QuickBooks Online 2021 journal report. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports on the left hand side, we’re going to go all the way down to the accounting reports looking for the journal report, which after this point in time, you might find by simply typing up top for it, but right now we’re going to scroll on down.

Posts with the Debits tag

Finance, Accounting, & Economics 110

Corporate Finance PowerPoint presentation. And this presentation we will discuss the differences between finance, accounting and economics, the differences between the fields of finance, accounting and economics Get ready, it’s time to take your chance with corporate finance, there’s a lot of overlap and differences between the fields of finance, accounting and economics, what we want to do is think about those differences. And where that overlap is, as we do so we will do so from the perspective of corporate finance, because that’s the objective of our viewpoint here for this particular course.

Accounting Building Blocks

Hello in this lecture we will discuss the accounting building blocks and the double entry accounting system. At the end of this we will be able to define and describe the double entry accounting system, write down the accounting equation and define each individual part of it, define and describe debits and credits, define a balance sheet and list its parts define an income statement list its parts and explain the relationship between the balance sheet and the income statement. Okay, so starting off every business and accounting software uses the double entry accounting system. So the double entry accounting system, it’s kind of like the math behind the calculator, every software is going to use it. In order to understand what the system is doing, we need to understand the double entry accounting system.

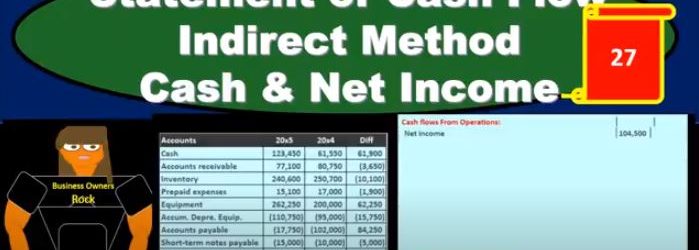

Statement of Cash Flow Indirect Method Cash & Net Income

This presentation, we will start to construct the statement of cash flows using the indirect method focusing in on cash and net income. This is going to be the resources we will have, we’ll have that comparative balance sheet, the income statement, and we’re gonna have some added information. In order to construct the statement of cash flows, we’re mainly going to be working with a worksheet that we’ve put together from a comparative balance sheet. That’s where we will start. So we’re going to find a home, this is going to be our worksheet. We have the two periods. So we have the current year, we’ve got the prior year, and we’ve got the difference between those activities. Now our goal here is to basically just find a home for every component on this difference section. So that’s going to be our home. Why? Well, we can first start thinking about cash. What are we going to do with cash? That’s the main thing. This is a statement of cash flows here. So where are we going to put cash? that’s actually going to start at the bottom, we’re going to say that’s going to be our in numbers. In number we know it’s going to be cached. Now, we’re going to recalculate it. But it’s useful for us to just know and we might just want to put there, hey, that’s where we’re going to end up. That’s where we are looking to get. And now what we really want is the change.

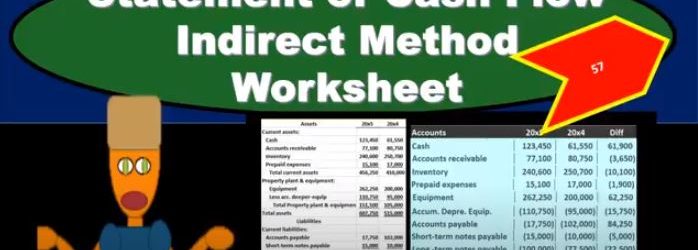

Statement of Cash Flow Indirect Method Worksheet

In this presentation, we will put together a worksheet that will then be used to create the statement of cash flows using the indirect method. To do this, we’re going to use our resources which will include a comparative balance sheet, and income statement and added information. Remember that in practice, we’re typically going to have a comparative balance sheet RS here being for the current year 2005 and 2000. x for the prior year. So we need a comparative to time periods in order to create our worksheet. This will be the primary components that we’ll use to create our worksheet. We will need the income statement when I’m creating the statement of cash flows mainly to check up on some of the differences that we will have in our worksheet. And then in a book problem will typically be told some other things related to for example, purchases of or sales of equipment, borrowings, if we had any cash dividends or any dividends at all, this is added information we would Need. In practice, of course, we would just be checking on these things by looking at the difference and going back to the GL. And just taking a look at those differences in order to determine if we have any added information that needs to be adjusted on our statement of cash flows.

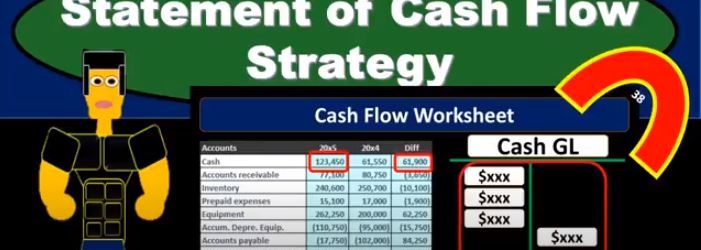

Statement of Cash Flow Strategy

In this presentation, we will take a look at strategies for thinking about the statement of cash flows and how we will approach the statement of cash flows. When considering the statement of cash flows, we typically look at a worksheet or put together a worksheet such as this for my comparative balance sheet, that given the balance sheet accounts for the current year and the prior year or the current period, and the prior period, and then giving us the difference between those accounts. So we have the cash, we’ve got the accounts receivable inventory, we’re representing this in debits and credits. So this is in essence going to be a post closing trial balance one with just the balance sheet accounts, the debits represented with positive and the credits represented with negative numbers in this worksheet, so the debits minus the credits equals zero for the current year, the prior year. And then if we take the difference between all the accounts, and we were to add them up, then that’s going to equal zero as well. This will be the worksheet that we’re thinking about. Now. When can In the statement of cash flows, we can think about the statement of cash flows in a few different ways. We know that this, of course, is the change in cash, this is the time period in the current time period, the prior year, in this case, the prior period, the difference between those two is the difference in cash.

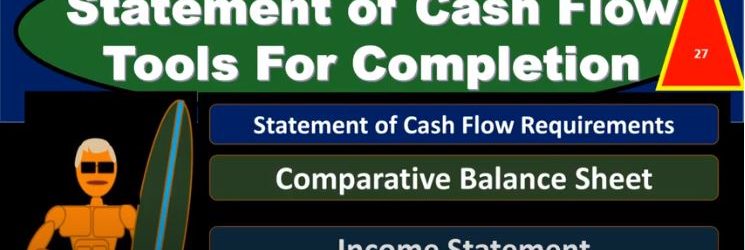

Statement of Cash Flow Tools For Completion

This presentation we will take a look at the tools needed in order to complete a statement of cash flows. to complete a statement of cash flows, we are typically going to need a comparative balance sheet that’s going to include a balance sheet from the prior period, whether that be the prior month or the prior year and a balance sheet from the current period, then we’re going to have to have an income statement. And then we’ll need some additional information in a book problem, it’ll typically give us some additional additional information often having to do with things like worth an equipment purchases, whether equipment purchases or equipment sales, were their investments in the company where their sales of stocks, what were the dividends within the company. In practice, of course, we would have to just know and recognize those types of areas where we might need more detail. And we would get that additional information with General Ledger we’d go into the general ledger, look at that added information. Now once we have this information, our major component we’re going to use is going to be the comparative balance sheet. That’s where we will start. So that comparative balance sheet is going to be used to make a worksheet such as this.

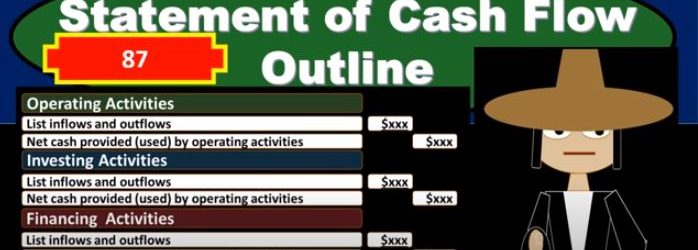

Statement of Cash Flow Outline

In this presentation, we will take a look at a basic outline for a statement of cash flows. In order to do this, we first want to give an idea of how the statement of cash flows will be generated. So we can think about these components of the statement of cash flows and where they come from. Typically, we will have a worksheet such as this that we will use in order to generate the statement of cash flows. That statement of cash flows, having three major components, operating activities, investing activities, and financing activities. Our goal here is going to be to fill out these three components and typically we will use a worksheet such as this on the left. The worksheet is just basically a comparative balance sheet that we have here that we’ve reformatted from a balance sheet to just a trial balance type format, a debit and credit type format. So you can see that we have our balance sheet accounts, and we are imbalanced by having the debits the positive and the credits be negative or debits. Minus the credits equaling zero, given it’s an indication that this period, the current period that we are working on, is in balance, the prior period, same thing. So we have two points in time for to balance sheet points the prior year, or period the prior year in this case and the current year. And then we just took the difference between these two columns. And if we have something that’s in balance, here, the debits minus the credits equals zero, something that’s in balance here, the debits minus the credits equals zero. And then we take the difference of each line item in these columns. And some of those differences, it too must add up to zero. So in essence, what we’re going to do in order to create the statement of cash flows is find a home for all these differences. And that’ll give us a cash flow, a concept of the cash flow statement. We’ll get into more detail on how to do that when we create the cash flow statement. But as we look at the outline, keep that in mind. So here’s going to be the basic outline for the state. cash flows, we’re going to have the operating activities. That’s going to include a list of inflows and outflows from the operating activities. And then we’re going to have the net cash provided by the operating activities. Now, this list of inflows and outflows for the operating activity will be the most extensive list because the operating activities are in relation to you can think of it as similar to the income statement.

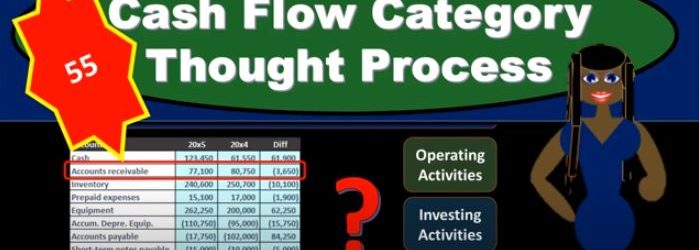

Cash Flow Category Thought Process

In this presentation, we will think about the thought process to know which category a cash flow should be entered into whether it should be operating, investing or financing activity. When putting together the statement of cash flows, we’re usually going to have a worksheet, which will typically have a comparison of balance sheet accounts. And we also might just have test questions that will ask us, where should this cash flow go? And that’s going to be a common kind of question that we’re going to have whether we build the entire cash flow statement from scratch, or whether we’re just asking test test questions and trying to know what types of Cash Flows we’re talking about. It’s also important for practice as well so that we can understand when we’re thinking about cash flows, where do they belong? What are these cash flows mean? What are they doing for us? What are they doing for the company? Are they part of the operations? Are they part of investing? Are they part of financing? If we look at a worksheet like this to build the statement of cash flow, typically we’re going to look at a balance sheet for two periods. So here our balance sheet for these two periods. And we’ll have the difference between the two periods in terms of the balance for these balance sheet accounts. So we’ve got cash, accounts receivable, inventory, prepaid expenses.

01:13

Now what we’re going to do is we’re going to take the change in cash, that’s going to be the end result on our statement of cash flows. And we’re going to kind of back in to that end result by looking at the change in the other balance sheet accounts and tried to figure out what’s causing this change. So we’re going to go through all the other balance sheet accounts, look through these changes. And we know that if we look if we add them all up, they add up to zero. Why? Because the debits and credits for one year, add up to zero the debits and credits for the other year add up to zero. In other words, the debits minus the credits equals zero. And therefore the difference between the two years debits and credits the change will add up to zero. So we know that’s the case and we know that if we add up then everything except cash Then the result will be the difference in cash. So that’s how we’re going to kind of work and put together our statement of cash flows. So what we need to do then is we’re going to take a look at these changes in receivables, changes in inventory changes in prepaid expenses, and then try to determine where does that change belong? Before we get into any other question is, is the change of inventory and operating, investing or financing activity? And is the change in long term notes payable? Is that going to be an operating investing or financing activity? Our goal here is to go through a thought process to see if we can think through more clearly which category these these should be belong to. So what’s the most common journal entry in this account? It’s going to be our first question.

02:48

Whatever account they’re given us here, we’re going to say it let’s think about the most common journal entry that’s related to this account, there’s typically going to be one or two journal entries that are going to be very common and we want just right down first, once we know the most common journal entry, then we’re going to ask is an income statement account involved? So when we think about whatever account we’re dealing with, we’d write down the journal entry and say, Okay, is there an income statement account involved? Is there a revenue account or an expense account involved? If the answer is yes, then it’s probably the change that we’re dealing with is probably something that should be in the operating activities. Because remember, the operating activities is kind of like the income statement on a cash basis. So if we’re dealing with something that’s this change has something to do with the income statement, then it’s going to be something on the operating activities. Typically, if the journal entry has nothing to do with the income statement, there’s no revenue or expense accounts involved in the normal journal entries related to these accounts, then we’re going to ask the question, are we purchasing or selling an asset? Because it’s so if it’s not operating, this means that it’s not operating therefore, We’re trying to see if it’s going to be investing activity. And that typically means we’re purchasing or selling an asset. If it has to do with, for example, property, plant and equipment, or some other type of investment, then it’s going to be an investing activity. And then if it’s not, then it’s going to be financing. And of course, financing is going to be dealing with notes, something that we’re dealing with that doesn’t deal with operating activities in terms of the income statement, no revenue and expenses, and typically doesn’t have assets involved either, because what we’re doing is funding the company. So that’s typically going to be something that deals with cash and subtype of liability or the equity section. So this is going to be our thought process if we go through each of those line items, and think about each account on the balance sheet.

04:46

And then try to go through this thought process and think okay, which category are we going to be putting this change to? Now, this looks a little less intuitive than we might think at first glance here because no one We’re doing we’re looking at the balance sheet accounts. And we’re trying to see what category these things are going to fit into. And remember that the operating activities I’m keep on comparing that to the income statement. And you might be thinking, well, these are all balance sheet accounts. Why do you keep mentioning the income statement. And note, what we’re doing here is we’re really kind of backing into the activity is happening by looking at the change in two points in time. So we’re kind of still looking at the income statement activity type of accounts, we’re looking at change, we’re looking at activity, even though we’re doing that by looking at the change in two points in time to balance sheet accounts, which are points in time. So when we look at the change in accounts receivable for example, if we go through our thought process, we’re going to say okay, accounts receivable was at 80,007 50. In the prior year, end of the current year, it’s at 77,100.

05:51

That means it went down by 3650. So our goal here is just to determine which category That change belongs to it’s an operating, investing or financing. And if we think about that, then we could think Well, what’s the normal journal entry related to accounts receivable? We’re going to have a debit to accounts receivable and a credit to sales. That’s going to be our normal journal entry that we’ll have related to accounts receivable. And we can see there that sales is an income statement account. So we know that it is an income statement account involved, we’re going to say yes, therefore, it’s an operating activity. So note what we’re doing here, we’re looking at the change in a balance sheet account. We’re looking at the change in the balance sheet account, then ask yourself, what’s the normal journal entry related to this account? And if we think about the normal journal entry related to accounts receivable, that’s a sale of something on account. So accounts receivable goes up when we make a sale on account, and we credit revenue and revenue is clearly an income statement account. So this Change, then that’s what we’re going to think through, we’re going to say that change looks like it belongs somewhere in the operating activities. Because we’re dealing, we’re really kind of backing into sales. That’s what we’re really looking at. And we’re going to do that by writing down the journal entry. Let’s look at another account. We’re going to pick equipment now. So we’re just going to go through all these changes. And we just got to find a home for all these changes.

07:21

When we when we make the statement of cash flows. We got to find a home for them in either operating, investing or financing. And we’ll end up with the change in cash, which is kind of like the bottom line. The bottom line will be cashed at the end of the day. So we’re going to find a home for the equipment. Where’s that going to go that change? Well, if we think about the journal entry for equipment, then if we buy equipment, we’re going to debit equipment, and credit cash and possibly credit like a note payable, some type of financing. But if we pay cash for it, this would be the most simplified journal entry. Even if we had a note there’d be no Part of it that would be on the income statement, one asset went up, the other asset is going down. So therefore, is the is an income statement account involved? No. So we’re purchasing or weren’t, so it’s not going to be an operating activity. And then the next question is, are we purchasing or selling an asset? In this case, yeah, we’re purchasing an asset. And that means that it’s going to be an investing activity. So and this was the confusing thing for me when I first started learning this thing, because investing activities, I had a different conception of what investing is to invest in something like any asset any anything we purchase in the business that we’re not consuming now is an investment to the future. In terms of the cash flow statement, we’re trying to spend our cash in order to put our money somewhere that’s going to help us make money in the future. That’s going to be some type of investment. So in this case, it’s going to be an investing activity.

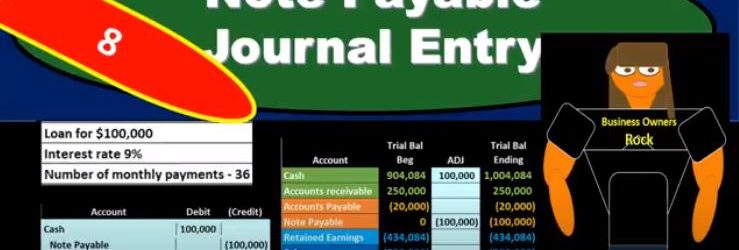

Note Payable Journal Entry

In this presentation, we will record the journal entry related to a note payable related to taking out a new loan from the bank. Here’s going to be our terms. We’re going to record that here in our general journal and then we’ll post that to our worksheet. The trial balances in order assets, liabilities, equity, income and expenses, we have the debits being non bracketed or positive and the credits being bracketed or negative debits minus the credits equaling zero net income currently at 700,000 income, not a loss, revenue minus expenses. The difficult thing in terms of a book problem, when we record the loan is typically that we have too much information and this is the difficult thing in practice as well. So once we have the terms of the loan, and we have the information, we’ve already taken the loan out, then it’s the question of well, how are we going to record this thing? How are we going to put it on the books and if we have this information here, if we have a loan for 100,000, the interest is 9%. And then the next number of payments that we’re going to have, we’re going to pay back our 36. Then how do we record this on the books? Well, first, we know that we can ask our question is cash affected? We’re going to say, Yeah, because we got a loan for 100,000. That’s why we got the loan.

01:14

So cash is a debit balance, it’s going to go up with a debit, so we’ll increase the cash. And then the other side of it is going to be something we owe back in the future. And that’s going to be note payable. And that’s as easy as it is to record the initial loan. The problem with this the thing it’s difficult in practice, and in the book question is that we’re often given, of course, the other information, like the interest in the number of payments, and possibly more information that can cloudy up the what we’re doing, and the reason these are needed, so that we calculate interest in the future, but they’re not really We don’t even need that information to record the initial loan. All we need to know is that we got cash and we owe it back in the future. And you might be asking, Well, what about the interest we owe interest in the future as well? We do, but we don’t know it yet. And that that’s the confusing thing interest, although we we will pay interest and we know exactly how much interest we’re going to pay in the future. We don’t owe it yet. Why don’t we owe it yet? Because we’re going to pay back more than 100,000. Why don’t we Why don’t we record something greater than 100,000? You might say, because we know we’re going to pay more than 100,000. And that’s because the interest is something that it’s like rent. So we’re paying rent on the use of this 100,000. And just like if we if we had a building that we rented, that we’re using for office space, we’re not even though we know we’re going to pay rent in the future. We’re not going to record the rent now. Because we haven’t incurred it until we use the building.

02:41

So the same things happening here. We know we’re going to pay interest in the future we’re no we know we’re going to pay more than 100,000 but it hasn’t happened yet. We haven’t used up we haven’t gotten the use of this hundred thousand and therefore haven’t incurred the expense of it yet. So the interest and is something we need to negotiate when making To turn off the loan, but once the loan has been made, and we’re just trying to record it, it’s not going to be in the initial recording. It will be there when we calculate the payments need and the amortization table. So the initial recording is pretty straightforward. We’re just going to say okay, cash is going to go up by 100,000. And then the notes payable is going to go up from zero in the credit direction to 100,000. So what we have here is the cash increasing the liability increasing, although we got cash, there’s no effect on net income because we haven’t incurred any expenses. We’re going to use that cash most likely to pay for expenses possibly or pay for other assets or pay off liabilities in order to help us to generate revenue in the future. But as of now, we’ve gotten we increase an asset and we increase the liability