QuickBooks Online 2021 bank reconciliation month one or the first month of the bank reconciliation we’re going to be focusing in on the deposit side of the process. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars a practice file continuing on with our bank reconciliations. So we’re first going to be opening up our balance sheet report and duplicating the tab up top to do so. So I’m going to go up top right click on the tab, duplicate it, then we’re going to go down to the reports on the left hand side selecting our favorite report that being the balance sheet report.

Posts with the difference tag

Comparative Balance Sheet Creation 2.35

QuickBooks Online 2021 comparative balance sheet creation, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive practice file, which you can find by searching in your favorite browser for QuickBooks Online at test drive, we’re in Craig’s design and landscaping services practice file, we’re going to be constructing a comparative balance sheet. So we’re going to go down here to the reports. On the left hand side, we’re going to be creating the comparative balance sheet from a standard balance sheet.

Subsidiary Purchases Shares from Parent

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a subsidiary that purchases shares from the parent. So what’s going to be the effect on the consolidation process? When we have a subsidiary that purchases shares from a parent get ready to account with advanced financial accounting. We are talking about a situation here where this subsidiary is purchasing shares from the parent what’s the effect on the consolidation process? In the past, the parent has often recognized a gain or loss on the difference between the selling price and the change in the carrying amount of its investment. So in the past, it’s often been recorded as a gain or loss on parent companies that difference as a gain or loss on the parent company’s income statement.

Statement of Cash Flow Investing Activities Cash Paid for Purchase of Equipment

In this presentation, we will continue on with our statement of cash flows. Taking a look at the investing activities, specifically the purchase of equipment, we’re going to be using the comparative balance sheet, the income statement and additional information focusing here on the comparative balance sheet, which we use to make this worksheet. So this worksheet is our comparative balance sheet. We’ve been going through this worksheet and really looking for the differences. We’re finding a home for all the differences. Once we do that, we’re feeling pretty good. We have done this all the way through the operating activities. So are the cash flows from operations. So we’ve gone through here we’ve kind of picked and choose the items that are going to be cash flows from operations, which is probably the way most people approach this. But just note that as we’ve done that, we’ve tried to pick up the exact differences here. We haven’t gone to the income statement and thought about it separately outside of this worksheet, and then we’re going to go back and make adjustments. So we found a home for the difference in cash because that’s Kind of like our bottom line. And then we’ve got accounts receivable, inventory prepaid expenses, and then we skipped equipment and went down to accounts payable.

Statement of Cash Flow Indirect Method Change in Prepaid Expense

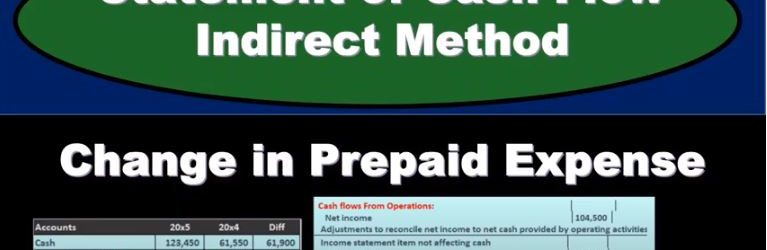

In this presentation, we will continue with the statement of cash flows indirect method looking at the change in prepaid expenses, we’re going to be using this information, we’ve got the comparative balance sheet, we’ve got the income statement and some additional information, we will be working primarily with the difference in the comparative balance sheet with the use of a worksheet taking this information to create this worksheet. So this is just basically a comparative balance sheet that has been condensed down to something that looks like a post closing trial balance. We are constructing our cash flows from operations from it, we have all of our differences. We’re basically just finding a home for these differences. We know if we do so that if we find a home for all of these differences, then it’ll add up to that difference, the difference in cash, which is basically the bottom line of our cash flow statement, or that’s what we want to get to in terms of adding up the cash flows. So we’ve gotten so far We’re working on the cash flows from operations. And we’ve done the cash flows in terms of the accounts receivable, inventory. Now we’re on prepaid expenses. We’re just going through these.

Statement of Cash Flow Indirect Method Adjustments to Reconcile Net Income to Net Cash Provided

In this presentation, we will continue putting together a statement of cash flows using the indirect method focusing in on adjustments to reconcile net income to net cash provided by operating activities. So this is going to be the information we will be using, we have the comparative balance sheet, the income statement added information, we took this comparative balance sheet to create our worksheet. So here is our worksheet for two time periods. This is the difference we’re basically looking to find a home for all of these differences we have done so with cash, and we’ve done so with a difference in retained earnings. So here’s cash, here’s net income, the difference in retained earnings, we will have to adjust net income shortly or at the end of the problem. We’ll we’ll take a look at that we’ll make an adjustment for it. We’re going to now find the difference for all the rest of these. Also note that of course cash is going to be the change in cash will be our bottom line. Never we’re going to recalculate this But it’s nice to know where we are ending up at. So this is kind of like even though it’s at the top of our worksheet, that’s where we want to end up by finding a home for everything else. So now we’re going to take a look at the adjustments to reconcile net income to net cash provided by operating activities. So these are going to be those types of things that we look at the income statement, and we’re going to say that these are non cash activities, meaning income is calculated as revenue minus expenses. And the cash flow.

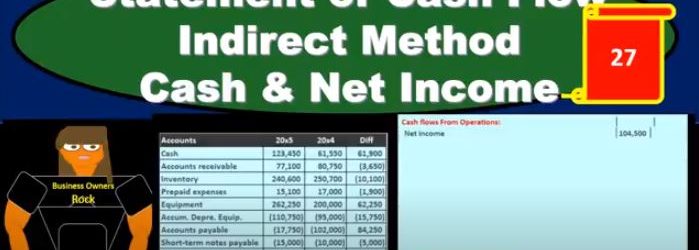

Statement of Cash Flow Indirect Method Cash & Net Income

This presentation, we will start to construct the statement of cash flows using the indirect method focusing in on cash and net income. This is going to be the resources we will have, we’ll have that comparative balance sheet, the income statement, and we’re gonna have some added information. In order to construct the statement of cash flows, we’re mainly going to be working with a worksheet that we’ve put together from a comparative balance sheet. That’s where we will start. So we’re going to find a home, this is going to be our worksheet. We have the two periods. So we have the current year, we’ve got the prior year, and we’ve got the difference between those activities. Now our goal here is to basically just find a home for every component on this difference section. So that’s going to be our home. Why? Well, we can first start thinking about cash. What are we going to do with cash? That’s the main thing. This is a statement of cash flows here. So where are we going to put cash? that’s actually going to start at the bottom, we’re going to say that’s going to be our in numbers. In number we know it’s going to be cached. Now, we’re going to recalculate it. But it’s useful for us to just know and we might just want to put there, hey, that’s where we’re going to end up. That’s where we are looking to get. And now what we really want is the change.

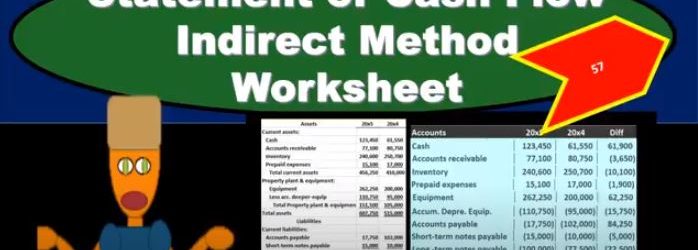

Statement of Cash Flow Indirect Method Worksheet

In this presentation, we will put together a worksheet that will then be used to create the statement of cash flows using the indirect method. To do this, we’re going to use our resources which will include a comparative balance sheet, and income statement and added information. Remember that in practice, we’re typically going to have a comparative balance sheet RS here being for the current year 2005 and 2000. x for the prior year. So we need a comparative to time periods in order to create our worksheet. This will be the primary components that we’ll use to create our worksheet. We will need the income statement when I’m creating the statement of cash flows mainly to check up on some of the differences that we will have in our worksheet. And then in a book problem will typically be told some other things related to for example, purchases of or sales of equipment, borrowings, if we had any cash dividends or any dividends at all, this is added information we would Need. In practice, of course, we would just be checking on these things by looking at the difference and going back to the GL. And just taking a look at those differences in order to determine if we have any added information that needs to be adjusted on our statement of cash flows.

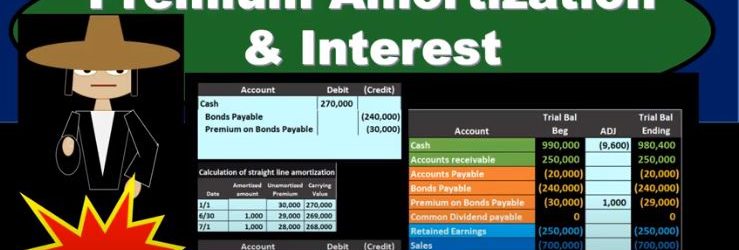

Premium Amortization & Interest

In this presentation, we will discuss the amortization of a bond premium and the recording of interest expense on bonds. This is going to be our starting point. This is the initial transaction in order to get the bonds on the books. Here’s our data down here we’ve got the number of years we’ve got the face amount of the bonds, we’ve got the issue price 270, we see that the interest on the market rate is different than the contract rate. The result then is that cash is going to be increased by the 217. The bonds payable went on the books for the face amount of the bond, the amount that’s on the bonds of the 240, which is a liability. And then we have the premium being the difference increasing the premium here by the 30. The 240 plus 230 is going to be equal to the 270,000 carrying amount book value of the bonds. Now we’re going to go through the process of recording the interest we can see that this is going to have 15 years bonds, we’re going to pay the bonds semi annually. So we’re going to have to record the interest on them. And we’re gonna have to reduce this premium in some way as well. Remember, at the end of the bonds, we’re not going to pay back the 270. We’re only going to pay back 240. So how are we going to get rid of that the premium on the bond and why are we going to do it in the way we will. We’ll start off by amortize in the premium using a straight line the method. Note that the effective method is the preferred method for amortize in a premium for generally accepted accounting principles, but the straight line method will be appropriate in some cases, if the difference is going to be a non material. And the straight line method is a simplified method and it’s easy for us to see what is going on. So we’ll start off with the straight line method.