QuickBooks Online 2021 Profit and Loss P and L income statement overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to go into the profit and loss or income statement by going to the reports down below, we’re going to be opening up the standard profit and loss which should be in your favorites because it is a favorite report, profit and loss report, otherwise known as an income statement, sometimes called or referred to, in short as the P and L,

Posts with the goods tag

Invoice Form 1.34

QuickBooks Online 2021 invoice form, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re searching for QuickBooks Online test drive, then we’re going to be selecting QuickBooks Online test drive from Intuit, it’s then going to ask if we’re a robot, I was once but then I made a wish upon a lucky star. Now I’m a kangaroo. So we’re good. We’re gonna check that off continue.

Pro Forma Income Statement 410

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the pro forma income statement, get ready, it’s time to take your chance with corporate finance pro forma income statement. Let’s first take a step back and think about the pro forma financial statements in general, remembering the fact that we got to do them in some type of order in order to do them in a logical fashion. And that would mean that we would first need the sales projection information, the production plan, we can use those in order to create the pro forma income statement.

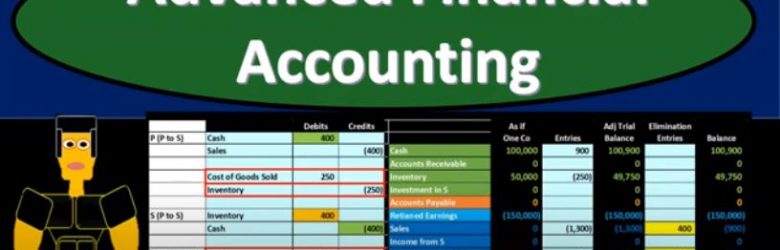

Sale From Parent to Sub Sub Has Not Resold

Advanced financial accounting PowerPoint. In this presentation we will discuss a situation where there is a sale of inventory or transfer of inventory from parent to subsidiary, the subsidiary not having yet sold the inventory. So in that sense, we have an intercompany type of transfer. When we consider the parent and subsidiary as a whole with regard to a consolidation process, the parent sold to the subsidiary the inventory, the subsidiary still holding on to that inventory has not resold it externally at this point, get ready to account with advanced financial accounting. What we want to do now is think about the transaction on p side and then on SSIS, and then what the elimination entry will be. So there’s a couple ways you can think about this, you can kind of memorize what the elimination process will be what the elimination entry will be and put together worksheets to do that elimination process kind of by just routine by just filling out the worksheet. And then you also want to analyze the worksheet and think about it in detail in terms of what is actually happening.

Parent Sale to Sub & Sub Resold

Advanced financial accounting. In this presentation we’re going to discuss an intercompany transaction where a parent makes a sale to a subsidiary and then the subsidiary resells it. In other words, we have this intercompany transaction, we want to think about how that is constructed. And then how we can do the reversing entry for it or a consolidation entry in the case of a consolidation of a parent and subsidiary in a consolidated financial statements, get ready to account with advanced financial accounting. So within a situation where we have a sale from P to s, and then S sells it to an outsider remember that as it goes to the outsider, that’s going to be the legitimate type of so that’s the arm’s length transaction, the sale from PETA is not so and therefore we kind of have to eliminate that. Now if it’s been sold to an outsider, then we have a situation where the inventory is still gone. There has been a sale being taken place. And so we so that’s good, but we still have to do the reversal of part of that intercompany transfer and it’s gonna boil down At the end of the day, basically debiting, the revenue account reversing revenue, and reversing the cost of goods sold. So this is the boiled down version. Now if you think about it, you might say what happy because if p sales to s, then you’re going to like debit cash credit, you know, you’re going to credit the sales, and then you debit cost of goods sold, and credit inventory and then asked is going to be recorded cash, and then they’re gonna be recording, then the other side go into inventory, and then right, there’s more, and then they made the sale to the outsider. So how do we boil this down? How does the intercompany boil down to just this right? We kind of kind of have an idea of that in our mind.

Eliminating Intercompany Transactions

Advanced financial accounting. In this presentation we will discuss eliminating intercompany transactions, the objective will be to have an overview of the intercompany transactions, the types of intercompany transactions and the basic elimination entry for those intercompany transactions get ready to account with advanced financial accounting intercompany transactions, we’re going to start off by listing the intercompany transactions as we list them. Remember, our objective is in essence to remove the intercompany transactions.

Cash Disbursements Internal Controls

In this presentation, we’re going to talk about Cash Disbursements, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happened. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request a payment may even you know, enter the payment into this system. However, we want to make sure that the owner still has some control over such as the cheque signing.

Cash Receipts Internal Controls

In this presentation, we will talk about cash receipts, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happen. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request the payment may even you know, enter the payment into the system.

Last In First Out LIFO Inventory Method Explained

Hello in this lecture we’re gonna be talking about the lastin first out inventory method, we will once again be selling our coffee mugs. Here, we will not be specifically identifying the coffee mugs that we sell, but rather using a cost flow method, that method been a lastin. First out this time, whenever doing a cost flow method, I do recommend setting up a worksheet such as this with three parts to it having the purchases, the cost of the merchandise and the ending inventory, and then calculating the units that we’re going to sell the unit cost and the total cost for those particular categories. As we will do here. This will answer the most amount of questions in any format that those questions could be asked. What we are trying to do here is of course, say that the inventory that is reported on the trial balance needs to be backed up in terms of a worksheet Why? Because on the trial balance, it’s reported in terms of dollars.

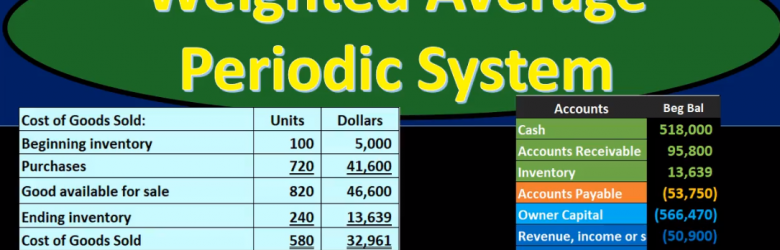

Weighted Average Periodic System

In this presentation we will discuss the weighted average inventory method using a periodic system. The weighted average method as opposed to a first in first out or last In First Out method, the periodic system as opposed to a perpetual system. We want to keep the other systems in mind as we work through this comparing and contrasting. We’re going to be working with this worksheet entering this information here. It’s important to note that this worksheet is a worksheet that can typically be used with any of these inventory flow type problems of which there are many. We have first out last in first out the average method. And then we have a perpetual and periodic system which can be used with any of those methods. It’s also possible for questions to ask for just one component such as cost of goods sold or Indian inventory, and therefore it can seem like there’s more types of problems that we can have in that format as well. If we set up everything in a standard way, even if that weighs a little bit longer for some types of problems, it may be easier because we can just memorize that one format to set things up, this would be a format to do that.