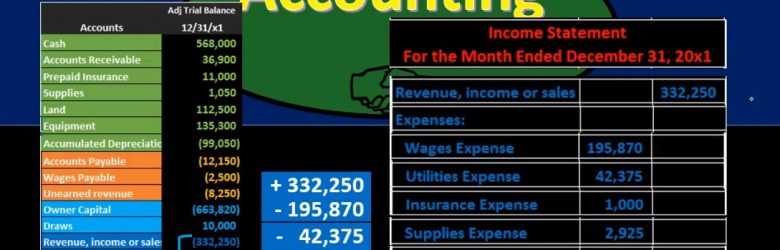

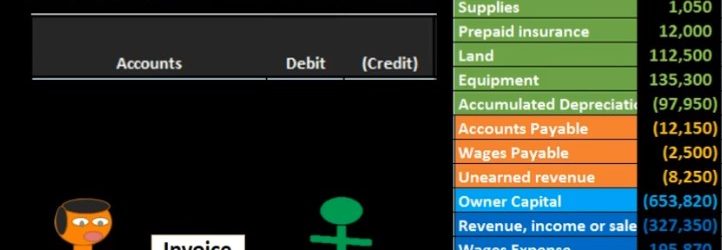

Hello in this presentation we’re going to take a look at the creation of the income statement from the trial balance. First, we want to take a look at the trial balance and consider where the income statement accounts will be. When looking at the trial balance, it will be in order we have the assets in green, the liabilities in orange, the equity in light blue, and then the income statement accounts including revenue and expenses. That’s what we are concentrating here we’re looking at those income statement accounts. And that is what will be used in order to create the financial statements to create the income statement. Note that all the blue accounts represents the equity section. So the income statement really is going to be part of total equity. If we consider that on the balance sheet, then we’re really looking at a component of this capital account.

Posts with the financial statements tag

Balance Sheet Equity Section Creation from Trial Balance 15

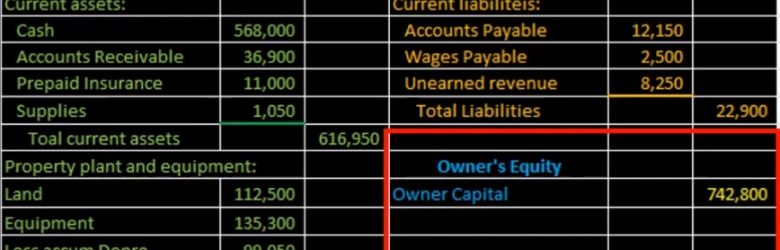

Hello in this lecture we’re going to be creating the equity section of the balance sheet. In prior lectures, we have taken a look at the current assets section, the property plant and equipment section and then the liability section. This will be rounding out the balance sheet where we will finally get to total assets being equal to total liabilities and equity represent in the double entry accounting system. In terms of the balance sheet in terms of the accounting equation, we of course, are pulling these numbers from the adjusted trial balance. the adjusted trial balance also represents the double entry accounting system. However, it represents that double entry accounting system in the format of the building blocks of debits and credits. All we’re doing is taking those building blocks in terms of debits and credits, rearranging them to the accounting equation, so that readers who don’t understand debits and credits can then read them. Now when we look at the equity section, this is a bit confusing when we convert from the trial balance to the equity section.

Balance Sheet Property Plant %26 Equipment From Trial Balance 13

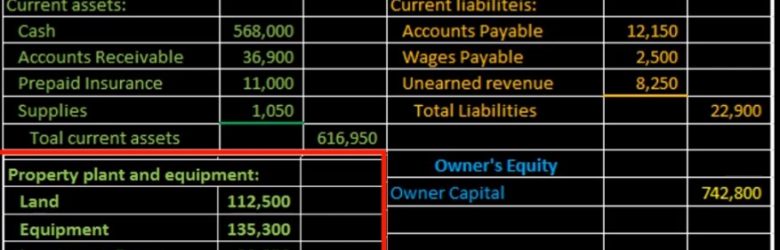

Hello in this lecture we’re going to put together the section of the balance sheet of property plant and equipment from the trial balance property, plant and equipment will be part of the assets can be the subcategory of assets, we talked last time about the creation of the current assets. And now we’ll be moving on to property, plant and equipment, which will then sum up everything for total assets. We will be picking these numbers up from a trial balance. And once we have completed all the financial statements, what we’re basically doing is taking a debit and credit format from the trial balance, converting it to a plus and minus format in terms of the financial statements, assets, equal liabilities plus owner’s equity so that people can read it even if they don’t understand debits and credits. In this lecture, we’re focusing in on this section here, which will be a land equipment and each cumulated depreciation.

Balance Sheet Current Assets from Trial Balance 12

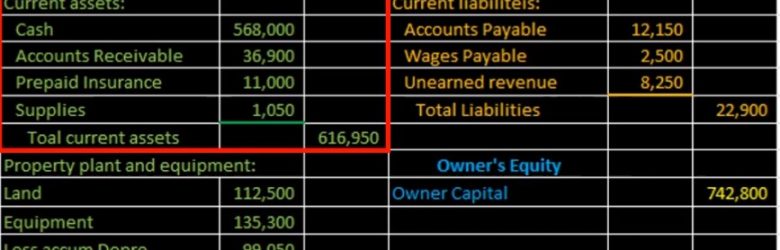

Hello in this lecture, we’re going to create the current asset section of the balance sheet, we’re going to create this current asset section from a trial balance, we’re going to piece together the financial statements piece by piece as we go through a series of lectures, the trial balance being here at this is going to be the adjusted trial balance. And what will happen is we will then find a home for all of the accounts on the financial statements. Once we then do that, that means that we have then converted this from the double entry accounting system being in the format of debits minus credits equaling zero or debits equaling the credits to the assets equals liabilities plus the owner’s equity, basically the accounting equation, which is reflected on the balance sheet. So we’re going to start off by doing the current assets section, which will just be this part we’re going to find a home for these first few accounts.

Reversing Journal Entries – Accrued Revenue 11

Hello. In this presentation we’re going to talk about reversing journal entries as they are related to accrued revenue. When considering reversing journal entries, we’re talking about those journal entries made after the financial statements have been generated after the adjusting process has been done. Remember that the adjusting process happens after all the normal transactions for the month have happened. Then at the end of the month, we have that adjusting process. All journal entries being made as of the same date as of the end of the month in order to make the financial statements correct so that the financial statements can be made. As of that point in time, in this case, the end of the year being 1231 that the cutoff date that the point in time that we make the financial statements, then we want to consider if we want to use reversing journal entries.

Adjusting Entry Accounts Receivable 8

Hello in this lecture, we’re going to record an adjusting transaction related to accounts receivable. We’re going to record the journal entry over here on the left hand side and then post it to the trial balance on the right hand side trial balance and format of assets in green liabilities in orange equity in the light blue and the income statement in the darker blue including revenue and expenses, we’ll first walk through which accounts will be affected and then explain why that is the case. So we know that it is an adjusting entry and knowing that it’s an adjusting entry means it’s slightly different than a normal journal entry in that it does have two accounts like normal journal entries, but it also generally has one income statement account below the blue line and one balance sheet account above the blue line the light blue line, so it’s going to be one account above owner’s equity, one account below owner’s equity.

Adjusting Entry Wages Payable 7

Hello, in this lecture, we’re going to record the adjusting entry related to payroll, we’re going to record the journal entry up here on the left hand side and post that post that to the trial balance over on the right hand side trial balance in terms of assets and liabilities, then equity and the income statement, including revenue and expenses, all blue accounts, including the income statement being part of equity, we’re first going to go through and see if we can find the accounts that will be related to a payroll adjusting entry. And then we’ll go explain why we are going through this process. So just if we have the trial balance, and we know it’s an adjusting entry related to payroll, we know that there’s going to be at least two accounts affected. And we know that because it’s an adjusting entry, it will be as of the end of the time period. In this case, let’s say it’s the end of the year 1231.

Adjusting Journal Entry Rules – What are Adjusting Journal 3

Hello in this presentation we’re going to talk about adjusting entry rules. In order to talk about adjusting entry rules. We first want to distinguish what adjusting entries are from normal journal entries. Normal journal entries being those transactions we will be recording throughout the month including the payment of the utility bill pain of wages, purchasing something on account the things that the accounting department typically does. Within the adjusting process, we’re going to draw a line or head and say the adjusting department is done in a separate department or as a separate process have a separate set of rules. Some of those rules being the same as for every journal entry, some different, the adjusting process is going to adjust accounts such as prepaid insurance, depreciation, unearned revenue, those types of accounts that need to be adjusted as of the end of the time period as a financial statement date in order to make the accounts on an accrual basis as of that date.

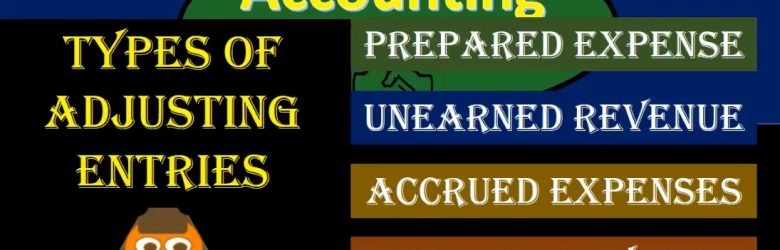

Types of Adjusting Journal Entries Adjusting Journal Entry 2

Hello in this presentation we’re going to talk about types of adjusting journal entries. When considering adjusting journal entries we want to know where we are at within the accounting process within the accounting cycle. all the entries the normal adjusting entries have been done the bills have been paid the invoices have been entered for the month we have reconciled the bank accounts. Now we are considering the adjusting process. Those adjusting journal entries are needed in order to make the adjusted trial balance so that we can create the financial statements from them. The adjusting journal entries being used to be as close to an accrual basis as possible. those categories of adjusting journal entries, which will then have more types of adjusting entries within each category will include prepaid expense, unearned revenue, accrued expenses and accrued revenue. Let’s consider each of these we have the types of adjusting entries first type prepaid account expenses. prepaid expenses are items paid in advance.

Accounting Cycle Steps in the Accounting Process 1

Hello, in this presentation, we’re going to be talking about the accounting cycle or the accounting process, that process that the accounting department will go through on a systematic basis over and over and over again, typically thought of as a monthly process. Although it could be thought of as a yearly process or some other process in terms of the amount of time that will pass. But these are going to be the steps that we’ll be going through in terms of the accounting process, always keeping in mind that in goal of financial accounting, which are the financial statements, some texts will have more steps than five as we have here. Some texts will have less than five steps. But the goal here is to really have a broad picture big picture, so that when we think about the accounting process, we can break down that that big picture view, five is a pretty good number for us to be able to memorize and keep in our mind if we have more than that, it can start to kind of muddy the picture. So once we get into each of these individual steps, we want to get into more detail, obviously.