Corporate Finance PowerPoint presentation. In this presentation, we will discuss types of business organizations, including the corporation, partnership, and sole proprietorship Get ready, it’s time to take your chance with corporate finance types of business organizations. Now, as we go through here, note that we’re focusing in on corporate finance, and therefore on the corporate type of business organization, but many of the concepts that we will learn will be applicable to all types of business organizations. Therefore, we want to have a general idea of the different main kind of components or main types of business organizations. So those will include a sole proprietorship, partnership, and a corporation.

Posts with the Business tag

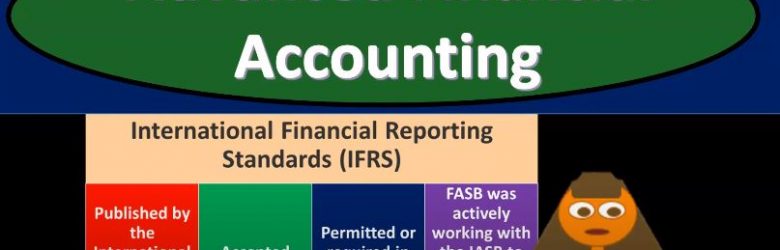

Attempts to Converge to One Set of Global Accounting

Advanced financial accounting PowerPoint presentation. In this presentation, we will take a look at attempts to converge to one set of global accounting standards get ready to account with advanced financial accounting attempts to converge to one set of global accounting standards. When preparing financial statements of global companies, accounting firms must think about differences and accounting principles across national boundaries. So obviously, if we’re a large company, and we have places of business across national boundaries, then we got to think about well, what are the accounting principles and standards in those different locations? And what are the requirements for us to prepare financial statements if doing business in you know, different countries across boundaries that have different accounting standards, differences in currencies that are used to measure the operations of companies in different countries. So again, this is something of course we have to think about it for a large company. We have places of business in our company that are across different different areas. Different countries that have different currencies, that it’s possible that we could be measuring parts of the books and whatnot in different currencies. We need to know what the standards are in different places so that we can meet those standards if we’re a large company. International Financial Reporting Standards IFRS published by the International Accounting Standards Board is ay ay ay ay SB, as the name indicates International Financial Reporting Standards. The goal here or one of the goals is have one set of standards that will go across different areas, different countries, different nations, which could make it easier to do business in different companies or across borders. So it is accepted widely the set of standards and permitted or required in over 100 countries.

Financial Reporting After a Business Combination

In this presentation, we will discuss financial reporting, after a business combination, get ready to account with advanced financial accounting, financial reporting, after a business combination, show the combined entity starting on the date of combination and going forward. So in other words, we probably when we’re imagining this type of scenario, we’re going to say, Okay, I see how this all works out here. And then we imagine this happening if we have a calendar year in a calendar, fiscal year, January through December, we say, Alright, the purchase happens, it will just apply it to January out through December. But obviously, that’s not always the case here. What happens when we have that interim kind of transaction where the purchase happened sometime in the middle of the of the fiscal year then that adds some bit of a complication. So you want to think about this in terms of a clean, you know, year, if it happened at the beginning of the fiscal year in combination, and then you know, what would happen if it did not happen at the beginning of the fiscal year, so if a combination of During a fiscal period, revenue earned by the acquire II before the combination is not reported in revenue for that combined enterprise. So you can see that can add a bit of complication with regards to that reporting

Acquisition Accounting Goodwill

In this presentation, we’re going to continue on with our discussion of acquisition accounting, this time focusing in on the concept of goodwill. Get ready, because it’s time to account with advanced financial accounting. First question is, what is goodwill. So it’s an intangible factors that allow a business to earn above average profits. So the way you might want to think about that is the first thing about a business that isn’t being purchased and sold. If you just got one business that started from scratch, they just started doing business, they started earning revenue, then you can look at their financial statements, they got the they got the balance sheet, assets minus liabilities is the book value of the company, and then the income statement, which is their performance. Now, if you were to say, Hey, is this company worth more than their equity than their assets minus the liabilities than their net assets? In other words, if it is, then you’re saying hey, there must be some intangible factor that’s not really on the balance sheet that would explain the reason why the you know the value of them because most likely through Profit generation, after the the perceived ability, the likely ability to earn profit in the future is greater than just what’s on the balance sheet assets minus liabilities. So you would think then that many companies, if a company is doing well, then there’s going to be some kind of intangible factor there. That’s not basically on the balance sheet that basically explains why the company is doing better than then just the value of the company being assets minus liabilities. So in other words, if we were to purchase the company, you would think that you would purchase it for their assets minus the liabilities, that’s what they consist of, that’s breaking them down to their parts.

Cash Internal Controls Overview

In this presentation, we’re going to introduce the internal controls related specifically to cash, cash internal control goals, these are going to be the objectives of the internal control system over cash, we want to have the cash handling separate from the record keeping. So whoever is handling the cash, we would like to have them not be the same person doing the record keeping. And therefore we have that separation of duties. We have the person that is entering the data, not having as much of an incentive to steal the cash because they’re not the ones handling the cash, the people handling the cash, know that if they do steal it, the record keeping should pick that up, and they are a separate person. cash receipts are deposited to the bank. We want to make sure that the cash receipts are going to the bank as soon as possible, hopefully on a daily basis, so that we’re not actually emulating cash. We don’t want a cash to be piling up, because if it is then we have a greater risk of theft to happen and greater loss if that does happen.