QuickBooks Online 2021 comparative balance sheet creation, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive practice file, which you can find by searching in your favorite browser for QuickBooks Online at test drive, we’re in Craig’s design and landscaping services practice file, we’re going to be constructing a comparative balance sheet. So we’re going to go down here to the reports. On the left hand side, we’re going to be creating the comparative balance sheet from a standard balance sheet.

Posts with the current tag

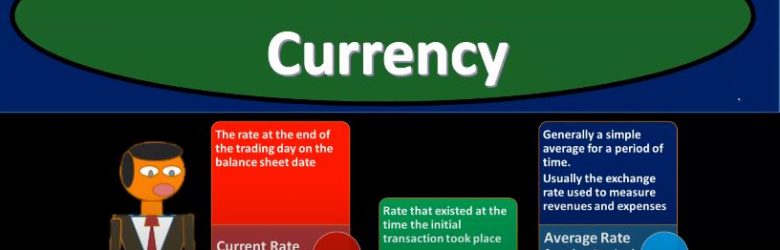

Functional Currency

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss functional currency get ready to account with advanced financial accounting, functional currency. When financial statements are restated from a foreign currency into US dollars, we must consider which exchange rate should be used to translate the foreign currency amounts to the domestic currency. So, when we translate the foreign currency to the domestic currency, we’ll have to determine what our exchange rate Are we going to be using in order to do so how will we account for translation gains and losses? So if there’s going to be a translation gain or loss, what are we going to do with that? In other words, should we put the translation gains and losses as part of the income statement reporting it on the income statement, the gains and losses that are due to the translation process exchange rates that may be used? So what kind of exchange rates might we use during this exchange process? Well, we could use the current rates probably the first thing that comes to mind you say, Hey, we got the financial status. As of the year ended of this time period, why don’t we just use the current rate. And that’s typically what we will do for the balance sheet amounts. And that typically makes sense for the balance sheet amounts, because remember, the financial statements, of course on the balance sheet represents where we are at a particular point in time. So simply converting them makes some sense on the balance sheet. But you also might think, Well, what about those things, you know, that we purchased, like fixed assets at a point in time, maybe we should use the point in time that we had the purchase took place. So you could argue on that on the balance sheet, but the current rate on the balance sheet and makes the most sense, but if you’re looking at the income statement, the current rate might not make as much sense because we’re measuring a timeframe that from a year will, let’s say, for a year’s timeframe from the beginning to the end, so maybe it doesn’t seem quite right to use simply the current rate, which would be the rate as of the end of the financial statements if we’re talking like December 31, rather than using some type of race. That would be representative of the period that would covered being January through December, we could use the historical rate, that’s gonna be the rate that exists at the time the initial transaction took place. And again, this one is often would make sense to us if we’re talking about a situation like if we bought equipment or something like that fixed assets, property, plant and equipment, large purchases that are on the books, we might say, well, maybe we should be putting those on the books at the rate that we should be using at the time, basically, the transaction took place. So maybe we would argue for the historical right there. And then we have the average rate for the period, generally a simple average for a period of time, usually the exchange rate used to measure revenues and expenses.

Statement of Cash Flow Indirect Method Change In Inventory

In this presentation, we will continue putting together our statement of cash flows using the indirect method. Now taking a look at the change in inventory, we’re going to be using our materials here with a comparative balance sheet, the income statement and some added information, working primarily at this time from a worksheet that was made from the comparative balance sheet. So here is our worksheet. Here’s what we have. So far, we basically have a comparative balance sheet in a trial balance type format, where we have the current year, the prior year, and then the difference. Our goal is to find a home for all of these differences are in number that we’re looking for, is basically the 61 900 change in cash. So we’ve gone through this, from top to bottom, we’re working through basically the operating cash flows from operating First, the indirect method. So we started off with the net income, then we made our adjustments. And then now we’re going through basically The accounts receivable to inventory. Now once we get into the current assets, we’re going to group those into this change in current assets under the cash flows from operations. Once we know the theme here on what’s going to happen with these current assets, it’s it’s always going to be the same.

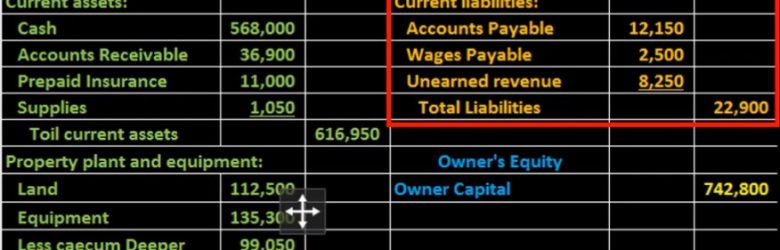

Balance Sheet Liability Section Creation From Trial Balance 14

Hello in this lecture we’re going to create the liability section of the balance sheet. In prior lectures, we have taken a look at the assets in terms of first current assets and then property, plant and equipment and given us the total assets at that time, then we are now going to move on to liabilities, and that will be part of the second part of the balance sheet meaning it’ll then sum up to total liabilities and owner’s equity. We are going to be taking this information of course from the adjusted trial balance the adjusted trial balance in the format of debits and credits, we are now formatting it in the format of the accounting equation. Still the double entry accounting system just in two different formats, just reshuffling the puzzles so that different readers can understand the financial statements even though they don’t understand debits and credits.