This presentation and we’re going to consolidate two loans and reflect that in our bookkeeping. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to start off by going to our reports down below and taking a look at the balance sheet, we’re going to be opening up our balance sheet report to consider the loans that we currently have on the book. I’m going to scroll back up top, we’re going to change the dates up top from a one a 120 to 1231 to zero, and then we will run that report. I’m going to then duplicate the tab up top.

00:32

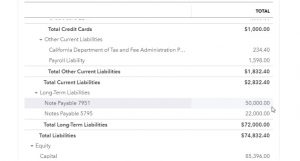

So we’re going to go to the tab up top right click on it and duplicate that tab, duplicating that tab so we can do the data input on the left, we could check out our form the balance sheet on the right, then I’m going to close the old hamburger. I’m going to make this a little bit larger holding down control and scrolling up a bit to 125. Then I’m going to scroll down to the liability so I’m in the liability section. And then under long term liabilities we see our two loans. We’re going to say now they have been consolidated to one loan, so we’d like to consolidate them and reflect that consolidation within our QuickBooks file here.

01:07

So we’d like to have one loan account, rather than the two loan accounts to represent the consolidation. Now how can we do that, there’s not going to be typically any normal kind of transaction form related to that, because it’s not something that happens all the time. And therefore, there’s no form that really reflects that. Therefore, the default would typically be going to a journal entry, we can do the journal entry. However, we can also do this with a register. So if there’s only two accounts that are affected, then the register can be very useful because one account would go up and the other accounts is going to go the other way. So what I’m going to do is pick one of these registers, they’re going to pick the first loan for the 7951. I’m going to go into that register, I’m going to increase it by this amount, and then just assign the other side to go to this loan, which would decrease the other loan.

01:51

So let’s take a look at what that would look like. I’m going to go back to the first tap now. We’re going to then go down I’m going to hold down Control and get down to 100% against doesn’t do anything funny as I move around the data input section, then we’re going to go to the accounting down below on the bottom, we’re looking for our chart of accounts. That’s what we want the chart of accounts, then I’m going to go find those registers the correct register for the loans, it’s going to be in order by account. So I’m looking for the liability type of accounts. Here’s the current liabilities. Here’s the long term liabilities, I’m going to go into the register for note payable 7951.

02:26

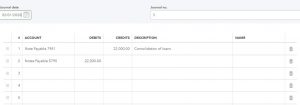

So I’m going to open up that register it is a balance sheet account, therefore has a register, which will look kind of like the check register have up and down type of transactions, we can enter into it. And then I’m going to open up the transaction types notice we only have to we may be able to use a transfer but I’m going to I feel more comfortable using a journal entry here. So I’m just going to go with the journal entry. And then we’re going to enter this as of it’s going to be Oh 20120. So February 1 2020, this first transaction of the new month here, so I’m not gonna put AP because we don’t need one here, I’m gonna say we could put in a memory memo consolidated division of loans, something like that. And we’re going to decrease this one, actually, I’m going to increase this one by the amount of going back to the balance sheet because I can’t remember the other one, but up 22,000.

03:20

So we’re going to increase this loan by the 22,000 and decrease this loan to zero. So let’s that makes sense. I’m gonna go back over, I’ve convinced myself of that, we’re going to increase it by 22,000, then, and then the other side is going to go to the other loan account, which should take it down to zero. So notice how these journal entries how these registers work. All I need to know is the account that I’m in, I want to do whatever I need to do to it, increase it or decrease it. Then if I put the other side to the other account, and there’s only two accounts involved, it should do what we want to the other account, hopefully in this case, bring it down to zero.

03:56

So I’m going to select the drop down. We’re looking for the other loan accounts. Were Looking for a liability account, it might be easier to type it in if I type in loan, not what we call it, if I type in loan payable, I can see it there. Or we call it note payable, notes payable. And there it is at the with the 57945795. Alright, then I’m going to go ahead and Save and Close. And that should bring this one down to zero. So if I scroll back out,we’re going to be down to zero on this one. And then if I go back to the balance sheet, then we’ll see if it does what we would expect. I’m going to refresh the balance sheet on the second tab. I’m going to close the hamburger hold down Control and scroll in a little bit back to that 125 which is the that’s the type of scrolling I like to zoom in. I like there it is.

04:51

So now we have the one note table at the 7951. If I go into it, then we see that we have those that just Lunch right here. And notice, even though we went into the register basically makes it journal entry because it has no form. to to to use. So just realize that when you’re looking at transactions that aren’t normal day to day type transactions, then they’re going to be outside of the normal cycle. And therefore you may have to use something such as a journal entry. Now, sometimes a lot of times when you do more transactions that aren’t things you do every day, then you its cash is involved, you can use the cash register, and that’s fairly straightforward.

05:28

If cash is not involved, and it’s not an everyday transaction, then the journal entry is typically going to be the default or the last type of form that QuickBooks will will default to and that if you go into it then will actually show the debits and credits so you can see the debits and credits of one loan going up, it’s a liability, it’s going up in the credit direction, the other loan going down it’s a liability therefore debiting it will make it decrease.

05:54

So closing this back out, scrolling back up top, going back to our Balance Sheet, then the other side, of course, this account going down, it’s now at zero. However, QuickBooks will still show the zero balance there because something there was activity in it during the time period that we’re covering up top with the date range. So if we go into that one, then of course, we’ll see it going down from that 22 down by the 22, down to zero. And once again, that transaction being in the format of a journal entry, back to our balance sheet. So this is what the balance sheet looks like right now. We will be printing out the trial balances so you can match up the trial balances after each of the presentations just to check your numbers.