know about it, it’s not really our fault.

07:13

We didn’t know about it until now. But unless I’m going to argue with the bank to see whether or not I’m going to have those charges, I need to include it right, I’m going to include even if I argue with them, they’re going to give me a chargeback. And that’ll that’ll show up on the next bank statement. So in our case, we need to, we need to include these. So we’re going to say it’s on the bank statements, not on our books, we have to fix our books, the banks probably right, we’re going to go to our books and fix it. So I’m going to say, let’s do this on.

07:37

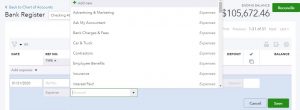

Now you could you know, leave here again, like I could just get out of this tab. So I’m going to go up top and just go right to the register to do this. So I’m going to go to to accounting. And then we’re going to close the old hamburger over here. I’m going to go to the chart of accounts. I’m going to open up the register for checking account, let’s open up the register for the checking account. And then I’m going to add a transaction, I’m going to make it the expense, I’m just going to call it an expense. And I’m going to say this was on a 130 120, the end of the month. And then the two expenses, we had the bank charges were 15. And then the let’s do the, what was this one, the $80 withdraw.

08:27

So I’m assuming I took that out if I’m assuming I’m the owner, right? So I’m going to call this a draw. And then it was for $80. Now if you’re a bookkeeper then a draw the problem with a draw is because now they took money out and it’s just cash. So the question with that is, cash is kind of a problem because I don’t have I don’t know who they paid with it or what the vendor is.

08:48

So the question then is, you know, if you’re the bookkeeper, and you’re asking, say, the owner, you know, there was a draw you Where should I put that? Or you know, the took money you took cash out of the checking account, where should I be? That, should I put it in as a business expense? Or should I put it in as a draw that you took out for personal use? And then if it’s a business expense, what’s the account that I should hit in terms of the business expense? Now the difference here, of course, is, if I, if someone took money out, if the owner took money out, and they took it out as an expense, then what’s going to happen is it’s going to increase the expenses and lower net income, which looks bad on the financial statements, but actually, that looks actually good for taxes right back and kind of if you can kind of get you in trouble in taxes, if you if you took draws out, and you and you’ve recorded them as expenses, because that would lower your your taxes, your taxable income.

09:42

So just be aware of that if if they took money out, that’s fine. But if it’s for personal use, then we should be putting it into into draws and that wouldn’t affect the income statement. Therefore, net income wouldn’t be going down. So if there was money taken out of the account, we would see it on the bank statement. Of course. Then we have to determine, okay, cash was taken out? Was it a business type of cash? Or was it personal? Let’s first assume that the owner says it’s a business business it was used for business. Well, then the question is, well, what should what account? Should I put it in? What did you spend it on? You know what, you know, where should I put the cash. And let’s just assume that they were going to put it into miscellaneous at this point point in time, we don’t know where we spend it on. But it was business for some reason, we’re going to put it into miscellaneous expense.

10:27

So I think they had one for miscellaneous. Let’s type this in there. I’m going to type in m i s lane is miscellaneous. So they gave us one. This is one given from QuickBooks. We haven’t used it yet. But that’s what I’m going to put it in as. Now next time, you can ask, Well, what in the next month, you could say, well, is that always going to be the case? like can I assume that every time cash is taken out on the bank statement that I should put it to miscellaneous expense? And then you could try to come up with a system that you can you can work for it without having to ask a bunch of questions.

10:56

Or if they say that it’s going to be a draw, and it’s like, well can I assume then, that every time you take money out, you know out just cash like that, that it’s going to be a draw that I could put two draws to the equity section rather than the income statement. And we’ll see an example of that in month two will record the same kind of thing as a draw next time so you can see the difference. So I’m going to say save. And then the next item we have is a bank service charge for the 15. So I’m going to put this on the 31st. We should put the bank name. I’m not going to put it here for now, though, and I’m going to put it a payment for $15. So I’m going to put 15. And then the other account, let’s see if they have an account for bank charges. There it is bank charges that QuickBooks has set up for us.

11:43

Now, if we would have put this $15 in that first screen. When we first set up the bank reconciliation, they had that first green to put in bank charges, we could have put it into that little screen it would have recorded basically the same transaction. I like to just record the transaction myself so I can see it. And just check it off. So I’m going to say Save and Close. And then let’s go back to our Well, let’s take a look at. Let’s go back to our register now. So our bank statement, so we’re going to go back and open up the hamburger, I’m going to scroll down to the accounting, and we want to then go to the reconcile tab. So within the reconcile tab, we’re going to be reconciling and we want to be choosing that first account and it should save resume reconciling. That’s what we want. And then I’m gonna close the hamburger up top.

12:35

So then I’m going to go to the payments, let’s go to the payments, and we should have that ad dollars. So there’s the ad and the 15. So I’m going to check off the ad, and I’m going to check off the 15 and then this amount goes down to zero. So now at this point, we have found everything on the bank statement. We found the beginning balance tied out, we found everything else. So everything looks good. Good. So if I go back over here, that’s reflected by the fact that this is differences. Zero. Again, you really want that to be zero, even if it’s off like a by $1. It’s the level of assurance goes down, like exponentially, way, way less if it’s off by $1. Because Because again, that dollar difference could be like 10 deposits and, you know, five checks or something like that, if it’s exactly on, you know, it’s very, it’s unlikely that, you know, out of coincidence, you had a check and, you know, deposit that would match each other out. Exactly.

13:31

So if it’s exactly on it should be good, it should be not too difficult to get it exactly on. Now, I also want to just point out that this beginning balance that 25,000 if you didn’t have a beginning bounce here, and you just entered that into the system, and you had this at zero, and then in the first month, you just checked it off as a deposit down here because you entered in if you entered it in and just checked off that difference as a deposit, then you would still reconcile right it would still be okay. Because instead of this beginning balance, be Here it would be zero, and then you would do a check off the cleared amount.

14:03

Now it didn’t actually clear on this time period, that means you’d want to mark that off in the bank reconciliation. But if that’s what you needed to do to be in balance in the first month, you can do that. And it would be just like if we entered the beginning balance here, because we entered this as of the beginning balance, the other side went to equity. And therefore, if you if you had a beginning balance of zero, and you just entered the same transaction into the register, that would be okay. It just wouldn’t show up in the beginning balance, it would show up down here as something that you need to check off. Okay, so now it’s ready to reconcile will actually go through the reconciliation process. Next time.

14:39

I’m going to I’m going to reconcile it next time and then we’ll analyze the actual report. Note that this is just this is actually just a reconciliation kind of worksheet. This isn’t the actual reconciliation report. The reconciliation report is going to be showing, you know the beginning balances or actually it’s going to be showing what we really want to see is the ending balance per for the books and the balance. The bank and then exactly what the difference is, which is going to be these items that we did not check off these items that we did not check off, represent the items that are in our books that have not yet cleared the banks.

15:12

Why didn’t they clear the bank because of a timing difference. And just to point out note, just like we did with the deposits, that the checks down below, we have a significant amount of item a few items down here that didn’t clear. So what do we expect to have happen? We expect them to clear in February, if we’re concerned about them, we can go to the February bank statement or we can look online into the transactions in february two double check that these have indeed cleared in February. If they have then we feel pretty confident about them. Then we’re like oh, that’s okay. It’s just a timing difference.

15:46

We’ll check them off in February. Now if they haven’t cleared in February, that could be the case still it could be someone’s holding onto a check for a long time and it hasn’t cleared for some time doesn’t mean it’s necessarily wrong. But you would expect you know it declare like Within a month or something like that