In this presentation, we will enter bills and then to pay bills. In other words, we’re going to be entering some of the standard kind of bills, we would have monthly, like a phone bill and the utility bill, this time entering them in as bills and then going through and paying them all at one time with the pay bills feature. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re first going to take a look at the flowchart which is going to be on the desktop version just to get an idea of what we will be doing, we’re going to be entering the standard kind of bills like the phone bill and utility bill and so on and so forth.

00:34

Last time and month one, we did so by simply entering it directly into the bank account, basically imagining there going to be electronic transfers, and we made the expense form kind of like a check form with no check number, just simply taking it out of the bank account. This time we’re going to use the other method which is to list them out in the inter bills. And then so that’s going to increase the accounts payable and it’s going to be going the other side will go to the expense Then we’ll have that payable that we will then pay with the use of the pay bills. This can be a useful feature because it allows us to enter those bills at the point in time that we get the bills rather than just kind of holding on to them until we need to pay them. And then we can have a list of them in the inter bills section, help them help us to sort them put the financial transaction in the system.

01:22

At the point in time we get the bill which is closer to the point in time that we actually had the service. So that would be the good thing to do. And then we can decide which ones we want to pay with the pay bills feature help us to sort which ones we want to pay, and when. And it could help us to pay them more easily by paying them all at basically one time. And if we’re using the checks, actual checks that we will be printing out of QuickBooks or using QuickBooks to print on projects, then it could be useful feature as well for us to kind of list out those those bills and put them in the printer and print them out.

01:54

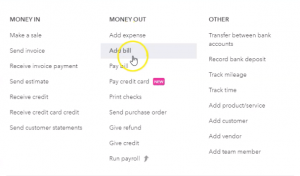

So let’s take a look at it. We’re going to go back to QuickBooks Online. We’re going to be entering our bills sort of Find the bills function here, we’re going to go to the plus button, I’m going to go to this is going to be money going out, we’re going to be entering the bills, and then we’re going to be paying the bills. So let’s go first to the interest of the bills. So we’ll go into enter bills. First we’re going to have a Verizon so Verizon is our phone company, we paid them last time, so I could just start to type it in there and there is Verizon, I’m gonna say tab, and it’ll populate for us, we’re going to say the terms I’m going to say our net 30. Let’s just give it net 30.

02:28

On the terms and the date of the invoice, we’re going to say we’re going to say as of Oh to 28 to zero, so 228 to zero, and then the due date here 329. So then I’m going to go down and we’re going to say choose the category. Now you might be asking, Hey, it’s month two, you said that’s the category would populate automatically for us. It would if we were using the same payment option. In other words, if we were entering this into the expense form, then it would populate for us because we had no entered that into the expense form last time. So if you’re consistent about how you pay things, then it’ll it’ll populate for you. So for example, next month, if we were to have the phone bill and it go to Verizon, then it would be populating the account for us down here already.

03:15

Now, it’s not because we used an expense last time. So I’m going to say this is going to be telephone. So I’m looking for the telephone expense. So there it is, telephone expense, I’m going to choose that. And then and if in the description, we could put a description like the the date of the bill, possibly the period covered, can be useful with the description, I’m going to leave it blank for our purposes here, then the amount we’re going to put here is going to be the 365. Note that if it did populate for us automatically from the prior month, it would already have an amount here and that’s basically the thing that we would need to change, we would need to change the amount we would need to change the date typically. What’s this going to do when we record it? Well, it’s a bill.

03:56

Therefore anytime you see a bill, it’s you’re thinking AP accounts payable is going to be bracing, the other side’s going to of course, the expense account increasing the expenses, decreasing net income. All right, I’m going to instead of saying save and close here, I’m going to select the drop down, which is really a drop up and or rise up, rise up, and then we’re going to hit the Save and new, we’re going to go to the Save and new and we’re going to enter another bill right after this one. Next bill, we’re going to say it’s going to spectrum that’s for we’re going to say that’s our cable company spectrum. And so we’re going to go to that we haven’t chosen spectrum before, this is the first time we’ve been paying spectrum.

04:29

So we’re going to be typing it in here, I’m going to add the vendor spectrum. And tab. I’m not sure I’m pretty sure that’s how you spell it. not totally sure. But that’s what we’re going with. And then I’m not going to add the detail again. So we’re not going to be adding the detail. I’m just going to be keeping the name up top for spectrum. Then I’m going to say save. And there we have it, that’s all we need. Let’s go with the terms. Let’s go with a net 30 on the terms, net 30 on the terms and then we’re going to go to the category down below with this is a new vendor. So we’re going to say this For our internet cable, so sometimes it depends how you want to group this, you may say, hey, that I pay that kind of with my telephone bill, possibly.

05:08

So maybe you put it in with the telephone. Or maybe you think of it as a utility. Maybe you group it with the utility, or like me, maybe you would say, you know, I kind of think this is important enough to break out on its own. I’d like to track the cable bill, and you know, or the internet connection bill separately, so I’m going to put in a separate expense account for it. So again, that’s a kind of a choice that you could make how many expense accounts Do you want, you don’t want too many, because then then it’s just too much too busy of a of an income statement. However, anything that you want to break out and track separately, you may want that added information I do here.

05:42

So I’m going to say in to net expense, I’m just going to call it internet expense. All right. And I don’t because we don’t have any account in there yet for it. And I probably should have checked to see if QuickBooks gave me an account that was like Internet expense, but I’m pretty sure they don’t. They would probably group it under utilities. telephone bill. And I would rather break it out. So I’m going to say internet expense tab, we’re going to be adding that account. It’s choosing an expense account. Why? Because we’re making a bill.

06:10

So it’s like guessing it’s saying, hey, it’s probably you want an expense type of account, rather than like a bank type of account or anything else, we’re going to say yes, you are correct. We want the expense type of account. Then the detailed type, I’m just going to choose utilities for the detailed type, which is way at the bottom, because it starts with you. And so utilities and then the name is going to be the internet expense, internet expense, okay? And then I’m going to say Save and Close. So there we have it. The amount we’re going to say is for 180. So 180.

06:38

What’s this gonna do? Well, accounts pay what’s a bill that means accounts payable is going to be going up by one at the others that’s going to go to an expense, that expense category being called the internet expense. Now we’re going to do this again. Let’s do another one. We’re going to go to save and new once again, save and new. The next one is Edison. We’re going to be paying Edison that’s our utility company. They were our electric bill. So we’re gonna be paying Edison Edison, we paid them last month with a with a expense form. So I’m going to say Edison. And there it is. We see them. We’ve seen them before. Let’s put in terms I’ll put in net 30 on the terms, and everything else looks good.

07:17

Once again, it doesn’t populate the category because we did the category on the expense form last time. And now when we’re on a bill form, we’re doing it a little bit differently. But in the following month, if we were to use the same form another bill form, then it would populate for us. Remember, we put the Edison Electric under utilities typically utilities, to me now means Gas and Electric typically, but you could break those out, you could include phone in the utilities and the internet, if you so choose in the utilities just depends on on how much differentiation you want. I’m going to be typing in their utilities and finding that there it is.

07:52

Once you do have a method However, you do want to be consistent with it because you know if you’re posting to one account one month and another account in the next month and you’re trying to figure out, you know, look at that data on that it’s going to be confusing. So you want to be consistent. Once you pick one, you want to stick with it, at least for a while, and then know when you adjusted and stick with the new change, whatever that will be. So now we’re going to say that’s going to be before the 648. So 648 for the utilities is the amount. This time we’re going to go to the Save and Close I’m going to go hit the drop down or the rise up and I’m going to go to the Save and Close. And then we’re going to open up our reports. Let’s see what has happened thus far.

08:29

We’re going to go down to the reports down below. Let’s open up all three since this is kind of a new transaction that we’ve had. So we’re going to be opening up the balance sheet our favorite report, scrolling back up top four it changing the dates up top on it from Oh 10120 1230 120 then we’ll run that report. We’re going to duplicate the tab up top by right clicking on it and duplicating it. Going to go back to the tab to the left and then go back to the boards on the left and then we’re going to open up the trial better The profit and loss the P and L second favorite report the basically income statement, then scroll back up top, change the dates on it from a one on one to zero 1231 to zero, then run that report. And then I’m going to go back up to the to the tab up top, right click on it, duplicate that tab.

09:20

Then I’m going to go back to the left again, and then we’re going to go down to the reports. Again, we’re gonna do this one more time with the trusty trial balance. That one’s the one that I like to search for because it’s way at the bottom trial balance. And there it is. going to select that item, change the dates up top once again from a one on one to zero to 1230 120 January through December 2020. Run that report, duplicate that report by going to the tab up top right clicking on the tab up top and duplicating that tab. Okay, so let’s take a look at it in terms of the balance sheet. First, let’s go to the balance sheet.

09:57

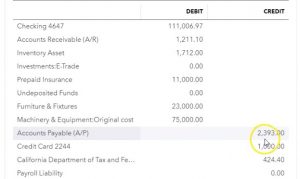

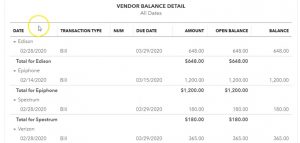

Close the hamburger hold down Control, scroll up A bit to get to that 125, which is where I like to see that my eyes about can see it kind of like that. And then we’re going to go say that the balance sheet is affected with the accounts payable because we entered bills. So we’re going to be down here in the liability section. In the liability section, we see the AP going to select the 2393. So the 2393 in the AP. There we have our three bills, Edison, Verizon and spectrum Edison, Verizon and spectrum. If I was to open either any of those, we would then be taken to the respective bill for it. Closing that back out, and scrolling back up, going back to the balance sheet.

10:41

The other side, of course, on the p&l profit and loss or income statement, closing up the hamburger on the left scrolling back down, and we see our expenses down here. So we have the internet expense, which is an account that we have added. So there’s the one at there’s the one at there’s the bill spectrum new new vendor going back over. And then we had the internet, we had office No, we had payroll, payroll taxes the telephone. So that’s one. That’s one that we did. And notice we last time we did an expense type form, and this time we did a bill. So this time of Bill, the expense form, taking it out of a checking account directly, this one going into AP, here’s the difference between the two.

11:25

Going Back up, back to our report summary. And then of course, same for the utilities. So within the utilities to two payments to Edison, one was an expense one was a bill as can be seen here prior month and this month difference being checking account versus the AP. On the other side of it, closing backup, going back to our trial, balance our profit and loss. Those of course increase the expenses, which would decrease the net income at this time. Then we’re going to go to the trial balance. So if we go to the trial balance We could see this a little bit faster, right, because the here, we could see both the balance sheet and income statement. So here’s the balance sheet.

12:07

For the AP, you can see the transaction there. And then if you wanted to go down to the expenses, they would be populated down below. So this is an easy way to go back and forth and kind of zoom into the accounts that you think would be affected. Now I want to look at another report with regards to accounts payable, that’s going to be the vendor balance detail. So we’re going to go back to the first tab, we’re going to go to the reports down below. I’m going to hold CTRL and scroll down a little bit, get back down to 100. So I can see more stuff down here. I could just close the hamburger and then I’m going to go down to the money we owe other people money is the section or who we owe, I believe they called it looking for the who we owe section or what you owe.

12:50

All right, what you owe. So we’re good Oh, we want the vendor balance Detail Report. So I’m looking for the vendor balance detail. I probably should just be finding these in the find field. But then I’m going to go back up top, I’m going to right click on the tab up top, I’m going to duplicate this tab as well. That tab then duplicated, closing that hamburger, they keep on putting that hamburger in front of me making me hungry. And we could see our detail here.

13:17

So here’s Edison with the bill. And there’s spectrum with the bill, and there’s Verizon with the bill that we have entered the total, of course, adding up to the 2003 93. If we go back to the trial balance, then of course, that is going to be here. 2003 93. Alright, so there is that now we’re going to be paying the bill, we’re going to be paying it out of the checking account, which of course will be reducing the accounts payable and reducing the checking account, there will be no effect on the profit and loss at this step. Because you could see that we affected the profit and loss when we entered the bill. That’s when it affected the income statement because that’s closer most likely to the time period in which we actually consume the service.

14:00

Such as the electric bill or the internet or the phone bill. So let’s go back over to the first tab, then I’m going to open up that hamburger again. And you’re going to scroll back down to 100%. We are then going to go to the plus button. We’re going to be looking for the pay bill feature. Now we’re looking for the pay bill. So we’re going to open up the pay bill. Then we have these are the items that are basically in the accounts payable.

14:24

Now they’re in accounts payable, we can sort them, we can sort them by the payee, we can sort them by the date, we can sort them by the amount, decide which ones we want to pay. For our purposes, we’re going to be paying off the ones that we just input Edison’s spectrum, and Verizon, so we’re just going to be paying off those three. We’re going to leave the Epiphone still on the books, we’re going to be paying them as of the end of the month, so I’m going to say oh to 29, let’s say two zero 29. And then we have the check number.

14:57

Now if we are printing the checks, remember We want the first check number should populate here we would have the checks, then that would be pre printed, they’re already formatted checks. In other words, then we’re not printing them on a blank piece of paper, we’d have to buy the checks, tie out the check number to the checks on the piece of paper, put the piece of paper into the check into the printer in the right format. And again, I would test that by using a blank piece of paper writing top bottom front back on it, and seeing where it prints and make sure you know what the top bottom, you know, and so is then put the checks in in the proper format into the printer.

15:31

Otherwise, you’re going to be wasting checks and having to reprint them so. So it’s going to start with that number and then you can print them all. And it should print you know in order for that for the check numbers. If you’re writing the checks by hand, remember that you could do the same process, you’re just writing the checks out of your checkbook, you’re still putting them into the system in the same format. And you just want to make sure that the checks line up to what you’re going to enter by hand. And now if you write them by hand already, you might want to actually like print them first and then go into the register to see to make sure you the order that they assigned them.

16:04

Because if you write them by hand, it might apply, you know, 104, there’s three checks, you know, in a different order than you apply them. But you can always go into the register and change you know, the check numbers if you so choose, but you’d rather not, you’d rather, you know, not be changing any check numbers. If you’re not actually writing the check and you’re using some other type of payment plan, but you’re using the pay bill feature, then delete the check number, because you don’t want the check number to populate in in that field. Next time you actually write a check, you would like it to populate with the next check in line.

16:37

So that in that case, you just remove the check numbers. Okay, so we’re going to kind of imagine here we’re writing the checks by hand, and we’re going to have to check numbers that want to line line up to the checks that we’re going to be writing by hand. What’s going to happen when we record this it’s a pay bill feature. Anytime you see pay bill, you know that you’re thinking accounts payable is going to go down, the liability is going to go down and The checking account is going to go down as well. So I’m going to go down here and say, Save and Close. Let’s go save and close and take a look at this. So it says the three bills are marked as paid. That’s nice. So let’s go back to our balance sheet then, and I’m going to hold down Control, scroll up a bit, back to that one to five, then if I go into the checking account up top, or in the checking account, we should have some bills or payments of bills. There they are notice to three check numbers that have populated for them.

17:31

So we are, you know, assigning those check numbers assuming these are checks, that thing says pay bills and a check, right. It’s basically saying these are checks here, but they’re different than other types of checks. In which case they wouldn’t have the pay bill. The pay bill means it’s going to be decreasing the accounts payable. And then of course, if we go to the right, we have the amounts that are going down the other side on the splits go into the AP account. If we then click on any of these will go back to that pay bill for Then we’re gonna close this back out. Going to go back up top, gonna go back to our balance sheet. So we’re going to go back to the balance sheet. And then the other side is in the AP accounts payable scrolling down to the liability section Where’s that’s where the AP lives.

18:16

There’s the accounts payable, there’s 1200 in it. If we go into the accounts payable by using the auto zoom feature and scroll down to the bottom of it, we see those pay bill feed items once again, go into the right, there’s our amounts for the amounts related to the PayPal items. The other side, of course go into the checking account in the split column. Going back up top and back to our balance sheet. If we take a look at the profit and loss Has anything happened to the profit and loss on the pay bill side? No, because all the expenses down there that we paid already have been input they were there last time when we entered the bill, not when we pay the bill when we pay the bill, we’re only talking about balance sheet type of items.

18:58

If we take a look at the trial balance, we can see of course, these two sides on the trial balance, which would be the checking accounts and the accounts payable. And it’s probably easier to find them on the trial balance even even though they’re both on the balance sheet. Because you don’t have all the sub accounts you don’t gotta scroll anywhere I could see him on one page. So it’s still useful to be using the trial balance even when you’re talking about a transaction that is only using balance sheet accounts.

19:25

Then if we go to the vendor detail and if we were to refresh the screen with the vendor detailed hope and I’m not sure I refresh the screen with a trial balance either so if the balance was different on the trial balance, then it’s because the screen was not refreshed. If If I refresh the screen here, then there you have the bill, we’re down to just this one bill for the payment that’s at the 1200 so that is left that is still on the books that 1200 of course time out to Let’s go and see if this one is refreshed and today No, it’s not. So I’m going to go ahead and refresh the screen on the trial balance. And there you have, there’s the 1200. So 1200 left ties out to the supporting schedule here.

20:11

If I go back to the first tap now, and hold down Control, scroll down a bit to back to 100%. So it doesn’t do anything funny. As we go around to the data input, go to the expenses tab over here, we’re in the vendors tab up top. And if we were to choose one of these vendors we’ve been dealing with such as, let’s say Edison. So Edison is going to be here’s Edison. If I go into Edison, we could see our transactions here as well. So we had an expense that we did in the in the first month than a bill and then a pay bill. So the bill here and then the pay bill there so you can see the detail through the vendor section if you if we go back to the expenses tab over here, we can also see the detail in the expenses tab up top for the activity related to them. So we have the Purchase Orders. We’ve got the bills and then we have the pay bills.