QuickBooks Online 2021 comparative profit and loss, p&l or income statement, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online test drive. When Craig’s design and landscaping services, we’re going to go down to the reports on the left hand side and take a look at a comparative profit and loss. We’re going to construct one from a standard Profit and Loss report.

Posts with the comparative tag

Comparative Balance Sheet Creation 2.35

QuickBooks Online 2021 comparative balance sheet creation, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive practice file, which you can find by searching in your favorite browser for QuickBooks Online at test drive, we’re in Craig’s design and landscaping services practice file, we’re going to be constructing a comparative balance sheet. So we’re going to go down here to the reports. On the left hand side, we’re going to be creating the comparative balance sheet from a standard balance sheet.

Print, Export to Excel, & Create PDF from Reports 2.36

00:00

QuickBooks Online 2021. Now, print Export to Excel and create PDF from reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive were in Craig’s design and landscaping services, we’re now going to be generating a report. And we’re going to be exporting printing and saving as a PDF. Keeping in mind that we want to basically organize our report in such a way that will be as easy to read and open for either our supervisor or our clients or ourselves in the event that we need to get back into them in the future.

Memorize Report 2.45

QuickBooks Online 2021. Memorize report. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive file, which you can find by typing into your favorite browser QuickBooks Online test drive, we’re going to be taking a look at the memorizing of reports function. To do that, let’s go to the reports down below. And we’ll see that the normal tab that you will be on will be the standard tab, you can make the reports favorite of the reports that have already been made by putting that star next to them as we have seen, which will move them up into the Favorites area.

Statement of Cash Flow Indirect Method Change In Accounts Payable

In this presentation, we will continue on with our statement of cash flows using the indirect method looking in on the change in accounts payable, we’re going to be using this information or a comparative balance sheet income statement and other information focusing primarily on comparative balance sheet creating a worksheet with it, looking like this. This basically being the comparative balance sheet. But in a post closing trial balance format, we have our two periods and the difference between those periods here. Our goal is to find a home for all of these differences. Once we do so we’ll end up with basically the change in cash. That being our bottom line that we’re looking for. We’ve gone through this information in terms of the cash flows from operations. We’re currently looking through the current assets, and now we’re moving on to the current liabilities. So we’ve looked at the accounts receivable, the inventory, prepaid expenses, we have these here. We’re moving on now to a liability and notice when we do that, when we’re working From the worksheet, we’re kind of skipping over some things here.

Statement of Cash Flow Indirect Method Change in Prepaid Expense

In this presentation, we will continue with the statement of cash flows indirect method looking at the change in prepaid expenses, we’re going to be using this information, we’ve got the comparative balance sheet, we’ve got the income statement and some additional information, we will be working primarily with the difference in the comparative balance sheet with the use of a worksheet taking this information to create this worksheet. So this is just basically a comparative balance sheet that has been condensed down to something that looks like a post closing trial balance. We are constructing our cash flows from operations from it, we have all of our differences. We’re basically just finding a home for these differences. We know if we do so that if we find a home for all of these differences, then it’ll add up to that difference, the difference in cash, which is basically the bottom line of our cash flow statement, or that’s what we want to get to in terms of adding up the cash flows. So we’ve gotten so far We’re working on the cash flows from operations. And we’ve done the cash flows in terms of the accounts receivable, inventory. Now we’re on prepaid expenses. We’re just going through these.

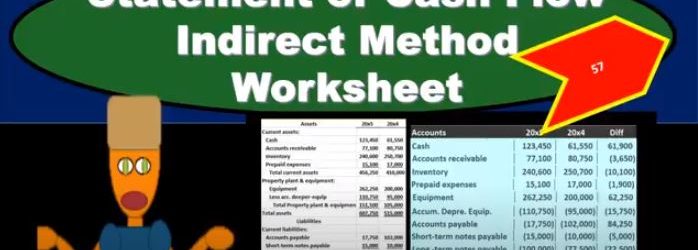

Statement of Cash Flow Indirect Method Worksheet

In this presentation, we will put together a worksheet that will then be used to create the statement of cash flows using the indirect method. To do this, we’re going to use our resources which will include a comparative balance sheet, and income statement and added information. Remember that in practice, we’re typically going to have a comparative balance sheet RS here being for the current year 2005 and 2000. x for the prior year. So we need a comparative to time periods in order to create our worksheet. This will be the primary components that we’ll use to create our worksheet. We will need the income statement when I’m creating the statement of cash flows mainly to check up on some of the differences that we will have in our worksheet. And then in a book problem will typically be told some other things related to for example, purchases of or sales of equipment, borrowings, if we had any cash dividends or any dividends at all, this is added information we would Need. In practice, of course, we would just be checking on these things by looking at the difference and going back to the GL. And just taking a look at those differences in order to determine if we have any added information that needs to be adjusted on our statement of cash flows.