In this presentation, we’re going to purchase equipment with debt. In other words, we’re going to purchase equipment and finance the entire thing. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s first start off by opening up our reports this time. So I’m going to go down to the reports down below, we’re going to be opening up our favorite report that being the balance sheet report. So let’s open up the balance sheet. Going to change the dates up top those from a 10120 to 1230 120 January through December 2020.

00:33

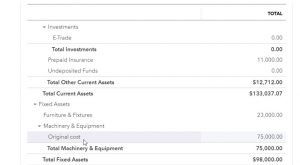

We’re going to run that report. Then I’m going to duplicate this report by going to the tab up top right clicking on it and duplicating that tab up top. Then let’s take a look at our objective on the balance sheet. I’m going to close up the hamburger on the left. I’m going to hold down Control and scroll up a bit to get to that 125 what we’re going to be doing is purchasing equipment. So we’re going to be purchasing equipment as we have in the past which is going to be Going down here into our fixed assets category. So we’re going to be purchasing equipment, we’re going to put it in here into the equipment section.

01:08

The difference here between what we’re doing now and in the past in the past, we simply paid cash for it. This time, we’re going to finance the entire thing. So first of all, just remember, remember that when we purchase the equipment, then we have to deviate from a cash basis, even if we’re using a cash basis for most cases, if we purchase something that’s large of value, because if we were to just simply expense it at the point of time of purchase, even if we paid cash for it, it would heavily distort the profit and loss.

01:35

In other words, if I purchased something for 100,000, even if I paid cash for it, and I tried to and I purchased it in January, and then I tried to compare January in February performance profit and loss, January would have a huge loss, but that’s not really fair because it’s really an investment that we’re putting the money into. And therefore we should put it on the books as an asset. And then we’re gonna have to depreciate it as we consume that asset to help us generate revenue. So that’s the first thing that Deal with with regards to equipment. The second thing that we need to deal with here is that equipment is not a normal type of transaction.

02:08

In other words, it’s not something we do every day, we don’t always buy large pieces of equipment. Therefore, there’s no kind of standardized form for us to use when we do do so. Now when we pay cash for it, we can always just use the check or the expense form to deal with it. But this time, we’re not even going to be paying cash for it. So I can’t just simply go to the register to enter it either. So where do I go, then? Typically, the default then would be a journal entry. So in QuickBooks may call it a journal entry no matter what format we use, or we can also use the registers so I can I can look at the registers and think about an increase and decrease type of format. That’s what we’ll do here, we’re going to look at the register the two accounts that will be affected one, the machinery and equipment two is going to be some type of liability account.

02:54

So if we go down, we’re going to have some type of liability. I’m not going to put it into the accounts payable because this is probably Got a long term liability, like financing a car or something like that, in which case, we have interest involved and things like that, therefore, will typically break it out into its own category, for example, the loans down below. So we’re going to create a note payable for it. Now I’m going to create the note table down here under the long term liabilities, because I want to group all of our notes together, realizing that there may be notes that are that have a short term portion, or if not all short term, in some cases, and we’ll have to break that out, which we will do and the adjusting journal entries.

03:33

So what I’m going to do, we don’t have one set up, I’m going to set up a separate loan for this new or note for this new loan. And so therefore, I’m going to start by going to the register. Here I’m going to go to the register for the machinery and equipment. We’re going to add the machinery and equipment to it increasing the account in the register there. Then we’re going to add another account that being a liability account as we record it, that go into a new note payable account. Alright, so let’s go back to the first tab then, and I’m going to hold down Control, scroll down, we’re going to then go down to our accounting down at the bottom.

04:10

So we’re in the accounting, we’re in the chart of accounts, I’m going to close the hamburger up top we’re looking for and I’m going to be sorting here by the account type. So we’re in the asset accounts were in the other current assets, and then we’re in the fixed assets, we want to be in the fixed assets. You’ll recall the meat machinery and equipment had it had a parent account of machinery and equipment, and then the depreciation and the original cost, we want to be in the original cost item in this setup. So I’m going to be down here in original cost, we’re going to be opening up the register, so I’m going to open up the register.

04:44

So now I’m in the register not for cash, but for the equipment. If I select the drop down, say, Well what kind of forms or transactions are here with relation to it, there are basically very little forms of transfer form or journal entry. So that’s all we have to go by. So I’m going to go with the journal entry. Which is like the last resort according to QuickBooks, kind of like the bare bones, it stripped away the form and just gets down to the journal entry. But we’re still going to enter it not with debits and credits, but with increases and decreases.

05:12

So we’re then going to say that this is going to be Oh to 29. to zero, so to 29 to zero, we’re going to say that we’re going to be paying Office Depot. So say Office Depot, we have seen Office Depot in the past, we’re going to say this is for machinery might want to be more specific than that, like give the serial number of type of machinery and something like that. We’re going to say that this is going to be an increase, it costs us 50,000. And then the other side, this is increasing. Of course, the equipment account, the other side’s not go into cash, but rather some type of note payable we’re financing the entire thing. Now I don’t want to put it in the same note payable account. You could and that’s that’s an option you can have you can say if you have multiple notes payable, you can put it into the No paypal account, and then kind of track them in some other format such as the amortization schedules.

06:06

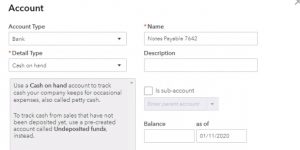

However, it might be useful if you have multiple loans to track them in separate accounts. That’s what will practice doing here. So I’m going to set up a new account, I’m just going to call it notes payable again. And then I might put a different last four digits of the of the loan number on it or something like that. So I can differentiate the note PayPal, or you may even put, you know, this is for Office Depot, or you know, kind of like the vendor on it, which might make it easier to recognize. So then I’m going to say, add that and and and just note that if you have a loan number might be better over the long run. If you’re dealing with the same vendor.

06:41

Obviously, if you have multiple loans from from Office Depot or whoever, then it’ll get confusing. If you simply use you know, Office Depot, you want it then you’d want to need to use the loan numbers, then we’ll go to the drop down up top and we’re looking for a liability type of account. So if I see the bank the assets, we have The other other current liabilities, I’m going to put it into the long term liability, because that’s where we put the last loan in, then it’s going to be a note payable. That’s what we want. And I’m not going to put a subcategory, although note that you could think about doing that if I go like for example, if I go back to the balance sheet, notice they’re there in the subcategory of long term liabilities.

07:22

So there’s only those two notes in there. So if that’s the case, then maybe you just don’t need a sub account. If you have other long term liabilities, then maybe you want to make a sub account of the notes payable and then put your multiple note payable balances in them so that they can be grouped up into that sub account. So I’m going to go back to the register. So we’re not going to have one there. We’re not going to be doing the beginning balance, we’re going to say Save and Close. What’s going to happen when we record this then it’s going to be a journal entry type of format. It’s going to be opening it’s going to be increasing the equipment account. And then it’s also going to be equipped increasing a liability, new liability that we are setting up here. That being noticed payable.

08:00

Let’s save and close and check it out. So there it is, we’re going to go back to our balance sheet, then we’re going to refresh the balance sheet up top. So I’ll select the URL and refresh it. It looks much fresher. All right, I’m going to close up the hamburger, I’m gonna hold down Control, bring it back up to one to five, and then scroll down down, and we see that machinery and equipment. Here’s the original cost, I’m going to go into the machinery and equipment. And that has increased so it’s increased by that 50,000. And we you see the other side it being a journal entry.

08:34

So there’s no form QuickBooks, you know, we’ve seen in the past, we’ve entered things into the register. And QuickBooks basically still had to basically apply to form they still apply to form for it. Here. They couldn’t because there’s no form to really apply to it. So they went they still just went to the journal entry. If you open up the journal entry, it doesn’t go to the register. It goes to a journal entry. So it’s it’s a journal entry has debits and credits. So we’re in the journal entry form with the debt It’s in credits here. So I’m going to close this back out, and then go back up top. Let’s see where the other side is. It’s also on the balance sheet.

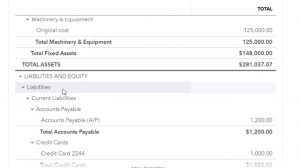

09:09

So if I scroll back down, we put it into the long term. So here’s the notes payable for the long term. Note that here, you can kind of minimize the column again, so that if you want to squish it up, you can and report it in just the notes payable or long term liabilities in this case or see the detail. And within the detail, we’re going to actually apply the account numbers. So in other words, you don’t typically want to see the account numbers or like the name of the vendor or something in the account. However, when you’re bouncing back and forth from the accounts payable or trial balance to the data input, it can be useful to have that information.

09:45

So it could that’s when you might want to use the subcategories, or at least the categories that are given by account type. And that’ll allow you to print a report without that kind of detail, and then have that detail to help you with the data input as you bounce back in forth from the data input to the forms. So then if we go into this 50,000 we’ll see, of course, that journal entry again, and there is the 50,000. There. If I go back up top back to our report summary, is there any effect on the profit and loss or income statement? No. Why? Because we capitalized it or we put it on the books as an asset. And you might say, well, it’s going to affect the current period somehow, and it will, but it’s, it’s going to be with depreciation, and we’ll do that in the adjusting entry process will take this cost and will allocate it to the current time period over what has been consumed with some type of estimate using depreciation and we’ll do that in adjusting entries.