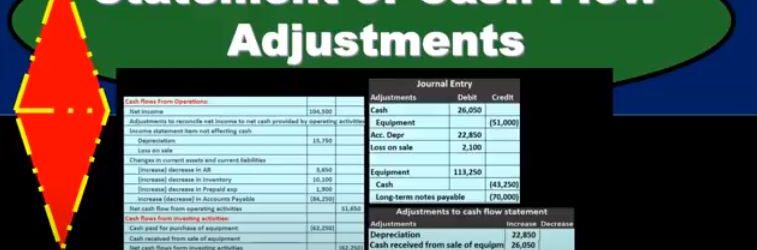

This presentation we will continue on with our statement of cash flows, we’re not going to enter the final adjustments that we will need to finalize the statement of cash flows to bring those last few numbers to the correct balances. In order to do that, we’re going to use this information we’ve got our comparative balance sheet, our income statement and additional information. We put together most of our information so far with the comparative balance sheet, which we made into a worksheet. Now we’re going to use some of these other resources, the income statement, the additional resources to make those final adjustments, those fine tunings that are needed to get those few numbers that we have left and noted into balance. And this is going to be part of the normal practice where once we get this information set up, we can then make some comparisons such as net income does it tie out, such as depreciation does it tie out on the cash flow statement to what we see here on the income statement, then we can have this other information which will be given in both problems in practice, of course, we’ll just go to the gym. General Ledger. And we’ll get this information in a book problem, we don’t want to give all the detail of a general ledger or just when we’re going over an example.

Posts with the Debit tag

Post Closing Trial Balance & financial statements

Hello in this presentation we will discuss the post closing trial balance and financial statements. When considering the financial statement relationship to the trial balance, we typically think of the adjusted trial balance that being used to create the financial statement. It’s important to note, however, that any trial balance that we use can be generated into financial statements. It’s just that the adjusted trial balance is the one that we have totally completed and prepared and ready. In order to create the financial statements to be as correct as possible as of the date we want them, which is usually the end of the month or the end of the year. Note that the names of the unadjusted trial balance the adjusted trial balance and the post closing trial balance are really a convention they’re all basically trial balances.

Closing Process Step 4 of 4 Closing Journal Entry Draws or Withdraws

Hello in this lecture we’re going to continue on with the closing process with step four, the final step of the process which will be to close out the draws. Remember that the objective is to have the adjusted trial balance be converted to the post closing trial balance. adjusted trial balance is what we use to create the financial statements. And the difference between the adjusted trial balance and the post closing trial balance will be that we want to have all temporary accounts including draws revenue and expense accounts to be converted to zero and have all that be in the owner capital account meaning the owner capital account will now be including all these accounts underneath it crunched into basically one number, we’re going to do that with a four step process.

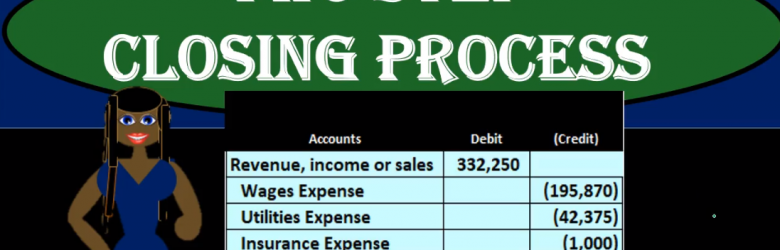

Closing Entries Journal Entry 3 of 4 Step 3 Income summary

Hello in this lecture, we’re going to talk about the closing process step three of the four step closing process, which will include the close of the income summary to the capital account. Remember that our objective is to close out all the temporary accounts, which are all the accounts below capital, including drawers, and the income statement accounts of revenue and expenses. So we want the adjusted trial balance to be converted to the post, post closing trial balance, which means that everything from capital on down will be zero. The way we do that is the four steps and that includes step one we did in a prior video closeout income to the income summary. Step two was to close out expenses to the income summary. Step three is what we’re going to do now close out the income summary now having net income in it to the capital account, then we’re finally going to close out the draws to the capital account.

Closing Step 2 of 4 – Journal Entry 2 of 4

Hello in this lecture, we’re going to talk about the closing process. Step two of the four step process being closing the expense accounts to the income summary. Remember that the goal of the closing process is to close out the temporary accounts that would include the drawers as well as all the income statement accounts, including revenue and expenses to the capital account. So we want our adjusted trial balance to thing we used to make our financial statements to look like the post closing trial balance with all the zeros from the capital accounts down. How do we do that? Last time we did the first step step one, which was to close out income to the income summary. This time we’re going to close out expenses to the income summary. Next time we’re going to close out the income summary to the capital account. And finally closeout draws to the capital account.

Closing Process Step 1 of 4 – Journal Entry 1 of 4

Hello, in this lecture, we’re going to talk about the closing process step one of the step four process. Last time, we talked about the objectives of the closing process, which in essence was to close out the temporary accounts, all the accounts from the draws, and the revenue and expenses on down to zero. Putting that balance into the capital account, we talked about how we were going to do that, we’re going to do a four step process, including closeout, the income to the income summary, and then close out the expenses to the income summary. And then we’re going to close out the entire income summary to the capital account. And finally closeout draws to the capital account. We’re going to start off with step one of those four step processes. In order to do this. We are adding this new account you’ve probably been wondering, income summary account, what is that? Where did it come from? Why is it there? The income summary can be called a clearing account, meaning it’s going to start at zero and it’s going to end at zero right when we’re done with this four step process which we’re going to do basically at the same point. Time.

Two Step Closing Process

Hello in this presentation we will take a look at a two step closing process. In other words, we will perform the closing process using two journal entries. There’s a couple different ways we can see the closing process, each of them having a pros and cons. The two step process is nice because it allows us to see net income broken out and being closed out directly to the capital account, followed by draws, which is similar to what we see when we actually do the statement of equity, meaning that when we do the statement of owner’s equity, we start with beginning balance and then we increase it by net income and decrease it by drawers or dividends. Because this process is similar to that process, it’s often easy to remember it’s the easiest for me to remember in any case, so we will take a look at the two step closing process.

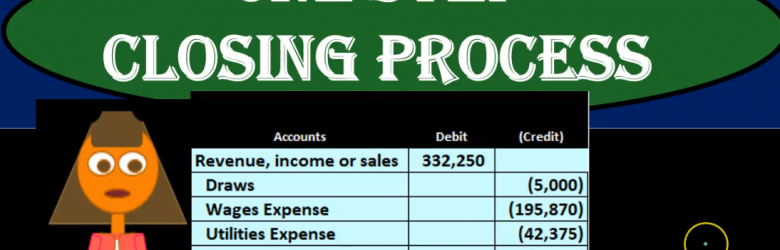

One Step Closing Process

Hello in this presentation, we will be looking at a one step closing process. In other words, we will be closing out temporary accounts using one journal entry. There’s a few different ways that we can perform the closing process. And there’s benefits and cons to each way of doing it. The one step closing process is the simplest way to do it. And it’s also a way that we can imagine what is happening within the closing process as easily as possible a skill useful when considering what’s happening from time period to time period, and how the financial statements are working. So here we’re going to look at a one step closing process. Remember what the closing process is, it’s going to be a process at the end of the time period that we will be performing.

Classification of Cash Flows

In this presentation, we will take a look at classifications of cash flows on the statement of cash flows, there’s going to be three major categories on the statement of cash flows. Those will be operating activities, investing activities, and financing activities. So our goal here, when we go through the statement of cash flow as we work through the statement of cash flows is going to be in part to decide which area these cash flows should go, should they go into operating, investing or financing. It’s going to be common questions and common problems and really just information we need to know when reading the statement of cash flows. So we’ll start off with the operating activities. We’re just going to look at the major components of the cash flows within the operating activities. So we’ll talk about inflows and outflows. Remember what we’re talking about here is cash. So when we’re talking about the statement of cash flows, we’re talking about cash flows, the cash that goes into the company, they cashed out goes out to the company. We’re going to talk about inflows and outflows here related to operating activities. Before we go into the list of inflows and outflows related to operating activities, we want to know first, that operating activities is going to be similar to us thinking about the income statement on a cash basis. So when we think about the operating activities were really thinking or one way to think about it would be that if we were to have the income statement on a cash basis, then what would the inflows and outflows be that’ll basically be what are in the operating activities when we get to the thought process in terms of how to determine operating investing and financing activities.

Bond Retirement

In this presentation, we will discuss the journal entries related to the retirement of bonds. the retirement of bonds just means that we’re going to pay off the bonds in some form or another at some time or another, meaning the bonds are going to go away. Typically, that’ll happen at the maturity date at the end of the bond. So for example, if we have a bond on these terms, with the face amount of 240, the issue price of 198 for 80, for 15 year bonds, they’re going to be semi annual. What would happen is when we put this on the books, we would put it on the books as cash we got for the 198, the bond payable on the books for 240, and then a discount. And then of course, over the life of the bond, we would be paying interest for that 15 year time period two times that’s 30 payments. And then at the end of this we would also be be amortizing out the discount to get rid of it, to make it go away to the interest and then By the end of this time period, the discount would be zero. And we would only be left with a bond on the books. In other words, at the maturity date, we would have something like this on our trial balance, the discount is now zero. And the bond is on the books at 240, which is the face amount of the bond, if it were a premium, it would be it would be the same in that we would be left with just the bond amount and the premium would be gone to zero. And now it’s just like anything else that we don’t have to deal with interest at this point or anything else, we just need to close out the bond. And so it’s just like any other liability, we’re just going to pay at the maturity date. That’s how we’re going to retire it. So this is a 240 credit, we’re going to make it go down by doing the opposite thing to it a debit, and we’re going to pay cash, cash is a debit balance, we need to make it go down. So we’re going to credit cash. So this is going to be our journal entry. We’ll debit the bond make go away, and then we’ll pay off the cash. When we post this then the bond payable will be here. Here, it’s going to go it’s a credit, we’re going to debit it, making it go away to zero, and then the cash has a debit balance, we’re going to credit it making the cash go down. So it’s a pretty straightforward journal entry.

02:12

The only confusing thing about this journal entry is that it happens at the end of the bond term. So when we’re talking about book questions, we often don’t get asked it because usually we’re concentrating on how to calculate the interest how to calculate the face amount of the bond, how to record the bond, how to amortize the the bond, discount or premium. And we don’t really typically get all the way to the end of the bond, the retirement the maturity date, to record the end transaction oftentimes, and it’s a pretty easy transaction if we were to do so. And it’s a lot easier to if we can actually see the trial balance. When you see the trial balance, you say, oh, there’s a liability there. We’re going to pay it just like we would if it were note payable at this time. It needs to go down and then we’re going to pay it off with cash. Now it is possible for us To have a callable bond that we’re going to retire before the end of the bond date before the maturity date. So in other words, in this case, we have the bond on the books of 240,000. And we have the discount of 338 748. And therefore, if we were to calculate the carrying amount, we’d have 240,000 minus 238 748, or two a one 252. This 201 252 is the carrying amount of this bond payable. This is something that we owe in the future. If we can pay it off at this point in time for some cash that’s going to be less than this amount, then we’re going to have a gain resulting in a gain. And if we are paying it off early for something more than this, we’re going to have a loss. So let’s see what that’s going to look like.

03:52

The gain or loss can be confusing here. When we’re talking about a bond. It’s easier to get to that point by just doing the journaling So if we have all this information, especially if we have the trial balance, because then we can see what accounts are debited and credited on the trial balance or which accounts have a debit or credit balance, then it’s a lot easier for us to construct the journal entry. So the first is going to be given to us, we’re going to say that the cash that we’re paying is 230,000. That’s gonna have to just be given in the problem because that’s the callable price that’s how much we’re able to purchase these bonds for. So cash is going to go down because remember, we are buying them back basically, or we’re we’re paying them off early before the maturity date. So it’s going to be 230. Then we’re going to say that the bond payable has to go off the books. Now the bond payables on the books at 240,000, we can see it’s a liability, it has a credit balance. So to take it off the books, we do the opposite thing to it, a debit for whatever it needs to be to make it go to zero, the discount. Same thing we need to do whatever we need to do to make it go to zero because it’s Gotta go away. So when we construct the journal entry, we just know that we just got to do whatever we need to do to make it go to zero. If you have a trial balance in front of you, that’s easy to do, because we can see the discounts on the books at a debit. And we need to do the opposite to make it go down, which is a credit. If you’re looking at a book problem that doesn’t give you a trial balance, and just tells you that the bond is on the books at a discount, then you got to think through it. And one way to think through it might be to say, well, the bonds is a liability, it must be a credit, that discount means that we’re making the bond go down, because it must be decreasing, we’re having it less than the state, the face amount, the sticker price.

05:40

And since it’s a credit, the thing that makes a credit go down would be a debit. So that discount must be a debit because these two are really combined together. And a discount means that we we really the net of the two are below the face amount price, so this must be a debit. So if it were a premium, then this amount be increasing or greater than the face amount, and it would be a credit normal balance. Once we know that this is a, this is a debit normal balance for a discount, then we can do the opposite thing to it to credit it to make it go down. And then of course, we just need to figure out what the difference is we’ve got credits of 230,038 748 minus the 240. Debit means we need a 28 748 debit. And that of course, in this case, I’m going to say it’s a gain loss account here because it could have gone either way. But if it’s a debit here, then it’s on the income statement. That’s going to be a loss. And you just got to basically start to be able to recognize that why would that be a loss? Well, you can think through that. We paid 230 versus the carrying value, or you can also just think well, if it’s a debit on the income statement, It’s acting more like an expense, meaning expenses have debit balances, they go up in the debit direction, and they bring net income down.

07:08

Revenue has a credit balance, it brings net income up. This is acting like a, an expense because it’s a debit balance. If we debit the income statement, it’s going to make net income go down, that means it must be a loss rather than a gain, which we would think would make net income go up. So the other way we can think about this is to is remember, the carrying value is going to be the 240,000 minus the 38 748. So this is kind of a value that we owe on the bond. And it’s a liability, that’s kind of the value we owe and we paid more than the value that we owe. So that’s going to be a loss in this case. And that’s another way you can think through it being a loss. So if we post this out, then we’re going to say that the gain or loss 28 748 Here, making the income statement accounts go up, kind of like an expense bringing net income down. The bond payable will be posted here, it’s going to make the bond payable go to zero. That’s why we are retiring. It’s making it go away. And then we’ve got the discount, it’s going to make the discount go to zero because we’re retiring it as well. And then the cash is going to be here, cash is going to go down. So there’s going to be our transaction. We have the bond payable and discount going away which has to be the case if we’re retiring the bonds. The cash is going down for the early retirement. And we resulted in a loss in order for us to be able to retire the bonds early.