Hello, in this presentation we will discuss the general ledger. At the end of this, we will be able to define what the general ledger is. We’ll list components of the general ledger and explain how the general ledger is used. When looking at transactions in terms of journal entries and posting those journal entries in track prior presentations, we were posting those journal entries mainly to a worksheet in order to see a quick computation over the beginning balance and what is happening to that balance, posting it to a format of a trial balance than an adjusting column and then an adjusted trial balance. Note, however, that we typically think of the journal entries being posted to a general ledger. The general ledger can be very complex when we look at it which is why it is often useful to not look at it when we first start posting the transactions but to see that how those transactions affect interest Visual accounts.

Posts in the QuickBooks category:

Accounts Payable Journal Entries 240

Hello in this presentation we will be recording a business transactions related to accounts payable or the purchases cycle recording these transactions with debits and credits. At the end of this we will be able to list transactions involving accounts payable, record transactions involving accounts payable using debits and credits and explain the effect of transactions on assets, liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here in the left hand side in accordance with our thought process. We will then be posting these not to the general ledger but to a worksheet format so that we can see a quick calculation as to what is the impact or effect on the individual accounts as well as the effect on the account groups as a whole. Remember that all the groups for the accounts will always be listed in order when you’re looking at a trial balance. Which is why I recommend looking at a trial balance.

Accounts Receivable Journal Entries 230

Hello in this presentation we will be recording that journal entries for business transactions related to accounts receivable otherwise known as the revenue cycle. We will be recording these using debits and credits. At the end of this we will be able to list transactions involving accounts receivable record transactions involving accounts receivable using debits and credits and explain the effect of transactions on assets liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here on the left hand side constructing those journal entries in accordance with our thought process our list of questions to most efficiently construct the journal entries.

Cash Journal Entries with Cash 225

Hello in this presentation we are going to record business transactions involving cash using debits and credits. At the end of this, we will be able to list transactions involving cash record transactions involving cash using debits and credits and explain the effect of transactions on assets, liabilities, equity, revenue, expenses and net income. We’re going to record these transactions on the left hand side in accordance with our thought process. We’re then going to post them to a worksheet format, not necessarily or in this case, not a general ledger. But in a similar way, we will post it to this worksheet in order to see what is happening to each of these accounts individually as well as the groups of accounts in terms of assets, liabilities, equity, revenue and expenses, notes the order of the trial balance, always in the order of acids in this case in green liabilities in orange, and then we have the equity and revenue and expenses, the income statement accounts and net income at the bottom calculated as revenue minus expenses.

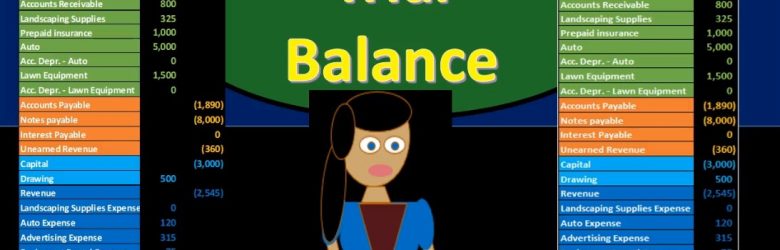

Trial Balance 220

Hello in this presentation we will be discussing a trial balance objectives at the end of this, we will be able to define a trial balance list components of a trial balance and explain how a trial balance is used. When considering the trial balance, we first want to think about where the trial balance falls within the construction of the financial statements. In other words, what processes go before the trial balance, what goes after the trial balance, where’s the trial balance fit into our process? Remember, the ending goal, the ending process of the accounting been to compile the data in such a way to create the finance financial statements. Those financial statements have been the end product. Typically if we’re thinking about a linear process, then we’re thinking about all the transactions that would happen during the month.

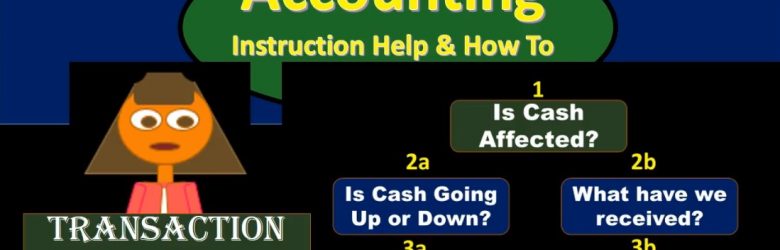

Journal Entry Thought Process 215

Hello in this presentation that we will discuss a thought process for recording financial transactions using debits and credits. Objectives. At the end of this, we will be able to list a thought process for recording journal entries. explain the reasons for using a defined thought process and apply thought process to recording journal entries. When we think about a thought process, we’re going to start with cash as the first part of the thought process is cash affected. We’ve discussed the thought process when we have considered the double entry accounting system in the format of the accounting equation, the thought process will be much the same here we now applying that thought process to the function of debits and credits recording the journal entries with regard to debits and credits.

Rules for Using Debits & Credits 210

Hello. In this presentation we’re going to discuss rules for debits and credits, how to make accounts go up and down using debits and credits. objectives, we will be able to at the end of this define rules to make accounts go up and down, apply rules to make accounts go up and down and explain how rules are used to construct journal entries. When considering these rules that will be applied, the rule will be very simple to apply once we understand the normal balances or have memorized or are using a cheat sheet in order to know what those normal balances are. There’s no getting around just memorizing the normal balances. That’s where most of the time will take place. Once we know what those normal balances are, we’re going to want to do things to those normal balances. We’re going to want to be increasing or decreasing those normal balances in some way.

Debits & Credits 205

Hello in this presentation we will discuss debits and credits. Objectives at the end of this we will be able to define debits and credits list account normal balances and explain how debits and credits work. First we want to take a look at the double entry accounting system and recognize that the double entry accounting system can be represented in multiple different ways including as we have seen before the accounting equation meaning that assets equal liabilities plus equity, we can record transactions using this accounting equation as we have done in the past. That accounting equation is the basis behind the balance sheet where we have the assets liabilities and equity representing the fact that the balance sheet then would be in balance.

Accounts Payable Transactions Accounting Equation 170

So there’s gonna be problems later on where they’ll basically say, you know, you got to pay off something on account and you have to assume that the prior transaction took place. You got to kind of know in your mind how these things are related. So if we go through them by cycle that will help to achieve that goal. first transaction, we’re going to say purchase supplies on account. If we go through our list of questions, we’re going to say is cash affected? In this case? No, because we purchased it on account, then we’re going to ask what we’ve received, in this case supplies. So we got supplies, that is here, it’s going to be an asset. Therefore the asset is going to go up because we got more of them, then the only question is, what is the other account? It’s not a decrease to cash because we didn’t pay cash. And therefore we must be doing something somewhere else. That will be accounts payable, so accounts payable is going to increase by the same amount.

Accounts Receivable Transactions – Accounting Equation 167

Hello in this presentation we will record transactions related to accounts receivable recording the transactions using the double entry accounting system in the format of the accounting equation that equation of assets equal liabilities plus equity objectives at the end of this we will be able to list at transactions involving accounts receivable and record transactions involving accounts receivable using the accounting equation. We will go through some examples of the accounting equation and recording transactions related to accounts receivable quick review of the accounting equation we have assets equal liabilities plus equity as the accounting equation. We then need to start memorizing those accounts that fit into those subcategories of assets, liabilities and equity.